This Stock Dip Is Buyable – Right Now

The markets will be closed this Friday in observance of Christmas Day.

Going into this holiday-shortened trading week, most optimistic-minded traders were hoping to see a year-end Santa Claus rally…

This morning, reality hit like a gut punch.

As I’m sure you know, the holiday-shortened trading session began with a sea of red.

The Dow Jones Industrial Average went down 1.7%, the S&P 500 dropped 1.2% and the Nasdaq-100 declined 1.4%.

Early on, the big drop was attributed to two things…

First, the CDC reported that a resurgence of COVID-19 is hitting the U.S., with 156,000 cases reported just last Friday. Renewed omicron fears could mean a major slowdown in the economic recovery – all while inflation remains high. None of that is good for Wall Steet bulls.

Second, West Virginia conservative Democrat Joe Manchin said on Sunday that he won’t support the Biden administration’s Build Back Better plan – which could kill the $1.75 trillion social spending and climate policy bill. Based on this decision, Goldman Sachs cut its first quarter 2022 GDP forecast from 3% to 2% – and lowered its second quarter and third quarter growth forecasts as well. And once again, none of this news is good for Wall Steet bulls.

Here’s the thing…

As the major market averages fall, opportunistic traders can sniff out bargains.

And today, I’m about to reveal my newest “dip buy.”

Why should you listen?

Well, my last two “dip buys” have been huge winners.

Back on March 8, I called Costco (Nasdaq: COST) “the most unloved stock on Wall Street.”

At the time, Costco was trading for less than $300 per share.

Today, it’s around $550. That’s a monster winner.

Then, on April 20, I said, “Buy this dip immediately.”

I was talking about Nike (NYSE: NKE).

At the time, Nike was trading for around $125 per share.

Just recently, it touched a high of $187. Again, that was a big winner.

So clearly, my “dip buy” track record has been on point.

What’s my newest pick?

Target (NYSE:TGT) – and here’s why…

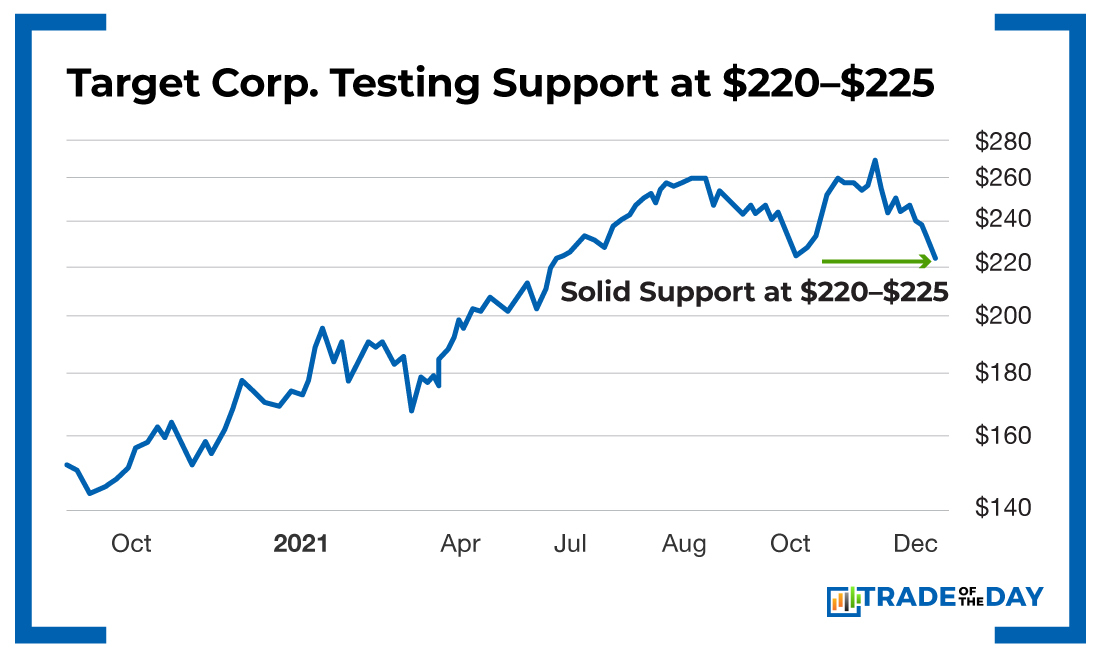

As you can see below, Target is now testing a twice-confirmed support range between $220 and $225 that held up in October and June.

Action Plan: If you want to buy one of the country’s top retailers at a 20% discount, then it’s now time to buy the dip on Target. This represents the best – and safest – way to capitalize on market fears. This strategy worked with Costco… and it worked with Nike. And right now, I believe it’ll work with Target. Buy this dip.

P.S. If you want to get my top pick delivered to your inbox each and every Wednesday, then you’re invited to level up and join Trade of the Day Plus. Click here for details.

More from Trade of the Day

An “A+” Pre-Earnings Squeeze Play

Apr 30, 2024

TikTok Ban Will Hurt This Stock

Apr 29, 2024

My Go-To Plays for Safety + Long-term Profits

Apr 26, 2024