Double-Barrel Bear Market Tamer

Editor’s Note: With the markets still showing plenty of volatility, we want to make sure you’re prepared for any dramatic swings. So we’re rehashing the perfect bear market strategy and our highly effective Crash-Proof Asset.

– Ryan Fitzwater, Associate Publisher

The Perfect Strategy for Bear Markets

I’ve got two bear market tactics I want to make sure you have in your trading arsenal – especially as we navigate what has been the market’s worst month historically.

First up is put selling.

In bull markets, I like to sell puts. In bear markets, I LOVE to sell puts.

When you sell a put, you are obliged to buy shares of the underlying stock at the strike price at which you sell the put – which you usually do only if the stock closes at or below that price at expiration or at any time prior to it. For taking on that risk, you are paid a premium – call it rent for the obligation.

So why is a bear market better for put sells?

Well, I like to buy stocks cheap. And when I sell puts, I shoot for a discount to market price of 20% to 50%. This means the strike price at which I sell the puts is 25% to 50% below the current price.

In a bear market, those price levels are 25% to 50% below an already discounted price. If I get put in a bear market, you can bet the stock is beyond cheap!

When selling puts in any market, it’s key that we follow two guidelines to maintain a win rate above 80%.

- We sell puts only on companies that we want to own.

- We sell puts with a goal of covering our position before expiration

In a volatile market with a downward bent, we’ll pick up more premium and have shorter holding periods.

The goal is to buy that put back when we hit 20% to 50% of the potential return.

Bear markets scare the heck out of investors. But I think they are the best times to establish positions in stocks for the future. In a bear market, stocks are cheap and hated – the two best words an investor can hear!

Now let’s dive into our second bear market strategy…

If the market bottoms out, this type of asset will make you money or balance your portfolio so that the swings won’t really impact you.

There are assets that have historically moved higher when the markets have moved lower, like gold and other precious metals. But they are not “Crash-Proof.” Heck, an investment in gold at the beginning of the year would net you a 5.5% loss today.

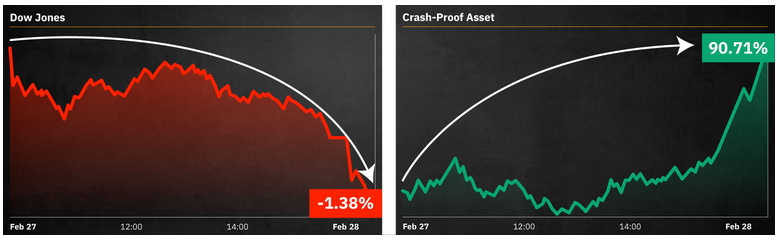

The truly “Crash-Proof” assets we are talking about move in the opposite direction of the market during corrective and recovery phases. Check out the charts below:

The red line is the Dow, which got hammered during this period. And the green line is the Crash-Proof Asset I’m telling you about.

See how it basically moves in the opposite direction of the market over the same exact time frame?

Action Plan: You’ve got the perfect bear market strategy in your back pocket now. If you want more info on how to safeguard your money with this special Crash-Proof Asset, check out Bryan’s presentation here. And even if the Dow drops 1,000 points tomorrow, you could 10X the market’s return.

More from Trade of the Day

How One Conversation Led to $100,000

Apr 23, 2024

How I Picked the Market Bottom

Apr 23, 2024

Warning: Trade This Notable Sentiment Shift

Apr 22, 2024

Why Next Week Could Be Big (Special Offer Inside)

Apr 19, 2024