Insiders Are Betting More Than $1 Billion on 3 Companies… in THIS MARKET?!

Three companies. Over $1 billion worth of shares bought on the OPEN MARKET. In 2022.

That’s enough to wake anyone up. And so far, two of the three are in the money, big-time.

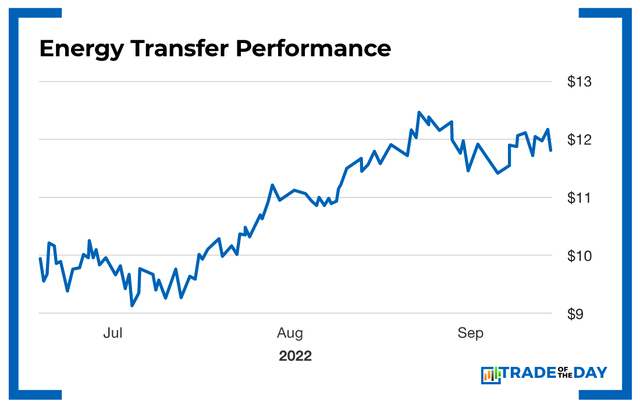

The first company is Energy Transfer (NYSE: ET), with its whopping 8% dividend. Its chairman has spent over $50 million in just the past two weeks. At an average price of $12, that’s over 4.1 million shares! And he bought over $120 million worth of shares a couple of years ago.

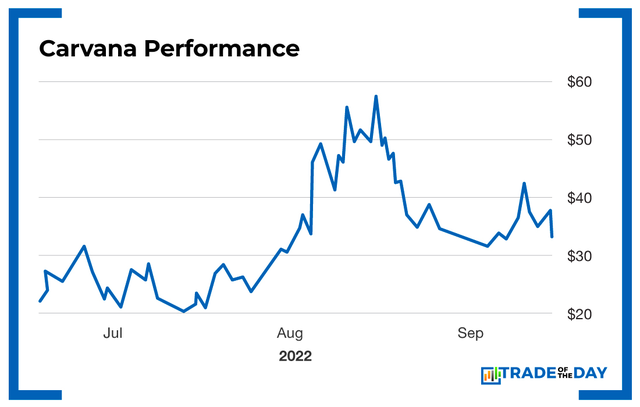

Then there are the insiders at Carvana (NYSE: CVNA). One insider scooped up $42 million worth of shares at $21 earlier this year. Those shares doubled in price just a couple of weeks ago.

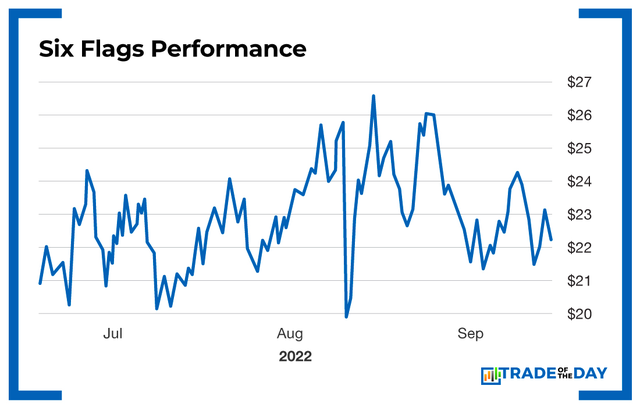

Finally, insiders at Six Flags (NYSE: SIX) are buying shares hand over fist right now with the stock in the low $20s. Something tells me that the shares will be a higher a year from now – maybe sooner and maybe much higher!

While so many people are losing their shirts, my readers made money on their trades in Energy Transfer and Carvana – good money.

It’s not what you know… it’s when you know it and how to see it.

I follow insider trading religiously. I look for specific buying patterns. Then I analyze the companies. Then we move. Fast. In real time. Before the talking heads even get wind of it. How?

I get real-time insider filings. It costs a fortune… but it also makes fortunes.

Yesterday, I recommended shares in a maker of clothing. Not the kind of clothing you’re thinking of, I guarantee it. EVERYONE buys this kind of clothing, whether we’re in a recession or not. And the insiders know it.

They’ve been buying shares almost every day for a couple of weeks now.

But I waited. I wanted to do a special play where I would pay just over $1 and still get the same profit opportunity as them.

They have been paying as much as 16X what my readers paid. You may be thinking I am talking about some type of short-term option. You’d be wrong.

We have a ton of time on our side – and all for just $1.15! I would share the pick with you, but then my readers would be mad at me!

Action Plan: If you want to see what company I’m talking about, then come join my Insider Matrix. Imagine being in the boardroom, as an insider. You know what’s ahead. You have all the knowledge, and you never panic when the markets are down (like they are right now). That’s what it’s like being an insider – and you could make gains as high as 2,250% with this kind of (legal) information.

Click here to unlock the Insider Matrix.

