How to Own the World’s “Testing Duopoly”

Let’s start with the bad news…

Lately, we’ve seen a trend forming.

And it’s not a good trend.

First, Johnson & Johnson (NYSE: JNJ) announced late on Monday that it’ll be pausing its late-stage coronavirus vaccine trial due to an “adverse event.”

Second, Eli Lilly (NYSE: LLY) paused its antibody trial on Tuesday, noting “a reason for concern,” without providing any further details. It simply said that the Data and Safety Monitoring Board (DSMB) has recommended a pause in enrollment.

And the FDA has yet to provide an update on these filings… which clearly raises some questions.

Most notably…

It’s still unknown whether the participants in either trials were receiving a placebo or the vaccine.

And of course…

This could impact every other vaccine using similar technology – such as the one used in a trial from AstraZeneca (Nasdaq: AZN) that was also put on hold after a serious adverse event from a trial participant back in September.

And now the good news…

All of these trials – and in some respects the shutdowns over safety concerns – make a strong case for any company performing testing.

And right now, there’s literally a duopoly in the companies that test.

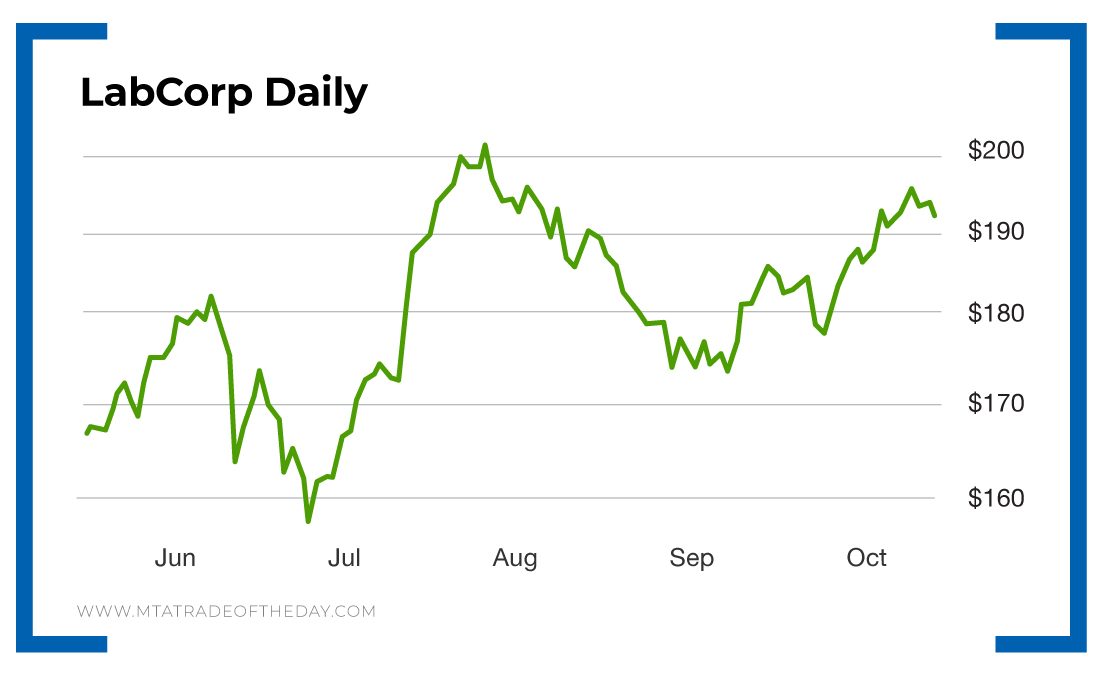

The first testing company is LabCorp (NYSE: LH).

