Don’t Fall Into This Trap

It’s never “different this time” in the markets. It just takes time to come to that conclusion. And during that time, you can make or lose a lot of money.

Valuations on companies always revert to the mean – their average levels, as determined by history.

Why is this?

Well, a business is valued based on its growth, its sales and its earnings.

History says businesses are usually valued at between 2X and 10X sales, depending on the sector.

In this cycle, we’ve seen companies trading at 25X, 50X, 75X and even 100X their reported yearly sales.

Would you pay someone 100X yearly sales for their business?

Probably not. But that’s exactly what so-called experts were doing.

How do I know this?

Look no further than the Tiger Cubs.

The Tiger Cubs were hedge funds created by protégés of famed hedge fund manager Julian Robertson. His original Tiger Fund took $8 million in seed capital in the early ‘80s and turned it into over $20 billion by the end of the ‘90s.

From January 1, 2022, through April, Tiger Global Management lost over 44% of its value, incinerating over $16 billion of investor capital! The markets are down much less than that.

The biggest losers among the fund’s holdings are down 70%, 80% and close to 90% from their highs, and they all have one thing in common…

Over the last few years, the companies in question were selling for 30X, 40X, 50X and even 100X sales. Now they are all trading for less than 5X sales – and in some cases less than 1X sales.

That’s reversion to the mean.

Action Plan: The next time you get that feeling that you just have to buy a stock, listen to that guy on your shoulder telling you to check the mean for the industry. That will help you determine whether you should trade or invest in that company.

Fun Fact Friday

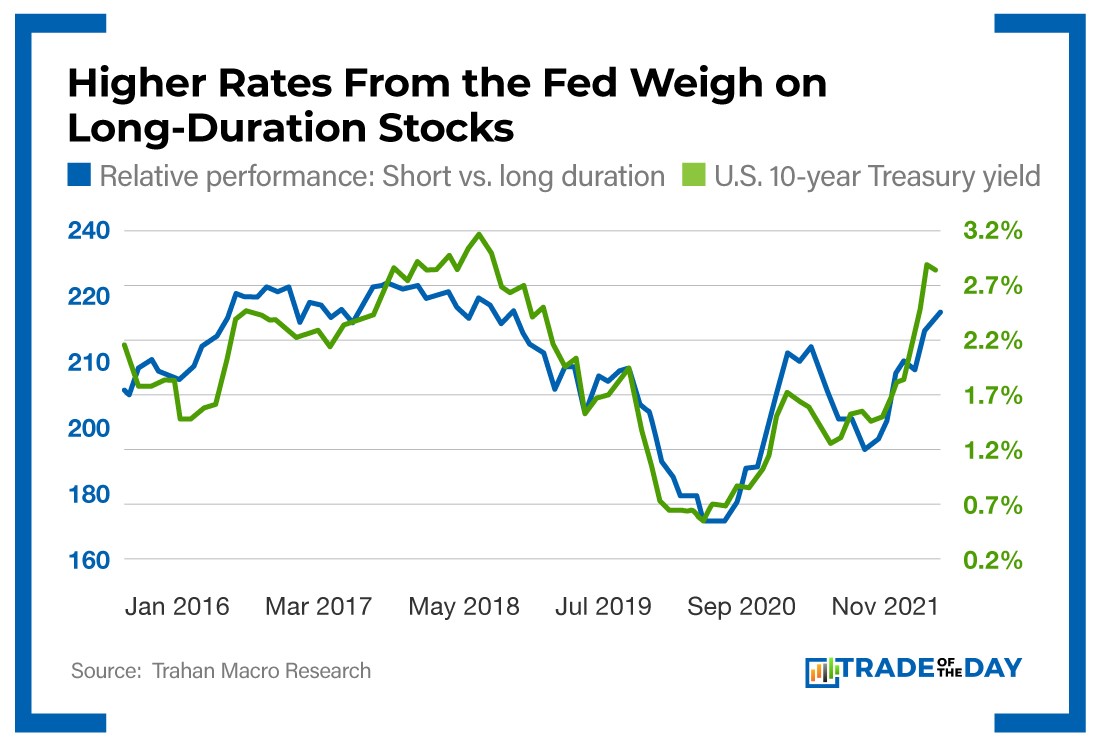

“Long-duration” stocks (such as growth companies, which take longer to turn a profit) are vulnerable to rising rates. As the Fed has tightened up, relative performance has dropped for growth, tech and other long-duration companies. As Karim noted above, you need to be on the hunt for stocks that are undervalued – and continue to ignore those that are overvalued.

More from Trade of the Day

A Golden Buying Opportunity Zone

Apr 15, 2024

Apr 12, 2024

Five Reasons to Use Stop Losses

Apr 11, 2024

Your Blueprint For Trading A Whippy Market

Apr 11, 2024