“Trash” Stocks Could Make You 1,000%-Plus

At the risk of telling you something plainly obvious…

Tech stocks are taking it on the chin in 2022.

But here’s the crazy part…

It’s about to get worse… A. LOT. WORSE.

In fact, there’s a very good chance that we just entered what I’ve dubbed the “Dot-BOMB, Part II.”

This means tech stocks could crash even harder, especially the ones that are complete fundamental trash…

I know what you’re thinking…

“We’ve already seen stocks like Peloton fall 80% through 2021. How much downside is left?”

I hate to be the bearer of bad news, but there is A TON of downside left.

My research shows that what we’ve seen so far is just the beginning.

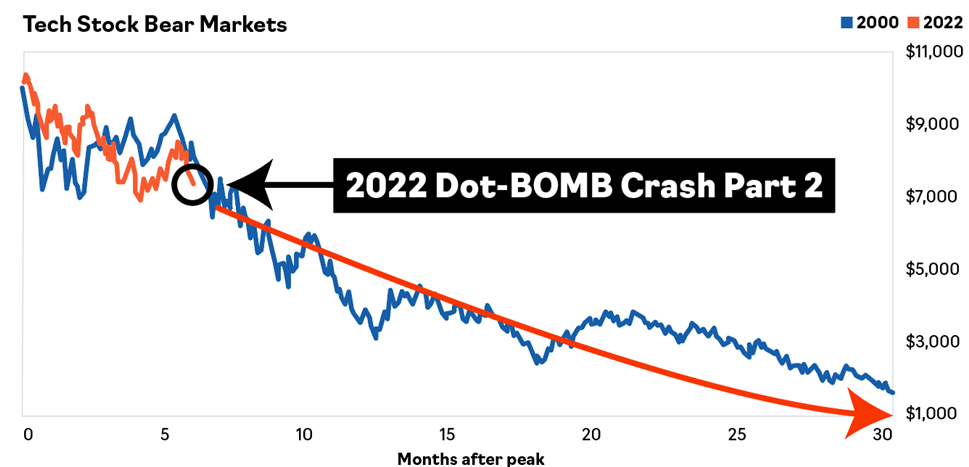

As proof, check out this shocking chart. You’ll see exactly what I mean…

Take a look at the blue line.

That line shows the trajectory of the dot-com bubble burst back in the late ’90s and early 2000s.

During this time, I was on the floor of the CBOE, trading Apple.

I saw the entire dot-com boom and bust cycle firsthand, as it was happening.

Now look at the orange line…

That’s where we are RIGHT NOW in 2022.

Yikes.

THE BIG TAKEAWAY… There’s way more room for potential declines. Sizable room, in fact.

But here’s where things take a big, hard turn…

My research team just crunched some numbers that shocked me.

Here’s the jaw-dropping stat that blew me away…

In 2000, during the first dot-com crash, the average operating margin for tech companies valued under $5 billion was -217%.

That means it took $2.17 just for these incompetent companies to make $1.

But… those figures are NOTHING compared with what we’re seeing today…

Are you ready for this???

Right now, the average operating margin for tech companies valued under $5 billion is -1,603%.

That means these knucklehead companies are spending $16 just to make $1!

Let that sink in…

Today, there’s a group of tech companies that are losing so much money… they’re actually blowing 8X more than they were during the original dot-com crash in 2000.

If you are a “buy and hold” investor with a single tech stock in your portfolio right now, this should send a cold shiver down your spine.

But today, I’m going to turn the tables and approach this situation differently.

You see, instead of losing money off a tech sector crash…

What if you could actually profit off these awful, terrible, cash-burning tech stocks?

It goes against everything Wall Street teaches you…

But if you can pick a losing tech stock, I’m going to show you how to profit off it.

3 Steps to Identifying – and PROFITING Off – Trash Tech Stocks

First, you identify the garbage tech stocks that are most likely to crash next and position yourself with a unique trading strategy that could help you win BIG when stocks drop.

No, you don’t have to short these stocks. It’s not that risky.

Consider this…

Since this bear market began, I’ve been using three simple criteria to identify trash stocks.

These three criteria are…

- Overhyped

- Not profitable

- Overvalued compared with peers.

Sounds simple enough, right?

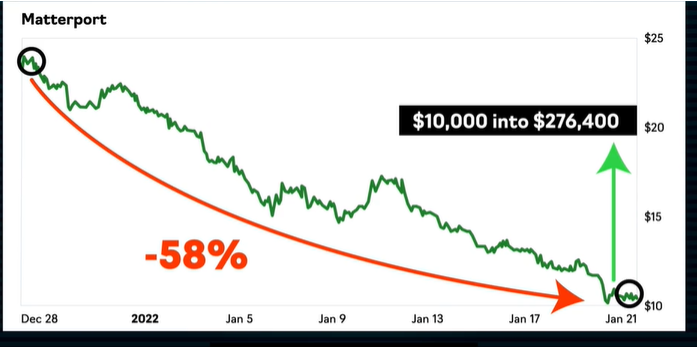

Case in point, spatial data company Matterport met my criteria earlier this year. And look what happened.

If you had invested $10,000 in Matterport stock, $5,800 of that would have been lost between December 27 and January 21 alone. But, with the strategy I use to profit when stocks tank… you could have taken that same $10,000 and made up to $276,400.

Lose $5,800… or make $276,400…

It’s the biggest no-brainer on earth.

And that’s the big secret…

Contrary to what you’ve been told…

A trash, crashing tech stock can actually make you life-changing money.

But only if you know what you’re doing.

This is exactly what I’m showing readers like you how to do in my latest video.

Action Plan: If you have a few minutes, I can show you how to profit off trash stocks like Matterport.

Click below to see exactly how you can turn these money-sucking loser stocks into profits upward of 1,000%.

Click here to learn how to make these trades.

P.S. If I’m right that “Dot-Bomb 2.0” has started, you could have the RARE chance to turn $1,000 into as much as $30,000… within months or even weeks! But only if you make a move and check this out right now. Get all the details in my new special video below.

“Trash” Stocks Could Make You 1,000%-Plus

Monday Market Minutes

- Federal Reserve Announcement. Major market news will come Wednesday when the Fed offers up its next policy decision. It’s possible the market could fluctuate 1,000 points in either direction after the news breaks. Tracking.

- Barron’s Bullish on Newmont. Barron’s is now saying Newmont is too cheap to ignore, meaning Barron’s is also bullish on gold. If there was ever a time to get positioned in gold, it’s right now.

- Retail Slowing Down. High manufacturing costs and inflation rates are curbing spending in this sector. When it starts to impact specific businesses, we’ll be ready.

- KnowBe4 (Nasdaq: KNBE) Sees a Spike! The company was up 26% in premarket trading after it received a nonbinding proposal from Vista Equity Partners to acquire all of its outstanding shares for $24 per share.

More from Trade of the Day

My Favorite Way to Hedge Choppy Markets

Apr 25, 2024

The Story Behind My 10 Bagger on RILY

Apr 25, 2024

A Silver Lining From Last Week’s Underperformance

Apr 24, 2024

How One Conversation Led to $100,000

Apr 23, 2024