Clean Energy Lathers Up

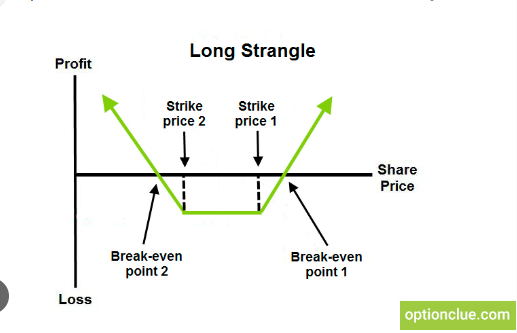

Nate’s Monday Stocks to Watch are here: This week our Lead Technical Tactician Nate Bear is giving us his weekly stocks to watch. Right now he’s looking at a pullback in the SPX as he waits with open arms to trade his favorite names. Click the image below to see what he’s looking at.

Are you tired of seeing massive gains in the AI sector? Nate isn’t. Last week he took another big win on NVDA, notching a 219.38% gain in 7 trading days.

Good morning Wake-up Watchlisters! While you’re sipping coffee you’ll see stock futures dropped on Monday. Investors are still processing the implications of a recent brief challenge to Russian President Putin by armed mercenaries over the last few days. They’re also looking at upcoming data on PCE inflation and consumer confidence, and may shift their attention back to the Federal Reserve’s future actions regarding inflation.

While we don’t like war, the fact is Russia’s war in Ukraine has created a profound shift in the world’s oil markets, and our friend Marc Lichtenfeld is letting readers in an alternative investment opportunity outside the stock market.

Here’s a look at the top-moving stocks this morning.

Lucid Group (Nasdaq: LCID)

Lucid Group is up 11.52% premarket following the recent rally in industry leader Tesla (Nasdaq: TSLA). Tesla shares have risen about 40% in the past five weeks, adding more than $240 billion to the company’s market value. If the Federal Reserve stops raising interest rates, it will make the growth of clean-energy startups even more enticing.

New technologies like renewable energy are on the verge of changing the way we live. Right now our Head Fundamental Tactician Karim Rahemtulla is pounding the table on a company that’s at the forefront of a lot of these new technologies.

Click here to learn why he’s calling this “The Last Great Value Stock.”

PacWest Bancorp (Nasdaq: PACW)

PacWest Corp. is up 7.61% premarket after selling its $3.5 billion specialty finance loan portfolio to Ares Management, in an attempt to boost liquidity at the U.S. regional lender after a recent banking crisis. Ares’ alternative credit arm bought the loans, and the private equity firm also added that Barclays provided the funding.

Those are the biggest stock movers for today.

Happy trading!

The Wake-Up Watchlist Research Team

More from Wake-up Watchlist

May 17, 2024

Warren Buffett Reveals $6B Stake

May 16, 2024

Hydrogen Company Could Get $1.6B

May 15, 2024

May 14, 2024