Double Your Money With One Inflation-Busting Trade

I’ll tell you exactly what I told War Room members today at 9:55 a.m…

“I’m shocked that gold assets are not screaming higher right now. It’s the only asset class (to me) that makes sense to fight inflation.”

I admit…

Lately, the belief that gold is the ideal inflation hedge hasn’t exactly held up.

While the price of gold is 50X higher than it was 1971, stocks have performed even better.

The S&P 500 has produced an annualized return of 11.2% since August 1971 – outperforming the 8.2% annualized return for gold.

If you tighten your search to the last 40 years, the discrepancy gets even wider.

Over the past 40 years, gold has risen at a 3.6% annualized rate, compared with 12.2% for the S&P 500.

This is why gold has NOT been considered a true inflation hedge lately.

As a result, investors are looking to find alternative ways to hedge against inflation.

In an interview with Trading Nation, Piper Sandler senior technical research analyst Craig Johnson said this…

“I don’t think it’s a great hedge at this point in time, and frankly, Bitcoin would look better – or real estate – from my perspective.”

Bitcoin, huh? Hmm.

In full disclosure, that interview took place on December 20, 2021.

But it goes to show you…

Just six months ago, top traders viewed cryptocurrencies as superior inflation hedges to gold.

But now… it’s my belief that view is rapidly changing.

The Nasdaq, which is considered the highest-volatility group of stocks to trade, is down 27% this year. But then there’s Bitcoin, which was supposed to act as an inflation hedge – and also offer a way to sidestep the Nasdaq’s volatility… It’s down 40% this year.

So yeah… That promise of Bitcoin being a superior inflation hedge has now been completely invalidated.

And this brings us back to gold…

One of my favorite ways to play gold is by trading the Direxion Daily Gold Miners Index Bull 2X Shares (NYSE: NUGT).

This leveraged asset essentially moves at a rate of 2X the daily movements of the VanEck Gold Miners ETF (NYSE: GDX), a basket of top gold companies that includes…

- Newmont

- Barrick Gold

- Franco-Nevada

- Wheaton Precious Metals.

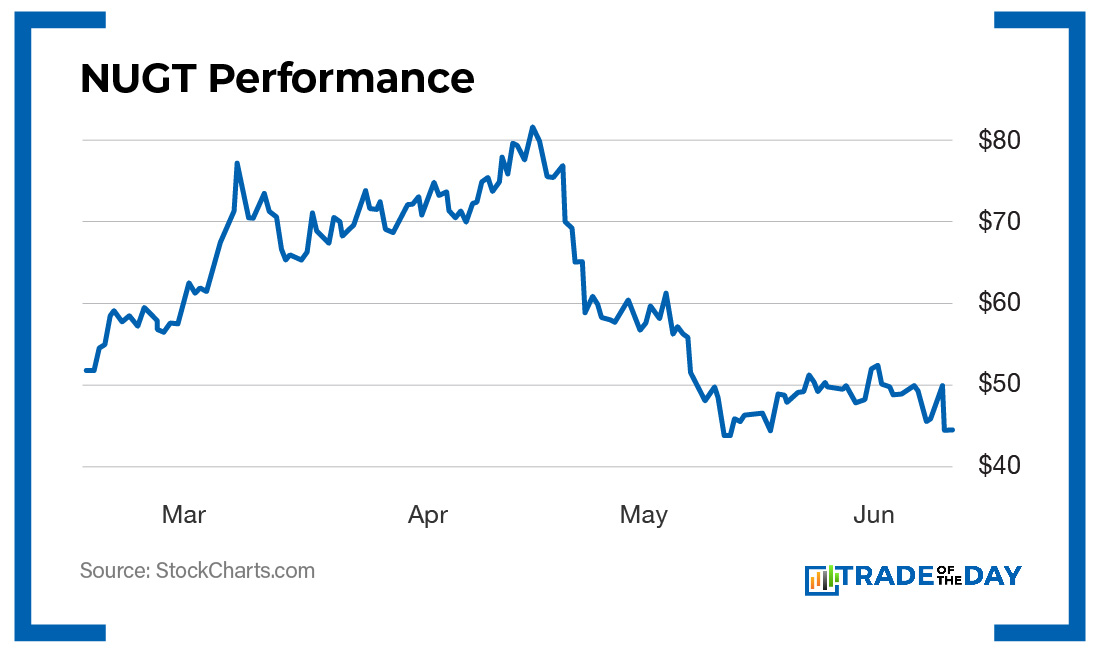

As you can see from the NUGT chart below, this gold basket traded for around $80 back in April. But right now, you can own it for around $44.

Action Plan: As inflation continues to soar – and the theory that cryptocurrencies are an inflation hedge continues to get invalidated – I believe that investors and traders alike will return to gold as a pure, true inflation hedge. And when that happens, NUGT could very easily move from currently levels back up to $80, which would be close to a double.

Are You Making Money Off a Falling Market? These War Room Traders Are!

*Notes below taken from just this morning…

“On May 31, I purchased Jun 17, 22 DXD $50 Calls at $0.80, Sold them today at $3.10 = $13,287.95 profit. Approximately 150% gain. Pays to hedge!”

– James GBS $ 6/13/2022 at 10:14 a.m.

“Just made $5,320 on the DXD trade. I closed the 40 Shares/Contracts I opened at $1.67 for $3.00!”

– Ednchina 6/13/2022 at 10:09 a.m.

$5,000 as the markets fall… $13,000 as the Dow crashes. Those are the REAL gains my readers are making using my top bear market strategies. And today, I’ll reveal them to you. If you’re losing money in this bear market, drop whatever you’re doing NOW!

Click here to join The War Room.

Monday Market Minutes:

Shut Down! Astra Space (Nasdaq: ASTR) is down 25% after saying, regarding its TROPICS-1 mission with NASA, that the rocket’s upper stage shut down early, and it did not deliver the payloads to orbit. Tracking.

Not Your Digital Currency? The Celsius Network is pausing all withdrawals, crypto swaps and transfers between accounts, citing “extreme market conditions.” If its 1.7 million strong customer base cannot withdraw their assets, then the very framework of the system is broken.

EV Company Gets Positive Charge! RBC Capital analyst Joseph Spak upgraded Tesla (Nasdaq: TSLA) from a “Sector Perform” to an “Outperform.” He believes Tesla’s focus on supply chain and vertical integration will be a competitive advantage.

More from Trade of the Day

Why Next Week Could Be Big (Special Offer Inside)

Apr 19, 2024

When it Comes to Positioning – Size Matters

Apr 18, 2024

The One Strategy I’m Leaning on in a Choppy Market

Apr 18, 2024

One Crucial Wartime Trade to Make Now

Apr 17, 2024