Here’s the Only Tech Stock Worth Dip-Buying

It’s been an extremely volatile start to the 2022 investing year.

The combination of…

- Higher inflation

- Three Fed rate hikes with the possibility of a fourth

- And the lingering impact of the omicron variant…

Has weighed on the ability of the major market averages to extend their upside moves.

As you know, inflation alone is more than enough to keep Wall Street up at night.

After all, the decline in a currency’s purchasing power – due to rising prices – has played a central role in all of America’s worst economic episodes.

Throw in omicron and the Fed rate hikes, and you’ve got a three-headed monster on your hands that has led to intense selling pressure at the start of the year.

From a tactical trading standpoint, what’s the best attack plan?

Inside The War Room, we’ve been positioning ourselves in trades that pass two critical tests.

- We’re looking for safe-haven trades that can withstand the renewed inflationary pressures.

- We’re looking for trades that have moved down to key support levels.

Using this strict and disciplined selection methodology, we locked in 13 winners inside The War Room last week – good for an 87% win rate.

What’s next up on the winning block?

One of my favorite tech stocks I’m tracking right now is Oracle (NYSE: ORCL).

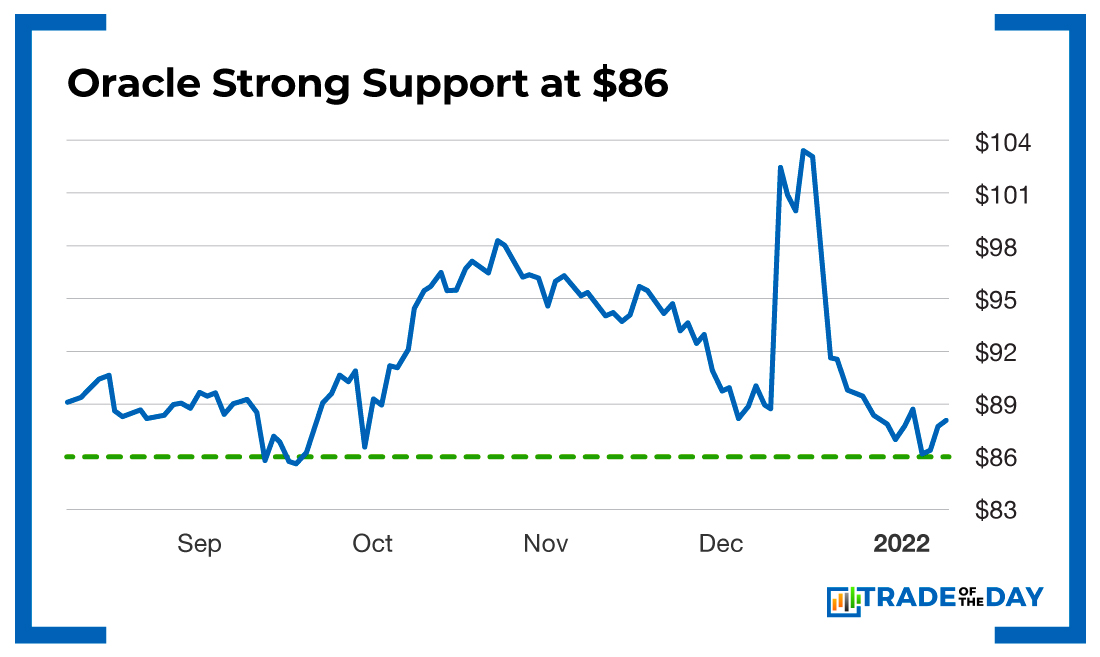

I love the pullback to the $86 support level on the cloud services company – this could be a buying opportunity!

Action Plan: Of all the tech stocks right now – the one (and only) pullback that I’m comfortable buying is on Oracle. The $86 level has acted as strong support dating back to September – so until proven otherwise, dip-buying at current levels represents a safe and savvy entry opportunity.

P.S. We’ve already taken profits on Oracle inside The War Room. It’s just one of the 300 wins we are guaranteeing in The War Room in 2022.

Stop missing out on real-time buy and sell alerts – and JOIN US IN THE WAR ROOM TODAY!

Monday Market Minute:

- Merck (NYSE: MRK) is an inflation safe haven with a consistent daily “W” that could extend up to $84. Tracking.

- The Nasdaq opened lower for the ninth time in the last 10 sessions, so we should have some great dip buys after this bathwater sell-off.

Some War Room members scored quadruple-digit gains on Zynga (Nasdaq: ZNGA) this morning. Over 1,300% gains! Why are you not winning in The War Room with us? Join now!

More from Trade of the Day

How One Conversation Led to $100,000

Apr 23, 2024

How I Picked the Market Bottom

Apr 23, 2024

Warning: Trade This Notable Sentiment Shift

Apr 22, 2024

Why Next Week Could Be Big (Special Offer Inside)

Apr 19, 2024