P.S. Also, remember the strategy I shared with you last week to make money if the market plunged… or soared? Well, it paid off big-time for our readers. Here’s just a sample of how they did…

“Entered a SPY 420C/400P D14 strangle yesterday for $1.33 total X2. STC 400P at $2.82 X1 & $2.95 X1 for a 117% win. Thank you, @Kirk & @krahemtulla, for the idea and commentary!”

– Spaceman S.

“Exited my QQQ PUTS that I bought yesterday after Karim’s comments for a 100% gain. Thanks, Karim! Also, bought and exited SPY PUTS for 113% gain.”

– Mike M4

“BTO SPY 403P yesterday at close at $1.14, STC at $4.58 just now.”

– EJ44

“Days like today are PRECISELY why we all joined Monument Traders Alliance. Thank you, Bryan and Karim!”

– PETER T.

“SPY 9/23 405 P pd $7.00. Sold today for $13.00. Maybe early on both buy and sell, but thanks, Karim.”

– Donald S8

“A record day for me thanks in part to all the help from The War Room. Best decision I every made, short of marrying my wife. Have to work tomorrow, so will be monitoring on iPad. Good night, War Room.”

– Dstoll

If you want to see how we make trades like these in real time, I invite you to join us in The War Room. We have a 76% win rate in 2022. And right now, we’re guaranteeing 252 winning trades for members in their first 12 months.

Click here to join the community.

Fun Fact Friday

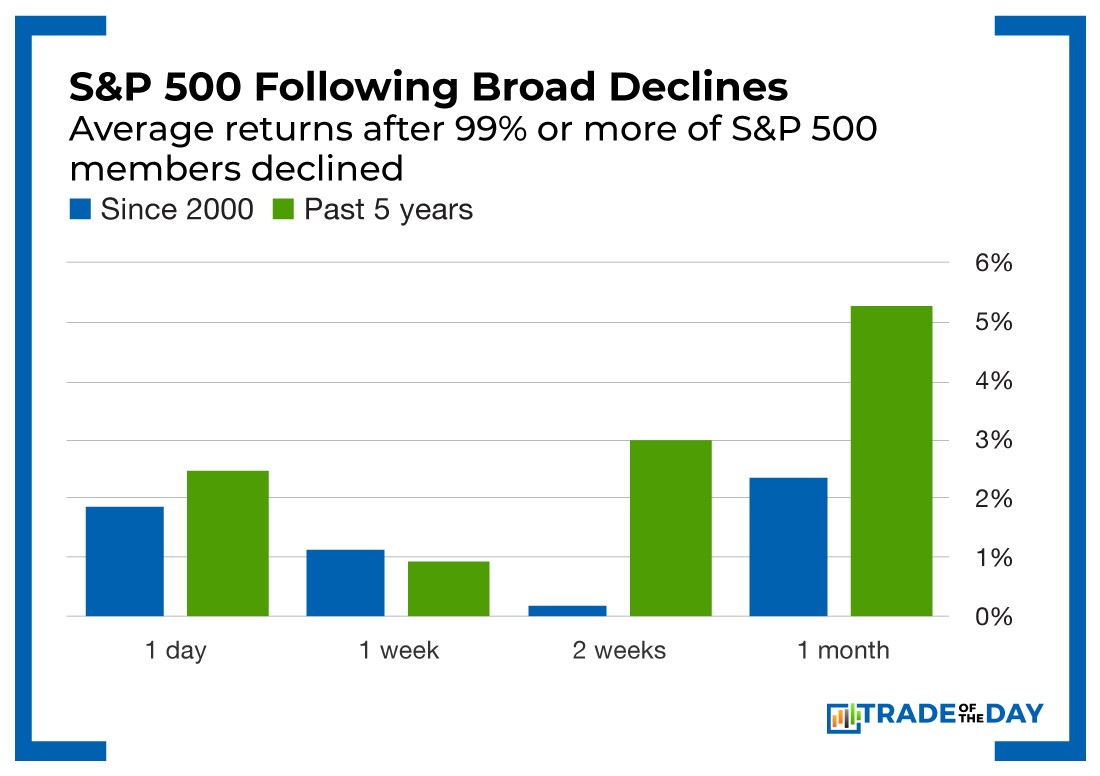

The worst market session since June of 2020 happened on Tuesday. When last month’s inflation numbers remained high, it confirmed that the Fed’s anti-inflation moves had not been as effective as hoped. Investors realized that the Fed wouldn’t back off its aggressive rate-hike plans anytime soon – and markets tanked as a result. But here’s the good news… Historically, markets perform well in the weeks following a broad decline. This has been especially true over the last five years.

More from Trade of the Day

When it Comes to Positioning – Size Matters

Apr 18, 2024

The One Strategy I’m Leaning on in a Choppy Market

Apr 18, 2024

One Crucial Wartime Trade to Make Now

Apr 17, 2024

Apr 17, 2024