The “JPow Pop…”

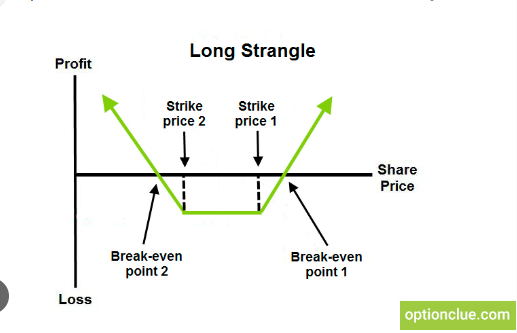

Good Morning Wake-Up Watchlisters! While you’re sipping coffee you’ll see stock futures advanced on Thursday as more corporate earnings pour in and latest Fed news eases markets. Yesterday Federal Reserve Chairman Jerome Powell ruled out any interest rate hikes for the forseeable future despite stubborn inflation rates.

Yesterday our Head Trading Tactician Bryan Bottarelli took advantage of the “JPow pop” in The War Room. He closed two winning trades, including a 13.94% gain on FSLY in less than 1 trading day and a 9.63% gain on UPWK in 1 trading day.

Click here to see how Bryan closes trades for gains in less than 24 hours in The War Room.

Here’s a look at the top-moving stocks this morning.

Carvana (NYSE: CVNA)

Carvana is up 37.38% in premarket trading after the online car retailer slayed its earnings, while also promising better results ahead. Shares came in 32% higher at $114.70. Revenue was at $3.06 billion, up 17% from a year ago. The stock had been consolidating since March, but is now set to shoot higher.

Qualcomm Incorporated (Nasdaq: QCOM)

Qualcomm is up 5.11% in premarket after posting strong earnings due to diversification efforts paying off. The San Diego-based company earned an adjusted $2.44 a share on sales of $9.39 billion in the quarter ending March 24. For the current quarter, Qualcomm expects to earn an adjusted $2.25 a share on $9.2 billion.

eBay Inc. (Nasdaq: EBAY)

EBay is down 3.37% in premarket trading despite solid first-quarter earnings. The online marketplace company’s second-quarter guidance fell short of estimates, with the latest results showing eBay continues to struggle with top-line growth. For the June quarter, eBay is projecting revenue of between $2.49 billion and $2.54 billion, which was below Wall Street estimates of $2.56 billion.

Yesterday our Head Trading Tactician Bryan Bottarelli got positioned on an overnight trade on EBAY in The War Room.

Click here to unlock that trade.

DoorDash (Nasdaq: DASH)

DoorDash is down 11.74% in premarket trading despite beating revenue expectations of $2.45 billion by posting revenue of $2.51 billion. However, the company’s weak outlook was just shy of estimates, forecasting second-quarter gross order value of $19 billion, which was below FactSet estimates for $19.22 billion.

Those are the biggest stock movers for today.

Happy trading!

The Wake-Up Watchlist Research Team

More from Wake-up Watchlist

Warren Buffett Reveals $6B Stake

May 16, 2024

Hydrogen Company Could Get $1.6B

May 15, 2024

May 14, 2024

May 13, 2024