My Top Coronavirus Picks (You Won’t Believe Pick No. 3)

Looking back, this just might be the day that the bull market died…

As I’m sure you know, the Dow futures opened down more than 800 points as the rapid spread of the coronavirus sparked fears of a global economic impact.

Making the most headlines was the fact that the virus spread to northern Italy – the country was forced to cancel the famous Venice Carnival after officials said they now have 152 confirmed cases, which is the most in any country outside Asia.

In many respects, everything we saw today had been warned about over the last 2 to 3 weeks, but it just seems like today the markets finally realized that it’s now a reality.

In other words, the coronavirus impact has finally sunk in – and has been accepted. And today’s downside reaction was representative of that troubling realization.

So of course, as traders, the big question is what do we do?

That’s what we spend the majority of the day discussing in The War Room.

Normally, I’d reserve the private trading conversations we’ve had within The War Room to our site. But since today’s downside move was so violent, I’m willing to make an exception to share our discussion with you here in Trade of the Day.

Here’s what was said…

First off, I discussed the life cycle of health scares.

When it comes to a health scare – like SARS and now coronavirus – the cycle seems to go like this: new cases and deaths, media panics, market shrugs off, media forgets, and media moves on. Right now we’re in the “media panic” phase.

So with that in mind, I first introduced the idea of hedging last week.

Here’s what I said…

Coronavirus Play No. 1:

I think that our best protective choice right now comes from the ProShares UltraShort Dow30 ETF (NYSE: DXD), which is a two-times inverse play on the Dow. In other words, DXD calls go up in value at a rate of two times the rate of the Dow going down. Simply put, if the Dow is down 1%, the DXD is designed to move up 2%. Right now, for less than $1, we can own the DXD March $21 calls (with $0.37 in intrinsic value going out until D20 expiration).

Please understand – the DXD play is nothing more than upside exposure protection. For less than $1 going out until March 21, this is a cheap way to insure yourself against a sharp market downside move. Just in case we see a sharp correction – sparked by any number of unpredictable news triggers – this asset offers you protection.

Some traders like to hedge. Others don’t. It’s totally up to you – based upon your own personal trading preferences. If you have no long exposure right now, then hedging doesn’t make any sense. If you have a substantial amount of long exposure – and you with to take a small fraction of our winnings to protect against any further downside – then you should consider making this play.

Those who followed along – and hedged – doubled their money this morning.

“DXD calls: In a $1.10 out @ $2. In @ $0.70 out at $1.35.” – Adrian

Coronavirus Play No. 2:

I’ve been talking about my favorite coronavirus play for the last few weeks in The War Room. And it’s Clorox (NYSE: CLX). And no wonder. The company makes the best cleaning agent in the entire world, Clorox Bleach. I’m convinced that the next time you’re at Target, instead of grabbing one bottle of Clorox Bleach or one bottle of Formula 409 (or any other of its professional cleaning and disinfecting products), you’re going to throw two bottles into your cart. And just like that, on a global scale, Clorox has doubled in sales.

With that in mind, it was no shock today that the Dow opened down 900 points. And yet, the only stock on my screen that was green today was (you guessed it) Clorox. It opened up $3 on the session. And once again, those who followed along actually made money today.

“Clorox gains – I’m at +45% right now.” – Susan R.

Coronavirus Play No. 3:

Okay, so maybe you didn’t get the information on the ProShares UltraShort Dow30 ETF or Clorox because you were not inside The War Room to engage in our discussions. What is a play you can make right now?

Well, here’s a thought…

Say the worst-case scenario plays out – and the entire world ends up getting quarantined. We’re all trapped inside – wearing a carpenter’s mask over our mouths.

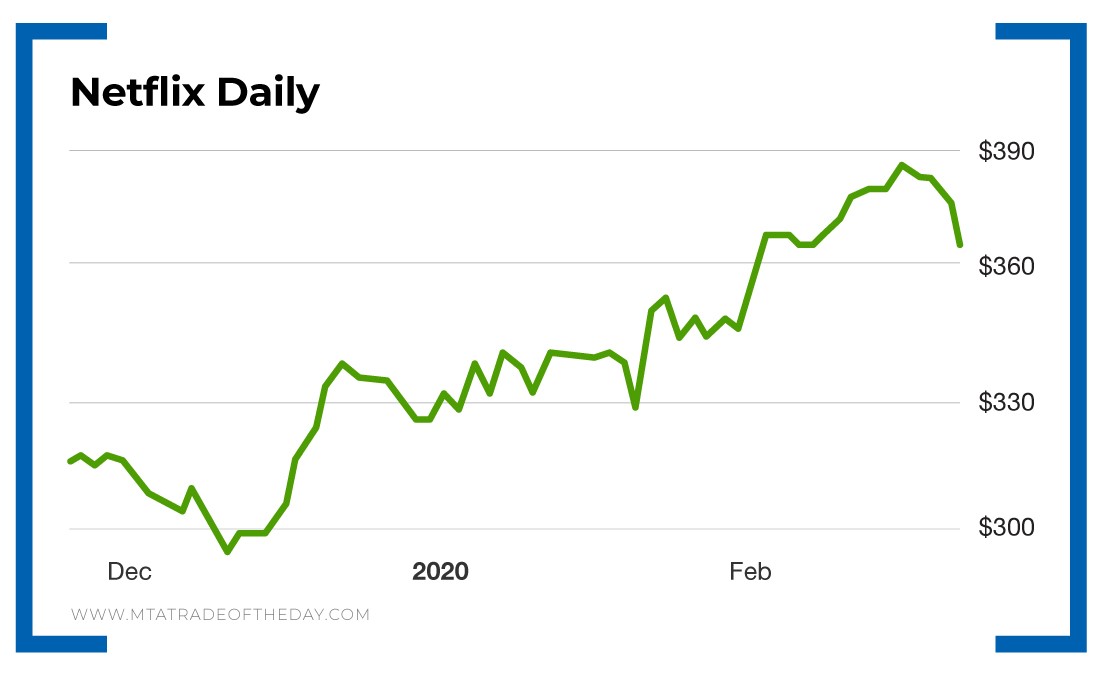

If that happens, I’d argue that it makes a strong, strong case for companies like Netflix (Nasdaq: NFLX) and Roku (Nasdaq: ROKU).

Action Plan: Think about it. What else are you going to do when you’re trapped inside your own self-contained cage? You’re going to binge-watch TV. And in the process, you’ll get yourself hooked on a ton of new Netflix shows. Call me crazy, but I honestly think that the absolute worse-case scenario in the coronavirus epidemic is potentially very bullish for Roku and Netflix. I’d nibble on each stock on today’s dip.

To start getting alerted about these positions in real time and get yourself positioned ahead of devastating moves like we saw today, I invite you to join me in The War Room!

P.S. On March 3, we’re getting prepared to release something that just might shock the financial world. Now, I don’t mean to be ambiguous – but I cannot say anything more about it at this time. Just put this date on your radar. It’s Super Tuesday, so it’ll be easy to remember. More to come.

More from Trade of the Day

My Favorite Way to Hedge Choppy Markets

Apr 25, 2024

The Story Behind My 10 Bagger on RILY

Apr 25, 2024

A Silver Lining From Last Week’s Underperformance

Apr 24, 2024

How One Conversation Led to $100,000

Apr 23, 2024