Revealed: The One and Only Safe Haven Investment Left

I asked this question to War Room members first thing this morning…

“In a market where nothing is safe, are diamonds now the answer?”

It might sound silly, but hear me out.

As you’ll see, the rationale actually makes a lot of sense…

So here goes…

Thanks to couples putting off their weddings until after COVID-19, there is a backlog in demand for diamonds that is now starting to unwind.

Diamond sales rose more than 60% in 2021 – all while production increased by only 5% (stats provided by consulting group Bain & Company).

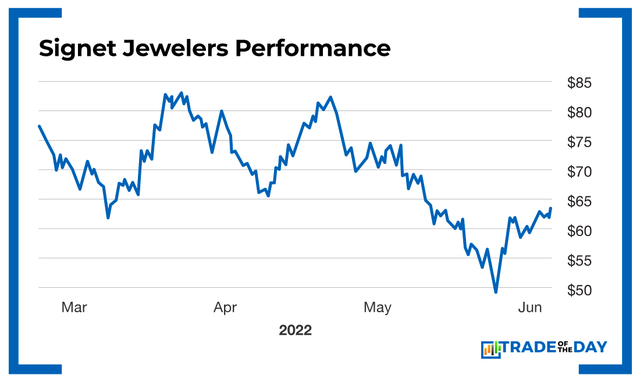

As a result of more demand and less supply, diamond prices went up 21% in 2021, which could be a big trigger for an online retailer with high short interest – namely, Signet Jewelers (NYSE: SIG).

Signet is a diamond jewelry retailer that primarily operates in malls, mall-based kiosks and off-mall locations under the brand names Kay Jewelers, Jared, Zales, Diamonds Direct, James Allen, Banter by Piercing Pagoda and Peoples Jewellers.

As of January 29, Signet operated 2,854 stores and kiosks. And as of mid-May, those stores had turned in some rather impressive performances.

For example…

- E-commerce sales jumped 8.7% year over year to $556 million in the fourth quarter of fiscal 2022.

- Brick-and-mortar sales grew 34.6% year over year to $2.3 billion.

- North American e-commerce sales grew 14% year over year, and brick-and-mortar same-store sales surged 30.6%.

Aside from those impressive sales numbers, here’s why I really like Signet…

Action Plan: Right now, Signet carries a short percentage of float over 30%, which means that it could be setting up for a short squeeze. And what better time to have a short squeeze than on earnings day? Guess what? Signet reports earnings this Thursday before the open, and its last three earnings reactions have all pushed the stock higher.

Will this trend continue? Well, consider this…

Half of the couples who were hoping for a 2020 wedding put off their event until 2021 or 2022. That brings the total number of weddings scheduled this year to 2.6 million (stats according to wedding website TheKnot). That is up from 1.9 million in 2021 and offers a strong upside catalyst for diamonds from now until the end of the year. If there was ever a time for Signet to report strong diamond sales, it’s right now.

Want to see how we’re trading Signet inside The War Room? Then you’re invited to join us today. The instant we make a new trade on Signet, you’ll get it! Last month, we rang the register 50 times at an 81% win rate. We also guarantee every new member will receive at least 322 winning trades in their first 12 months.

Click here to unlock this special offer and get updated the moment we open a new Signet trade.

Monday Market Minutes

- Retail Giant Now Affordable? Amazon (Nasdaq: AMZN) started trading at its adjusted 20-to-1 stock split price this morning. Splits are always positive events, so we could see a situation where investors who’ve always wanted to trade or own Amazon – but thought the share price was too high – can now move in. Tracking.

- Don’t Be a Fish Out of Water!Barron’s feature story “Water Scarcity Spells Opportunity” outlines the argument for conserving clean water, a vital resource for life. This could be good news for American Water Works (NYSE: AWK)… Developing situation – we are watching it.

- S&P Switched On! ON Semiconductor (Nasdaq: ON) is up 5% after being selected to be added to S&P 500 Index.

More from Trade of the Day

My Favorite Way to Hedge Choppy Markets

Apr 25, 2024

The Story Behind My 10 Bagger on RILY

Apr 25, 2024

A Silver Lining From Last Week’s Underperformance

Apr 24, 2024

How One Conversation Led to $100,000

Apr 23, 2024