Buy This Stock for Less Than What Bill Gates Paid

Following a visionary’s stock buys is just one of the strategies we teach War Room members to help them profit during crashing markets. Find out more here!

Bill Gates became one of the largest shareholders of Ecolab (NYSE: ECL) when he bought $230 million worth of the stock way back in March of 2018.

He hadn’t touched that position since… at least not until last week…

During the recent market dip, he added $57 million worth of shares to his position – his first purchase in four years.

What exactly does Ecolab do?

The company is a top provider of water-treatment, hygiene and infection-prevention services.

The company projects 12.7% growth for the next five years. But it’s down 27% year to date, which is probably why Gates made his move.

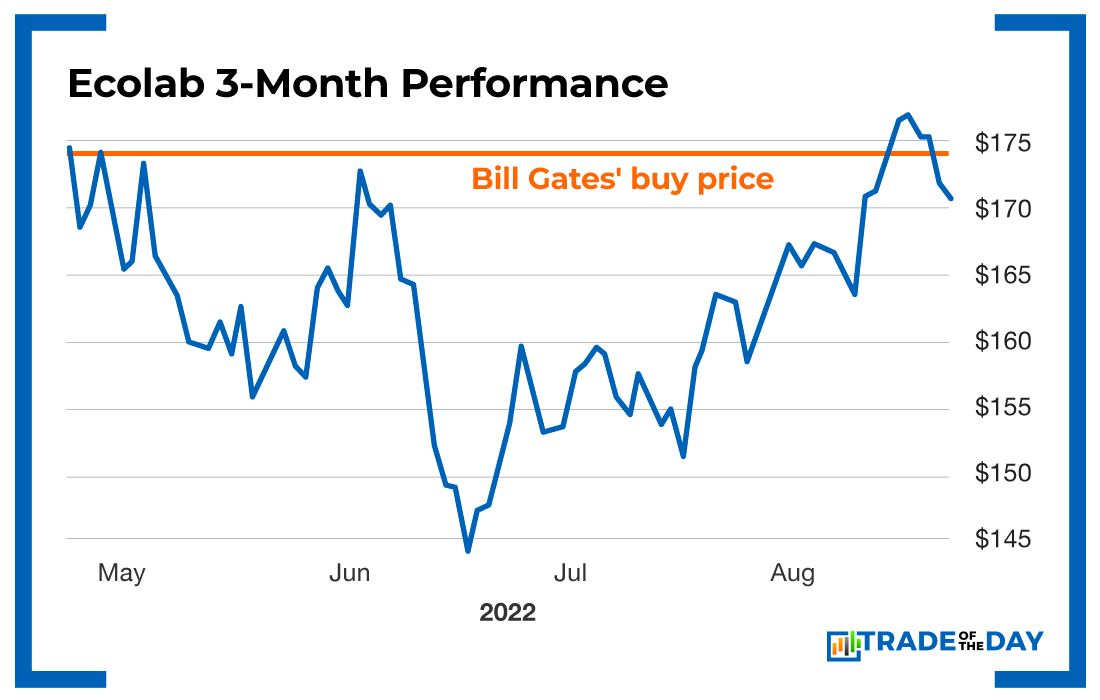

Specifically, he paid an average price of $173.92 per share from August 11-15, giving his Cascade Investment Fund an 11% stake in the company.

And there’s your opportunity…

As you can see below, you can now buy shares for less than what Gates paid.

Action Plan: Bill Gates is giving every indication that he thinks there is real potential with Ecolab going forward. This makes for a timely opportunity. Gates was one of the first visionaries to foresee the threats and impacts of the global COVID-19 pandemic. Maybe water treatment is the next sector to get positioned in? If so, now’s the time to make your move.

Monday Market Minutes:

- A cool way to play the biotech sector is the SPDR S&P Biotech ETF (NYSE: XBI), a collection of small cap biotech growth stocks. The ETF is up 40% since mid-June, far outpacing the 22% gain from the Russell 2000 over the same time frame. Tracking.

- Traders are skeptical that the Fed will continue to aggressively raise rates to curb runaway inflation. All eyes will be fixated on Jay Powell when he gives his speech at the Jackson Hole Economic Symposium on Friday.

- Warren Buffett is going big on Occidental Petroleum. He’s looking for a 50% stake – a bullish bet on energy. In The War Room, we will be looking to sell some puts on a pullback.

More from Trade of the Day

Why Next Week Could Be Big (Special Offer Inside)

Apr 19, 2024

When it Comes to Positioning – Size Matters

Apr 18, 2024

The One Strategy I’m Leaning on in a Choppy Market

Apr 18, 2024

One Crucial Wartime Trade to Make Now

Apr 17, 2024