Disney Reports First Streaming Profits

Good Morning Wake-Up Watchlisters! While you’re sipping coffee you’ll see stock futures were steady on Tuesday. Investors were upbeat after Disney’s earnings landed (more on that below). Investors now have new hope of an interest rate cut as soon as this summer. More incite will come from Minneapolis Fed president Neel Kashkari, who is expected to speak today.

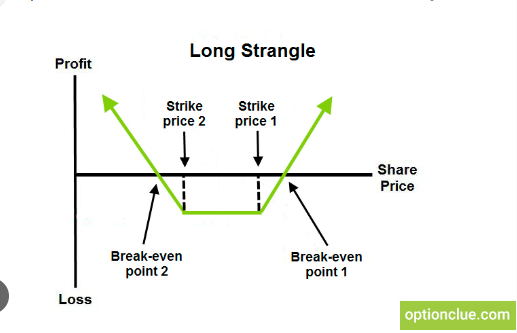

While earnings day has the potential to a move a stock big in either direction, our Lead Technical Tactician Nate Bear knows how risky trading earnings can be. That’s why he looks for the best trade setups AFTER earnings to capitalize on the surges while also avoiding “all-or-nothing” gambles.

Click here to receive Nate’s next post-earnings pick today.

Here’s a look at the top-moving stocks this morning.

Palantir Technologies (NYSE: PLTR)

Palantir Technologies is down 9.76% in premarket trading after closing 8% higher ahead of its earnings release. Its shares slid as the market appeared unimpressed by the company’s outlook for annual sales. It also struggled overseas, with its international commercial business declining 3% during the quarter as a result of continued headwinds in Europe.

Our Head Trading Tactician Bryan Bottarelli recently got positioned on PLTR in The War Room.

Click here to unlock that trade.

Rivian Automotive (Nasdaq: RIVN)

Rivian Automotive is up 7.94% in premarket amid rumors that Apple (APPL) is in talks with the EV maker about a possible partnership. Its unclear whether the talks actually happened, but those talks also might not amount to anything. Rivian is set to report earnings tonight.

Hims & Hers Health Inc. (NYSE: HIMS)

Hims & Hers Health is up 13.73% in premarket after its latest first quarter earnings beat. The telehealth platform reported revenue growth of 46% year-over-year, followed by a better-than-expected second quarter outlook. It currently sees revenue forecasts well above expectations, with the second quarter coming between $292 million and $297 million. The estimate there was for $288 million for the full year.

Walt Disney (NYSE: DIS)

Walt Disney is down 6.03% in premarket trading despite posting its first profit for its streaming entertainment unit. Disney had promised Wall Street that the streaming operation would become profitable by September. The division had been losing money since Disney+ debuted in 2019 in the company’s major push to compete with Netflix. It also incurred a $2 billion impairment hit after merging its Star India business with Reliance Industries.

Yesterday our Head Trading Tactician Byran Bottarelli got positioned on DIS in The War Room.

Click here to unlock that trade.

Those are the biggest stock movers for today.

Happy trading!

The Wake-Up Watchlist Research Team

More from Wake-up Watchlist

May 17, 2024

Warren Buffett Reveals $6B Stake

May 16, 2024

Hydrogen Company Could Get $1.6B

May 15, 2024

May 14, 2024