How High Will Gold Prices Go in 2020?

We have been following gold in The War Room since our inception in May 2019. And since that time, members have taken dozens of winners ranging from junior miners to leveraged ETFs.

The key to trading gold and gold shares right now is to buy on dips. Precious metals are in the middle of a confirmed bull market, outperforming every other major asset class in 2020.

That trend should continue, and you should position yourself to be a buyer on dips.

In The War Room, we are constantly trading metals stocks but always making sure at least one position is in the portfolio at all times.

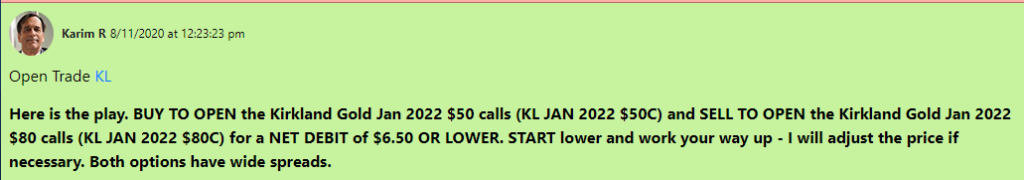

Just last week we closed out another winning gold trade on Kirkland Lake Gold (NYSE: KL), which, in my opinion, is the cream of the gold mining crop. It’s a low-cost producer with an excellent management team.

We will jump back into Kirkland Lake Gold again, I’m sure. The price of gold is not going to go up in a straight line. When it corrects, like it did recently, dropping from more than $2,000 per ounce to almost $1,900 per ounce in a matter of days, the effect on gold stocks can be drastic.

However, the volatility in the metals markets has opened another opportunity. You see, when volatility spikes, options premiums rise. And when that happens, a light bulb should automatically go off in your head.

When premiums increase, you should think like a seller. Instead of being forced to buy more expensive options, take the other side of the trade and sell the option at the inflated price.

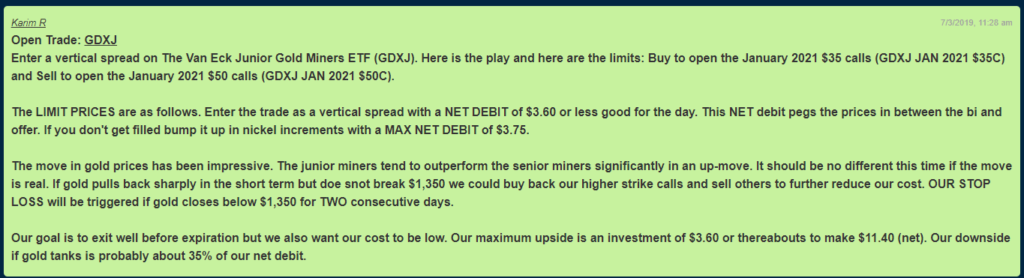

For example, War Room members took the other side with the VanEck Vectors Junior Gold Miners ETF (NYSE: GDX). They sold the January 2021 $40 puts, which gives them the right to buy the shares at $40 at expiration if the shares close below that amount (they are trading between $59 and $60). That’s right. They sold the $40 puts – almost 35% below the current price and got paid more than $1.15 ($115 per contract) for taking that risk.

If members are put, they will own the ETF at $38.85 ($40 strike minus $1.15 premium received). The great part about this trade is that the probability of being put is less than 25%. It’s going to make for a great trade, or we’ll get to buy a “hot commodity” on the cheap!

Action Plan: A play like this makes The War Room something unique and profitable. We’ve handed members an insane 80% win rate since we launched! Over that time frame, we’ve had a 10.02% average gain over a seven-day holding period. And this year alone, we’re hitting two winning trades every day the markets are open. Join me now and get in on the action in the hottest sector in the market!

P.S. Join our members-only Cliff House event via livestream! Back in July, The Oxford Club’s top strategists gave their predictions on what was coming in the markets. And the picks revealed at this conference are showing gains from 48% up to 168%! This September 14-15 at Cliff House in Cape Neddick, Maine, we’re about to do it again with The Oxford Club’s 2020 Private Wealth Seminar. Best of all, you can livestream the entire event from your home computer! Here’s the livestream link, which will give you the full details.

P.P.S. Take Profits Alert! Our position on SmileDirectClub (Nasdaq: SDC) is up more than 12%, and DraftKings (Nasdaq: DKNG) is up more than 24%. Let’s safely take profits and sell half of those positions now and then hold the remainder for more upside.

More from Trade of the Day

Why Next Week Could Be Big (Special Offer Inside)

Apr 19, 2024

When it Comes to Positioning – Size Matters

Apr 18, 2024

The One Strategy I’m Leaning on in a Choppy Market

Apr 18, 2024

One Crucial Wartime Trade to Make Now

Apr 17, 2024