Insiders Are Going Bonkers for This $10 Energy Stock

Insider buying is one of my favorite indicators. I have written extensively about it in past Trade of the Day articles.

The strongest signal is a cluster buy, where three or more insiders buy shares on the open market. An open market buy refers to buying shares in the market, just like you and I do.

When an insider makes a big purchase in the open market, it suggests a lot of conviction regarding the future direction of the stock.

Insiders also sell stocks. But they sell for a variety of reasons – to diversify, for estate planning, or even to buy a house or a car. However, they buy for only one reason – they think the shares will be higher in the future. And that’s exactly what insiders think will happen with this stock.

Before I get to the stock, let’s go over who the insiders really are…

Insiders are directors and members of the company’s management team. They are privy to the most sensitive information regarding the company’s plans, mergers and acquisitions, earnings, big contracts… the list is endless. That is the incentive for their purchases, and that is why I pay attention.

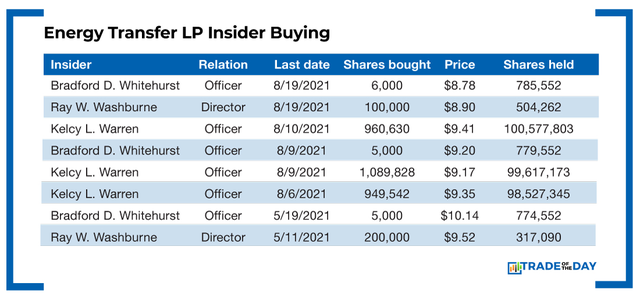

Over the past few months, and even as recently as the past couple of weeks, insiders at Energy Transfer LP (NYSE: ET) have been buying shares like they’re going out of style.

Just look at the table below…

If that isn’t conviction, I don’t know what is. Energy Transfer is not a conventional energy company. It makes money from the transport (through pipelines) and storage of energy products. And, with a resurging economy, the bet is that more energy will need to be produced, transported and stored. So the insiders are betting on a strong reopening!

In The War Room, we took a unique approach to this play. I can’t share that approach for obvious reasons, but you can find out what members did and how they play insider trades in real time by clicking here! And right now, we are making a BIG promise: 300 winners over the next year or you get The War Room FREE for life! But you better act now. This offer could be taken away by my publisher at any moment…

More from Trade of the Day

How One Conversation Led to $100,000

Apr 23, 2024

How I Picked the Market Bottom

Apr 23, 2024

Warning: Trade This Notable Sentiment Shift

Apr 22, 2024

Why Next Week Could Be Big (Special Offer Inside)

Apr 19, 2024