Three Places to Find Value in the Market Now

The market is not static.

It’s ever-changing, and you must keep up with the changes to cash in.

This past week we cashed in on Cleveland-Cliffs (NYSE: CLF) to the tune of almost 50% after holding the position for just a couple of weeks. Just look at what some members had to say.

SeaJay 1/5/2022 at 12:57 p.m.

In at $2.51, out at $3.92 for a NICE 56.2% PROFIT! Thank you, Karim!

Edwin G. 1/5/2022 at 10:03 a.m.

CLF 15 contracts filled at $3.85 48% profit. Thanks Karim!!!

Cire S. 1/5/2022 at 10:12 a.m.

I closed the 1 Shares/Contracts I opened at $2.50 for $3.85. Out at $3.85 for 54%. Thanks Karim!

Was it a fluke?

Absolutely not.

We purposefully rotated into areas of the market that are considered value stocks.

That side of the portfolio is offsetting the weakness of some of our growth names.

Investors are looking for earnings and cash flow – there are three sectors providing that right now, and they are cheaper than the market in general.

The first sector is materials stocks like Cleveland-Cliffs and Nucor.

These are companies with low price-to-earnings, great backlogs and futures that will be filled with lots of infrastructure spending. In the cases of Cliffs and Nucor, they will also benefit from a resurging auto sector.

The second sector is the pharmaceutical sector.

It is just gushing cash and profits. Companies like Pfizer and AbbVie are making money hand over fist. They are now on the prowl for more companies to buy with their fat cash hoards, and they’re also looking to raise dividends. Most trade at multiples that are less than half that of the market.

Finally, the heavy equipment sector is cheap.

Companies like Kubota, John Deere and Caterpillar are only now starting to get noticed as their backlogs, cash flow and earnings are all beginning to build. This buildup should last a while as major infrastructure projects begin to take hold.

The market is going to be volatile again in 2022, more than it was at the end of 2021. And, if it sells off, you want to be ready to pounce on the companies and sectors above. They’re on sale now, and if they get cheaper, the sale only gets better.

Action Plan: We’re covering these types of plays, and many others, hourly and daily in The War Room. When they get ripe for a trade, we’ll be on top of it – and so will you if you’re part of the most dynamic room for investing in 2022!

Reminder! We are making a HUGE performance guarantee this year.

Last year we are guaranteed new War Room members at least one winning trade per day in 2021.

There were 252 trading days, and we delivered, with well over 252 winners.

So, this year we are upping the ante!

If The War Room hasn’t shown you 300 winning trades within one year, I’ll give you lifetime access for free!

Click here to claim this insane performance guarantee.

Act now – this offer won’t last long!

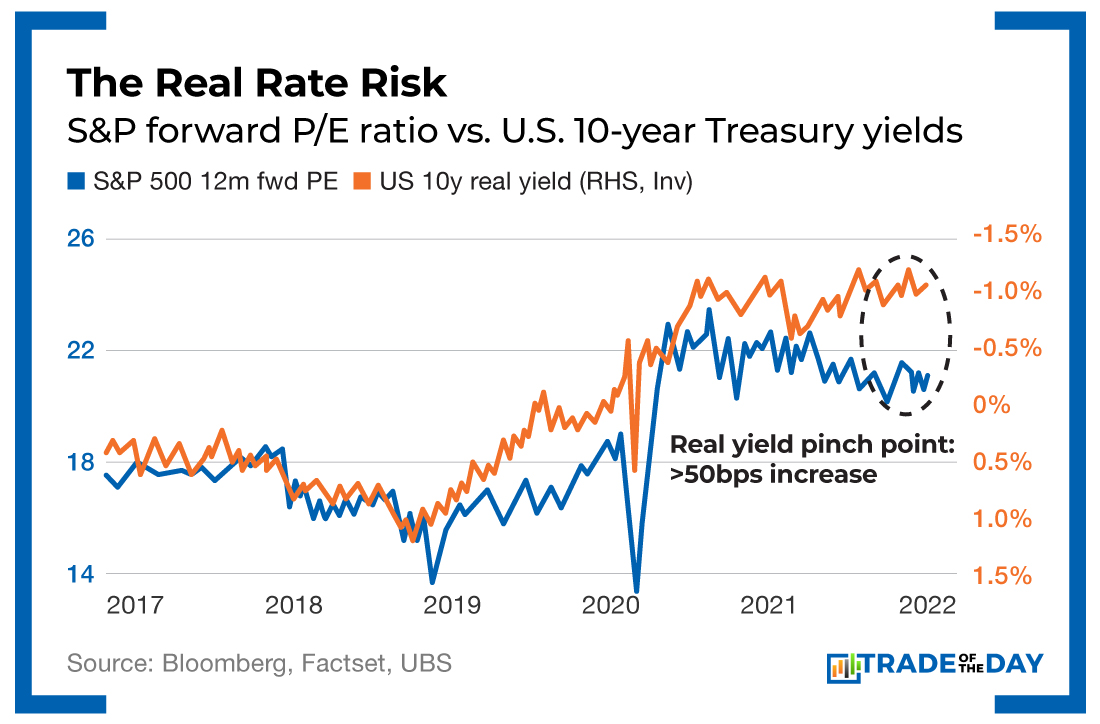

Fun Fact Friday!

“Rate risk” has pushed stock prices lower this week – but is that punishment really fair? Well, if you dig deeper – you’ll see that stock valuations decoupled significantly from real yields last year. This suggests that equities could absorb a rise in real yield. As you can see below, the real yield pinch point is currently greater than 50 basis points. So higher rates don’t necessarily mean a lower market, just the need to reallocate accordingly.

More from Trade of the Day

An “A+” Pre-Earnings Squeeze Play

Apr 30, 2024

TikTok Ban Will Hurt This Stock

Apr 29, 2024

My Go-To Plays for Safety + Long-term Profits

Apr 26, 2024