A $30 Billion Offer…

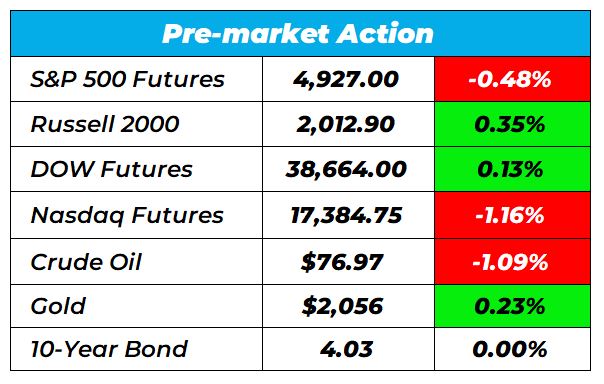

Good Morning Wake-Up Watchlisters! While you’re sipping coffee you’ll see stock futures fell as tech giants’ earnings didn’t meet high expectations (more on that below). Now, investors prepare for the first interest-rate decision of the year from the Federal Reserve, and traders currently see a 40% chance the central bank will lower rates for the first time in March.

No matter what the Fed does, our Head Trading Tactician Bryan Bottarelli has strategies to help you make consistent winning trades. Every Wednesday, he places one trade that takes advantages of a unique market phenomenon. Right now he’s guaranteeing an 80% win rate on this trade.

Click here to get Bryan’s latest pick today.

Here’s a look at the top-moving stocks this morning.

Google (Nasdaq: GOOG)

Google is down 5.46% in premarket trading after following its fourth-quarter earnings report. Although Alphabet’s revenue, excluding traffic acquisition costs, surpassed expectations at $72 billion, concerns were raised due to the shortfall in ad revenue, a critical component of Google’s business model. Despite the overall revenue being higher than the previous year, the slight miss in ad revenue compared to expectations seemed to overshadow the otherwise positive results.

As earnings season continues, it’s crucial to consider how stocks perform AFTER earnings for potential gains. Our Lead Technical Tactician Nate Bear follows the “post-earnings surge” in his latest service, Profit Surge Trader. Since he started his “One Ticker Payout” strategy, he’s posted an 85% win rate on these trades.

Click here to get Nate’s next “post-earnings surge” pick today.

Paramount Global (Nasdaq: PARA)

Paramount Global is up 17.25% in premarket trading after media mogul Byron Allen’s substantial offer to acquire the company. Allen proposed buying all outstanding shares of Paramount Global for $14.3 billion, totaling approximately $30 billion when including existing debt. This offer notably exceeds recent trading values, contributing to the surge in the stock’s premarket performance.

Manhattan Associates (NYSE: MANH)

Manhattan Associates is up 10.82% in premarket. Its boost can be attributed to the company’s strong financial performance in the fourth quarter of FY2023. They reported a 20.3% year-on-year revenue increase and provided an optimistic revenue guidance for the full year, beating analysts’ expectations.

New York Community Bancorp (NYSE: NYCB)

New York Bancorp is down 19.36% premarket due to reporting a loss of $252 million in the fourth quarter. The results fell short of Wall Street’s expectations, with both the per-share loss and the revenue not meeting analyst predictions. This underperformance in the quarter has likely contributed to the decline in the stock’s premarket value.

Those are the biggest stock movers for today.

Happy trading!

The Wake-Up Watchlist Research Team

More from Wake-up Watchlist

May 3, 2024

May 2, 2024

May 1, 2024

Apr 30, 2024