How to Trade Expensive Lithium Stocks

Founded in 1887 and headquartered in Charlotte, North Carolina, Albemarle Corporation (NYSE: ALB) is one of the largest lithium producers in the world.

And thanks to today’s top market trends…

This specialty chemicals company finds itself in a market sweet spot.

You see, it engineers lithium hydroxide, lithium chloride and lithium aluminum hydride for lithium batteries – which are used in both consumer electronics and electric vehicles.

As I’m sure you know, electric vehicles (EVs) are the hottest auto trend in decades – and lithium is the key component needed to make their batteries work.

So, as you can imagine, with EV production soaring (and expected to keep roaring higher for the foreseeable future) lithium prices have skyrocketed.

This could work to Albemarle’s advantage as the company approaches its next earnings report, which is due after the close on Wednesday, November 3.

So how do you play it?

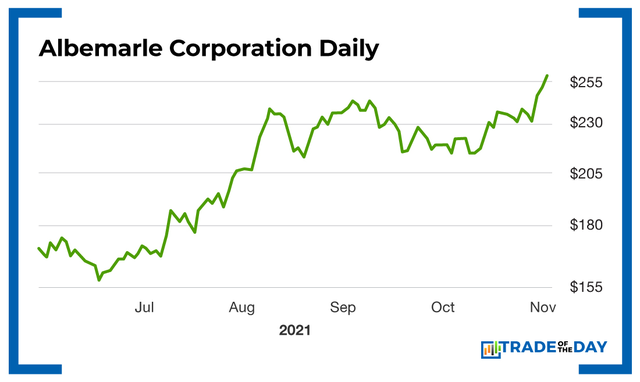

As this chart shows, shares continue to blast higher.

You could…

- Buy Albemarle stock – and hope that shares continue moving higher after it announces earnings

- Let the earnings report come and go – and (hopefully) buy Albemarle on a dip (while running the risk of buying at a higher price if the stock gaps up in response to earnings)

- Buy a call – and risk a big downswing on earnings crushing your trade while you hope for a huge winner on an earnings upswing.

What’s the best answer?

Action Plan: From a pure trading perspective, I believe this situation sets up perfectly for a call spread. I just initiated such a recommendation inside The War Room – and if you join us, you can still get into this trade. For more information on The War Room, you’re invited to view our new presentation. Explore The War Room here!

More from Trade of the Day

Why Next Week Could Be Big (Special Offer Inside)

Apr 19, 2024

When it Comes to Positioning – Size Matters

Apr 18, 2024

The One Strategy I’m Leaning on in a Choppy Market

Apr 18, 2024

One Crucial Wartime Trade to Make Now

Apr 17, 2024