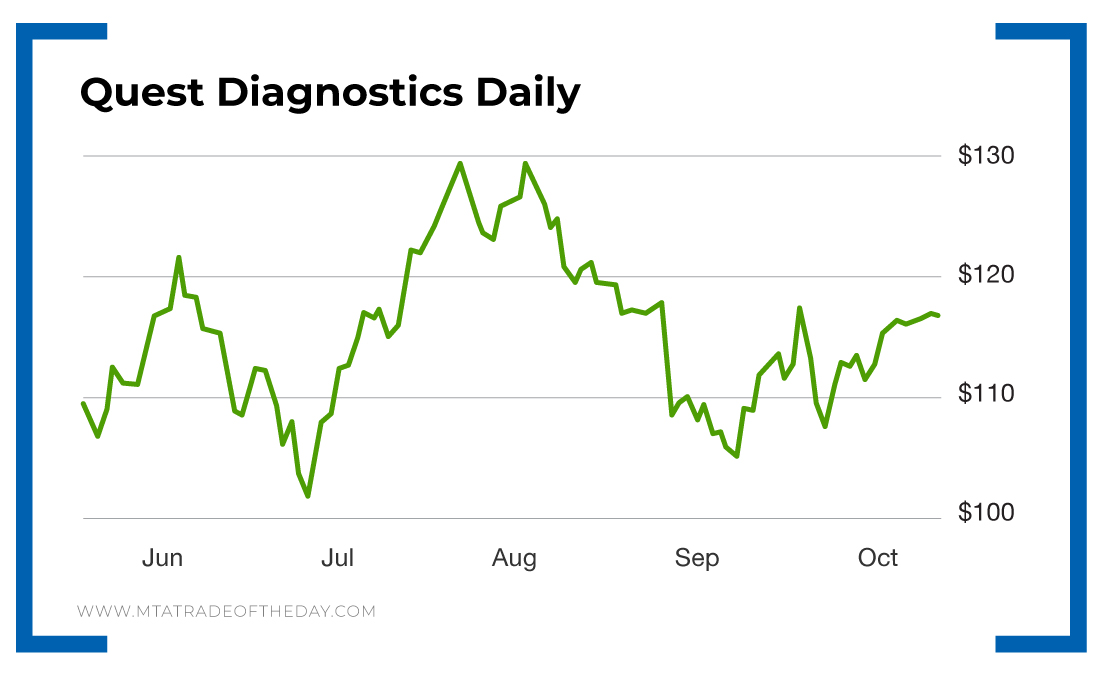

The second testing company is Quest Diagnostics (NYSE: DGX).

Currently, these two hold what Barron’s calls a “testing duopoly” on the $72 billion health testing market – this includes hospitals and home testing.

Looking specifically at LabCorp…

It’s gone from around 3,000 COVID-19 tests per week to 200,000 COVID-19 tests per day.

Last month, it also just launched a combination COVID-19 test that screens for COVID-19, the flu and respiratory syncytial virus (RSV).

It’s also developing blood tests that could take the place of biopsies.

To me, testing will not go away anytime soon.

If anything, it’ll continue to get bigger and bigger.

To take advantage of this, you’ve basically got two companies that’ll own the entire testing market sector.

So here’s how to play it…

Action Plan: Of the two names, I like the story behind LabCorp the best. But I like the Quest Diagnostics chart because it has more upside potential. Both stocks are buyable – but you may need to tinker your timing to get the best entry. And for that, you’ll need to join me inside The War Room!

P.S. THE WAIT IS ALMOST OVER! Get ready… because Trade of the Day Plus is ready to launch! Every week, Bryan and Karim will give you their very best pick, with unique entry and exit signals, straight to your inbox – all in a fun, engaging video. This is something that Trade of the Day members have been asking for – and it’s about to launch any day now. Be ready because we want you to be first in line. It’s all coming to you… very, very soon!

P.P.S. Join us on Instagram! Our new Instagram account is screaming! As a quick refresher, we just launched an Instagram page – and all Trade of the Day members are invited to join. It’s totally free! Just click here and then click “Follow.” And that’s it! You’re in! We plan to post charts, videos, trade results, and even some funny and entertaining memes. It’ll be a great experience and keep us all plugged in together – even on the go. So take a quick second and follow us now!

More from Trade of the Day

Why Next Week Could Be Big (Special Offer Inside)

Apr 19, 2024

When it Comes to Positioning – Size Matters

Apr 18, 2024

The One Strategy I’m Leaning on in a Choppy Market

Apr 18, 2024

One Crucial Wartime Trade to Make Now

Apr 17, 2024