Don’t Let Your 2020 Gains Become 2021 Losers

Editor’s Note: Don’t miss the 4X Stock Booster Summit featuring Oxford Club Chief Investment Strategist Alexander Green and Chief Income Strategist Marc Lichtenfeld!

In this special event – airing September 23 at 8 p.m. ET – these two experts interview the man who used a unique system to completely avoid the COVID-19 crash… and show how their Members can score up to 4X MORE on all their regular trades.

No leverage… no crazy gimmicks… just a powerful strategy that can transform your investing for good.

Click here to learn more and register for the virtual event.

– Karim Rahemtulla, Head Fundamental Tactician, Monument Traders Alliance

Against all odds, 2021 has been a fantastic year in the stock market.

Year to date, the S&P 500 is up about 20%.

And if you were smart enough to buy during the downturn in March 2020 or the recovery that spring, you are likely sitting on some big gains.

But buying is the easy part… even if you looked disaster in the face as stocks were tanking and had the guts to buy during that crazy time.

Buying is always easier than selling.

When we buy stocks or other investments, we feel hope and optimism. It’s a pleasant experience. We may even daydream about what we’ll do with our profits.

Selling is the opposite. If we’re selling for a loss, we are acknowledging that we were wrong and taking an action that will cause pain. That is very difficult to do from an emotional standpoint.

But even if we’re selling for a win, big ones included, it removes those positive emotions we had when we bought. We’ll always question whether we’re getting out too early and leaving more gains on the table.

Making the decision to sell is just plain hard.

That’s why I try to never let my emotions play a role in my selling decision. I have an exit plan from the moment I enter a trade because emotions will almost always lead you down the wrong path.

You’ll justify why you should stay in longer than you otherwise would have or bail too quickly.

Here are two important things I do to set up my selling decision ahead of time and help me sleep at night…

- Use trailing stops. By adding a trailing stop once I buy a stock, the decision to sell at a certain price has already been made. And it was made when I was thinking rationally and logically, not when the stock was in a free fall or when unexpected news hit the wires. I can always adjust my stops if I need to, but I never ignore my stops if they’ve been hit. If I did, that would be reacting emotionally. I always want my selling strategy to have been made without emotions coming into play.

- Position size appropriately. Never buy so much of an investment that you can’t recover if it becomes a loser. If you put too much money into any single investment, that will cause you a lot of stress. And when you’re stressed, you’re going to act emotionally.

You may sell too soon because you just can’t take it anymore, or if the investment goes south, you’ll hang on too long, praying it will come back because you can’t face selling for such a massive loss.

That is a recipe for disaster.

While we don’t want any of our positions to be losers, some definitely will be. By keeping your position sizes small, you can withstand a problem in any individual investment.

The Oxford Club recommends that investors not put more than 4% of their portfolio in any single investment.

You’re probably sitting on some fantastic gains from 2020 and perhaps earlier. Who knows what the rest of 2021 will bring?

Make sure you have an exit plan in place now so that you don’t watch your gains evaporate in the event of a big downturn.

Good investing,

Marc

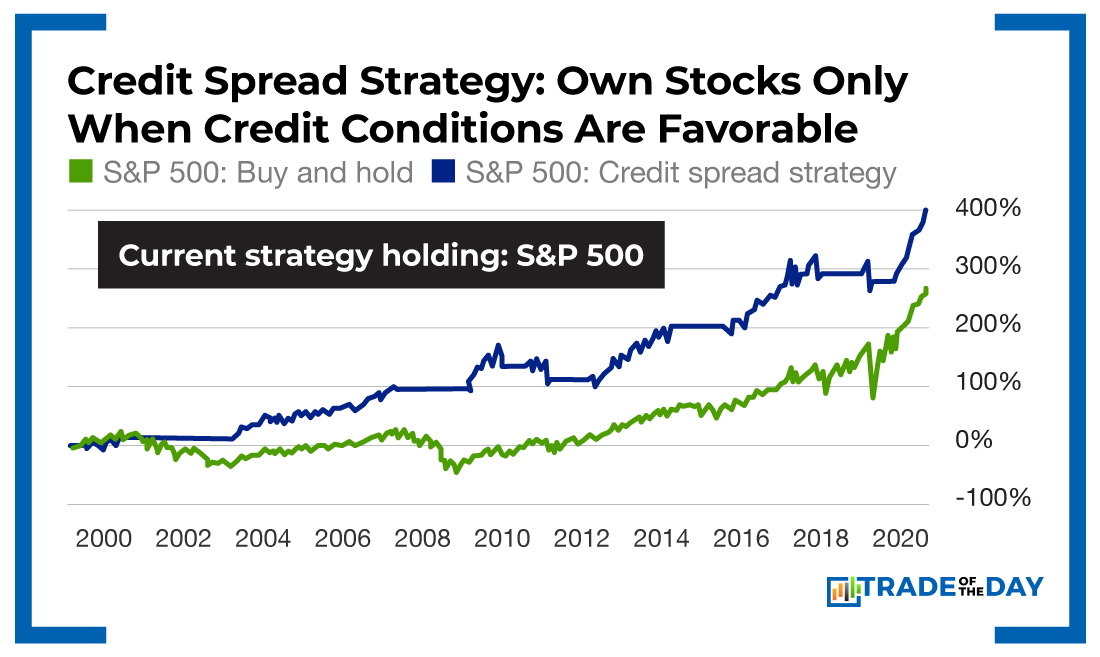

Fun Fact Friday: At Monument Traders Alliance, we know boring buy-and-hold strategies don’t hand you game-changing wealth. But smart speculation done right can. And data out of Cresset Asset Management backs that up. Historically, owning stocks only during favorable credit conditions has outperformed a buy-and-hold strategy. No surprise, in The War Room, we’ve crushed the S&P 500 by almost 700% since we launched in 2019. If you want to up your trading game – and get 300 winners guaranteed over the next year – join us here!

More from Trade of the Day

Why Next Week Could Be Big (Special Offer Inside)

Apr 19, 2024

When it Comes to Positioning – Size Matters

Apr 18, 2024

The One Strategy I’m Leaning on in a Choppy Market

Apr 18, 2024

One Crucial Wartime Trade to Make Now

Apr 17, 2024