Watch This Indicator for the Market’s Next Big Move

The market issues a lot of “tells.” We’ve covered the CBOE Volatility Index (VIX) in the past, as well as the put-call ratio. These are two important indicators that “tell” you in real time what is happening in the market.

There are of course other indicators, and the one I am going to share with you today is a great litmus test for how the market will act in the short term.

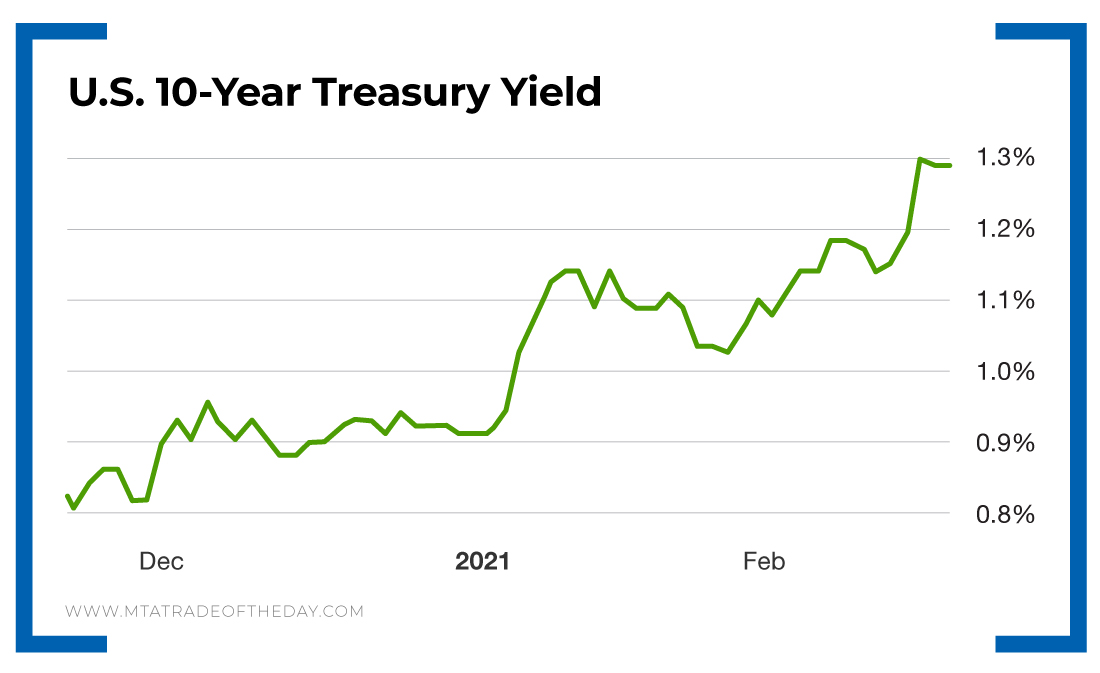

It’s one of those really simple “oh yeah” indicators, something that affects your daily life. I am talking about the 10-year U.S. Treasury yield. When the yield rises, it indicates falling demand for Treasury bonds, and a falling yield indicates the opposite. I know what you’re probably thinking…

Huh? A bond?

Yes, the 10-year yield is used to set all sorts of interest rate benchmarks such as mortgage rates. So when the yield begins to move higher, people pay attention, and so should you.

Changes in the yield over the course of a day or week are not significant, but a longer trend could start to worry market watchers.

For the past dozen years, we have been in an environment of record-low interest rates, meaning cheap money has been fueling massive consumption, rises in real estate prices and other assets, including stocks. When savings rates are less than one-tenth of 1% at most banks, putting your money in the market makes the most sense.

When the 10-year yield starts to rise, as it has over the past few days, the market historically heads south. Now, it’s not all bad because the 10-year and other bonds are going to yield more only if the economy is growing. So there is something to temper any move in the market.

The underlying fear is rising interest rates and rising inflation. That could really put a damper on things, as people are so used to low interest rates. There was a point in time in the late ’70s and early ’80s when a 15% mortgage was considered a bargain!

Action Plan: Now, I am not saying that is where we are headed. But in The War Room, we use real-time data like this with historical context to rack up an impressive track record of success. More than 800 winning trades with a 79% success rate since we launched in May 2019! Isn’t it time you joined me? Click HERE to get started!

More from Trade of the Day

My Go-To Plays for Safety + Long-term Profits

Apr 26, 2024

My Favorite Way to Hedge Choppy Markets

Apr 25, 2024

The Story Behind My 10 Bagger on RILY

Apr 25, 2024

A Silver Lining From Last Week’s Underperformance

Apr 24, 2024