War Room Members Locked In Profits of 65% From This Trade

“Hi Ho Silver, Away!”

Those who used to watch The Lone Ranger will understand my intro. But even if you missed the connection, War Room members certainly didn’t.

A couple of weeks ago, members entered a spread trade on Coeur Mining (NYSE: CDE), a producer of silver and gold. Now, I don’t really like Coeur Mining as a long-term, fundamental play. It’s not as well-run as most other metals-producing companies. The management has diluted shareholders with capital raises and missed estimates consistently.

So why did we trade Coeur Mining in The War Room and make a bundle from it?

It’s about sentiment and finding the right vehicle that few are paying attention to. You see, Coeur Mining was down for all the right reasons… poor earnings, mismanagement, etc.

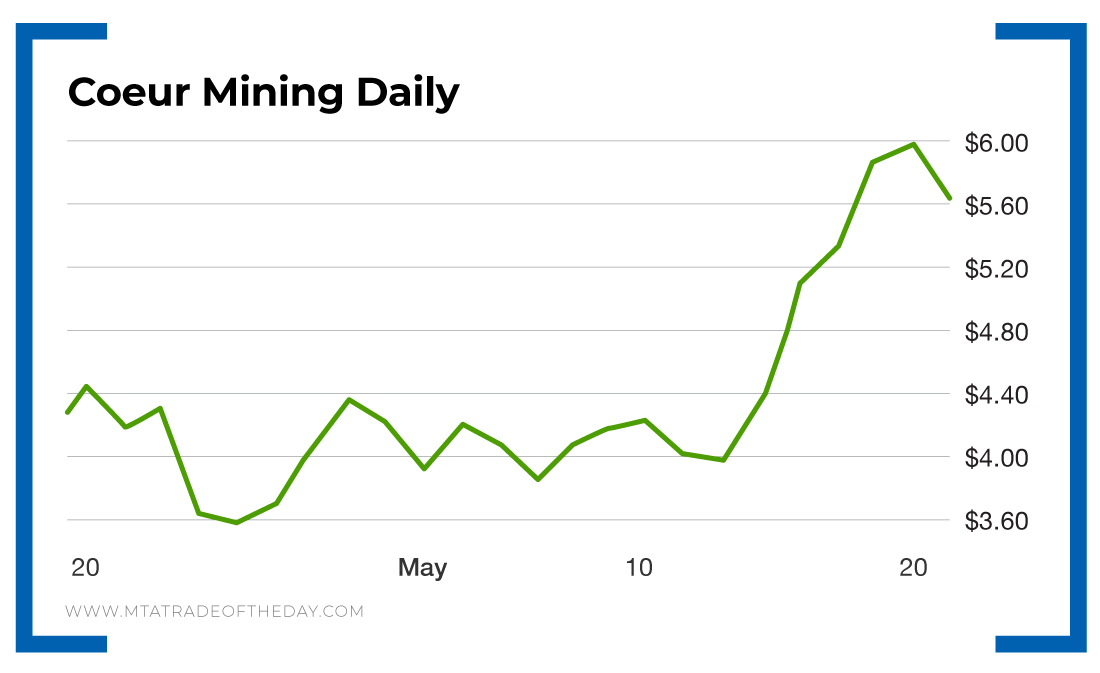

Take a look at what I shared with members…

Let’s start with Coeur Mining. This is a vertical call spread where we bought one option and sold another one against it for a net cost of around $1. The rationale for this play was that if gold and silver are in a real longer-term rally, we will see the price of gold eclipse its old highs of around $1,900 per ounce. We don’t care about Coeur Mining as a company, other than it is solvent, profitable at current gold prices and liquid. In other words, this is not a fundamental play on Coeur Mining, but a play on the metals.

As you can see, my focus was on the trend in silver and gold prices. A couple of days before members sold, I said this one could go up or down $2 in a day. It turns out that it went up almost $2 in a matter of three days. I was close!

Members used a spread to allow them to reduce their cost to $1, basically pennies, to participate in a sector that has been hot recently. This is the essence of smart speculation. We take a very low-cost position to make a lot of money. And that is exactly what members did.

Some pocketed as much as 60% gains! Here’s a sampling of what our members had to say…

“Closed this morning for +59.5%. Thank you!” – Steve RTJ, May 18 at 1:39 p.m.

“Karim, CDE now up 41% on my initial investment and USAS up 51.5% on initial investment and still looking strong.” – James C., May 19 at 9:20 a.m.

“Bought at $3.84 and sold at $5.85 within a couple of weeks. Nice and thank you.” – Tim H., May 19 at 9:55 a.m.

“Up 50% on CDE, torn between selling half of my position or closing it out altogether. Your stock picks have been great!” – Todd M., May 19 at 11:36 a.m.

And my favorites from Sal and Michael…

“Thanks K, I doubled this one. Only regret is my order was sized half of normal… but doubling half size isn’t all that bad! TU.” – Sal, May 19, at 11:59 a.m.

“I rode CDE far enough and didn’t want to get too greedy. Held call only: In @ $1.60, out @ $3.30. TY – 106%!” – Michael K., May 19 at 2:59 p.m.

Action Plan: Get off the sidelines and start cashing in on one of the most exciting markets of our time!

For more insight on trends and how to play them, join me in The War Room!

More from Trade of the Day

An “A+” Pre-Earnings Squeeze Play

Apr 30, 2024

TikTok Ban Will Hurt This Stock

Apr 29, 2024

My Go-To Plays for Safety + Long-term Profits

Apr 26, 2024