Are You Making a Guaranteed 9% Return on Your Money?

Yesterday I wrote to you about the “good” side of inflation. Today, I am going to share how you can tap into that side in just about two weeks – you’re gonna love this!

In May, the U.S. Treasury Department will issue its newest Series I savings bonds, or “I bonds.” These bonds have a yield that is based on the inflation rate. And in May, they will pay you 9% or more!

That’s not a typo. The U.S. government will pay you a guaranteed 9% on your money – try getting that from your bank!

Here’s the catch… You can get that 9%-plus return only on an investment of up to $10,000 and only if you hold the bonds for a year. Otherwise, you will get hit with a small penalty (though the return will still be better than you’d get from your bank or any certificate of deposit).

And if you want to get that 9% return on more than $10,000, here’s how you can:

- Every eligible member of your family can get that rate on an investment of up to $10,000.

- You have to sign up electronically here: https://www.treasurydirect.gov

- If you want to invest even more money and get that 9% return, you can invest an additional $5,000, but that has to be in physical (paper) notes.

The last time I checked, the best one-year certificate of deposit was paying around 1%. These I bonds generate 800% better returns – more than enough to sign up for a year of Trade of the Day Plus, with a bunch of money left over to take a short cruise!

And you can do it again next year.

So what are you waiting for?

Action Plan: Go to this site and set up your account. Then, you’ll be on your way to collecting more money from the government than most people you know. Just think of that Cheshire cat grin that you’ll be wearing at the next cocktail party!

And if you want to have more bragging rights with your friends…

I bonds aren’t the only exciting thing coming around in May. I have identified The Last Great Value Play, and what’s happening on May 12 could be a massive catalyst. Find out more and get in now!

Fun Fact Friday

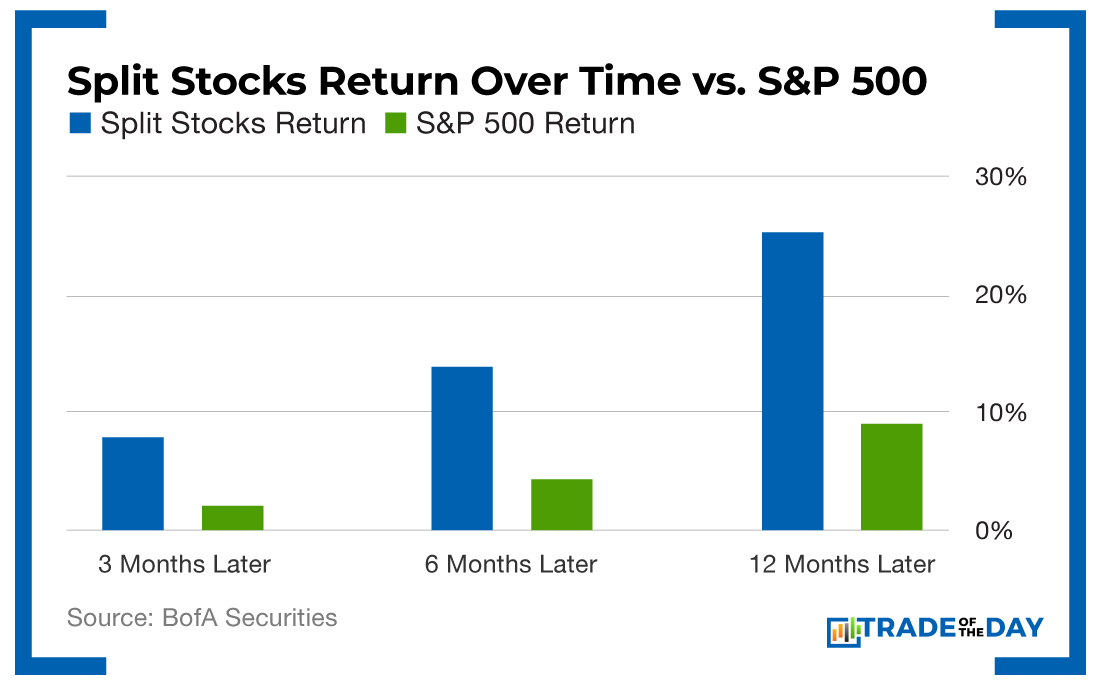

Historically, stocks that have gone through a split have returned 15% more than the S&P 500 in the 12 months after the split. That’s probably more about optics and showing confidence in the company than any real, technical changes. In the short term, it’s common to watch a stock jump on a split announcement. However, a split does not add any true value to a company in and of itself.