Instacart: A Warning About AI

Editor’s Note: As we enter 2024, there are a lot of questions swirling around artificial intelligence stocks.

That’s why in today’s guest article, Manward Press Chief Investment Strategist Shah Gilani is letting readers in on a specific AI-based stock he believes will be a stellar value play in 2024.

Plus, for those of you who want to learn exactly how Shah is investing in AI stocks this year, he just launched his 2024 AI playbook, in which he explains two critical moves he recommends you make in the next 72 hours to secure your future.

Click here to learn more about AI’s $100 trillion “Big Bang” moment.

– Ryan Fitzwater, Publisher

Every investor knows AI is hot. It was the buzzword of 2023.

It’s what launched stock market indexes higher. It’s what almost every listed company’s management team now says they’re using.

And it’s what companies have shouted the loudest about when they’ve announced their IPOs.

Chipmaker Arm Holdings (ARM) touted AI leading up to its September 14 IPO.

It highlighted its focus on GPU (graphics processing unit) chips, the not-so-secret sauce powering AI applications. And its IPO, initially priced at $51, opened at $56.10, traded up to $66.28 and closed the first day at $63.59.

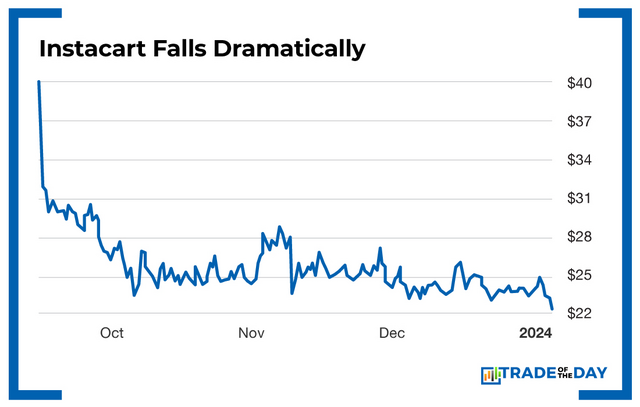

Instacart (CART), formally known as Maplebear, also touted AI leading up to its September 19 IPO. And its first day as a public company was almost as explosive as Arm’s.

But it didn’t last.

Maybe that was because Instacart’s AI-infused hype was more about getting investors to buy into the IPO than actually powering Instacart’s revenues or profits.

And therein lies a warning for investors…

It’s important to know what’s real and what’s not real about AI… and to discern who’s using it to hype up stock prices and who’s using it to actually make money.

That’s why investors need a road map when it comes to companies touting AI.

AI Offensive

Back in May 2023, when rumors that Instacart was planning an IPO started circulating, the company launched its AI-powered charm offensive. Leading up to the IPO, Instacart announced several major updates to its Storefront platform, all of them AI-driven.

The platform powers storefronts for more than 550 retail brands, including Costco. The updates, according to VentureBeat, included conversational search capabilities powered by OpenAI’s ChatGPT as well as proprietary AI models.

The company also announced AI upgrades to its Caper Carts, the checkout technology the firm acquired in 2021 when it bought startup Caper AI for $350 million.

There’s nothing wrong with touting AI when a company actually uses it. What’s wrong is advertising AI use or contemplated AI use to hype a company’s stock price.

Instacart priced its IPO at $30 a share. The buzz around the IPO was about how the company’s new AI upgrades were powering sales and profits – which, in fact, they were. So it was no surprise the stock opened its first day of trading at $42, 40% above its IPO price. It got up to $42.95 that day but closed at $33.70 – still a decent 12.3% above the initial price.

Then the AI hype, pushed by the IPO’s underwriters, faded as reality took hold. The stock fell shortly after its debut… and has struggled to regain the ground it lost. The stock’s now trading below its IPO price, at $22 and change.

I’m a frequent guest on Fox Business News. As Instacart prepared for its IPO, the hosts asked me about AI prospects driving its profitability when it came to market.

I told them I thought the hype was more about inflating the IPO and the stock than the company’s profitability and that I couldn’t in good conscience recommend it.

Investors have been taken in by AI hype a lot lately, and it’s going to wreck a lot of portfolios and retirement prospects.

Instacart faces stiff competition from DoorDash, Uber and, of course, Amazon. Looking at it in this light takes out the AI hype and flighty narratives and focuses your analysis on actual numbers.

Uber trades at 2.8 times revenue, DoorDash trades at 3.5 times revenue and Instacart started trading at four times revenue. On that basis alone, it’s expensive, and I wouldn’t recommend it.

AI hype aside, I would consider buying Instacart below $20… and it’s headed there. