Two Mouth-Watering Trade Ideas Amid the Panic

People are scared… bearish… and buying puts like crazy.

Those are just some of the trends I’m seeing in the current markets.

But the truth is…

The stock market isn’t doing anything it hasn’t done before.

And when it comes to finding mouth-watering trades amid the panic, it’s all about finding the right symmetry.

I’m going to show you exactly how to find that symmetry in today’s video.

The best part is…

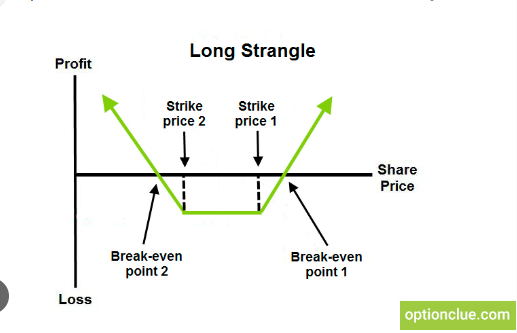

You don’t have to be RIGHT with this strategy – you can make money no matter whether a stock goes up, down or sideways.

Click the video below and I’ll show you how it works.

The video includes two timely trade ideas – so watch it ASAP.

Action Plan: Here are the details on the S&P 500 (SPX) trade…

Conditions to Be Met: The S&P would need to trade down into a range near 3,600 – plus or minus 20 points – for me to consider a “COVID Symmetry” entry.

Trade: If that happens, I will sell an SPX October 14 put credit spread. I’d be looking to receive a credit of no less than $10 – the bigger the credit, the better. If you sell this spread as SPX is falling – preferably to $3,600 or below – then the credit received will be larger. Note that the October 14 expiration would be used only if the trade were filled this week. If the trade doesn’t fill until next week, I’ll go out to the following week’s expiration, the October 21 series.

Trade Plan: Since I’m selling a spread, time is on my side. I’d like to hold this trade and look for a bounce in SPX, but I’ll enter a good-till-canceled order to buy the spread back at $2. As a stop, I would use a daily close under $3,550. However, I won’t stop out on the same day I enter the spread.

Complex trade, I know. But it’s a smart trade, one that has made me big money in the past. And I’ll break down more ideas like this in the future. If you have any questions about it or want me to cover other trade ideas in the future, send me an email at feedback@momumentradersalliance.com.

Bonus Trade: Long play on Netflix…

If the conditions above are met for the put credit spread on SPX, I’d also like to go long on Netflix (Nasdaq: NFLX).

Conditions to Be Met: Netflix had a perfect entry opportunity on Wednesday, as I outlined in the video. At this point, I’d need to see a pullback in Netflix. I’d like to enter a trade on a pullback to around the $232-$235 area. If that were to happen, I’d look to pick up some calls in Netflix. Netflix reports earnings on October 18, so I would buy calls that expire during that week. I would NOT hold those calls through earnings.

Trade Plan: If I get the needed pullback, I’d look to enter the October 21 $260 calls. The price should be around $10 or less. You could also buy the October 14 $250 calls for a cheaper debit. I’d stop on a daily close below $225 but would not stop out the same day as entry. Also, I would start with only a HALF-sized position, leaving room to add to the trade.

This is just one of the ways to trade in bear markets. These are counter-trend trades, but they offer an exceptional risk-reward profile. I understand you might want to protect your assets even more than usual right now.

If you want another super-cheap way to make money in bear markets…

Karim explains why you should move your cash into this $3 investment by October 7.

More from Trade of the Day

LEAP into Spreads for Potential Triple-Digit Winners

May 17, 2024

My Two Favorite LEAP Strategies for Making Money

May 16, 2024

A Backdoor Way to Trade Nvidia

May 16, 2024