How to Create Your Own Bull Market

Lemons? Lemonade?

What type of investor are you?

Do you get mad when the market goes lower or when volatility goes higher?

Do you look for opportunities to make money, regardless of direction?

It may seem like a frivolous question, but it could be the difference between making money consistently and losing money consistently.

Let me give you an example of a trade that members just made in The War Room.

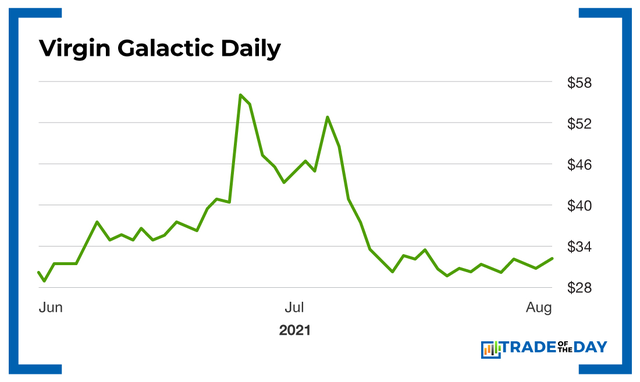

It was on Virgin Galactic (NYSE: SPCE). Unless you’ve been living under a rock, you probably saw or heard about Richard Branson’s flight to space on July 11.

Virgin Galactic shares jumped to $55 from less than $30 a few weeks earlier in anticipation of that flight. On June 10, I noted that it could shoot higher – a full month before it set new highs…

Here’s an interesting idea, in my opinion. It’s another binary type situation that offers before and after potential. Since I don’t do short-term plays, it’s an idea that you may want to look into.

Bezos is going to space on July 20. It could be a great event, and the run-up prior will be in the news. It could end badly or be delayed.

I think the way to play this is with a strangle on SPCE – probably the July 30 expiration. Not cheap and certainly speculative.

That strangle would have paid out nicely, as the shares moved from $35 on June 10 to more than $55 at their peak.

Then, just after the successful launch, Virgin Galactic announced this:

Virgin Galactic entered into a distribution agency agreement with Credit Suisse, Morgan Stanley and Goldman Sachs, dated July 12, relating to the sale of common stock. The company may offer and sell shares of common stock having an aggregate offering price of up to $500 million from time to time.

As you can see from the chart below, the stock basically followed the trajectory of a rocket that blasted off and then came back to earth – all within a very short period of time…

Some investors made a ton of money while others lost a ton. But as the dust settled, there was more money to be made by getting into a put sell with a 50% downside cushion. And that’s exactly what War Room members did this week. I can’t share the exact details, as that would be unfair to those paying members, but you get the idea.

The reason they were able to get into the trade with such great potential for profits and success was the volatility in the shares – which dropped from around $55 to around $30 in the span of three weeks.

That volatility increases options premiums dramatically. When that happens, you want to sell – and that’s exactly what members did.

Action Plan: While others are complaining about market lemons, we’re making lemonade in The War Room. Join me for some cool summer profits by clicking here!

More from Trade of the Day

A Silver Lining From Last Week’s Underperformance

Apr 24, 2024

How One Conversation Led to $100,000

Apr 23, 2024

How I Picked the Market Bottom

Apr 23, 2024

Warning: Trade This Notable Sentiment Shift

Apr 22, 2024