Here’s a Better Way to Trade Bitcoin

I’m sure you’ve heard about the recent resurgence of Bitcoin…

Back in 2017, Bitcoin peaked just under $20,000 – and then dramatically fell down to $4,000 12 months later.

Lately – for no apparent reason – Bitcoin is making another run at the 2017 highs.

Since early September, it’s nearly doubled.

Just this past month, Bitcoin popped 50% – hitting a new 52-week high of $19,345 – only to give back 15% of that rally in one day last week.

Seeing these massively volatile moves, many traders are asking this question…

How do you trade these huge price swings?

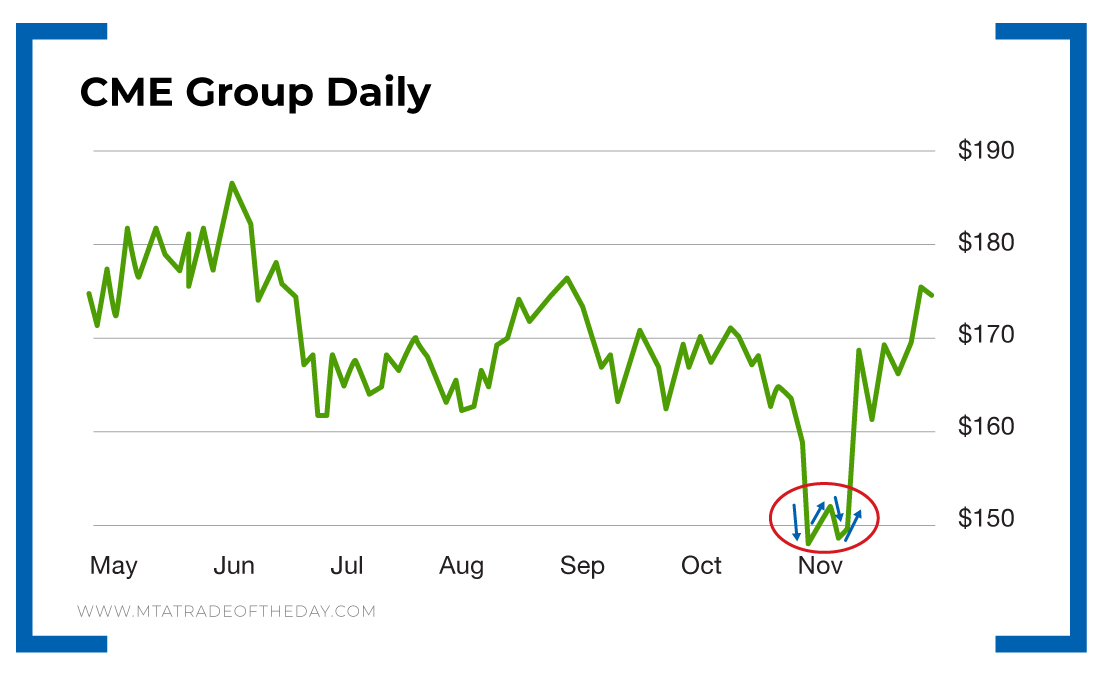

Well, in my opinion, the answer is by owning CME Group (Nasdaq: CME).

Why?

Because CME Group now trades Bitcoin futures – and the popularity of trading them is soaring.

Open interest rose 102% above 2019 levels – including a massive 221% increase here in the fourth quarter.

As a quick summary…

CME Group operates markets for trading futures contracts worldwide.

It offers products based on interest rates, equity indexes, foreign exchange, agricultural commodities, energy, metals and most recently Bitcoin.

Formerly known as the Chicago Mercantile Exchange, CME Group was founded in 1898 and is currently headquartered in Chicago, Illinois.

Action Plan: A clear “W” pattern in the November daily chart has triggered a rally up to $173. If Bitcoin futures continue to attract record trading volumes, this could be a new trigger catalyst to extend CME Group’s upside run. As a better way to trade the newfound popularity of Bitcoin, adding CME Group on any dip down to $170 is a tactical maneuver to consider.

P.S. Take Trade of the Day with you wherever you go – and join our new Instagram account! It’s totally free! Check it out here!

More from Trade of the Day

When it Comes to Positioning – Size Matters

Apr 18, 2024

The One Strategy I’m Leaning on in a Choppy Market

Apr 18, 2024

One Crucial Wartime Trade to Make Now

Apr 17, 2024

Apr 17, 2024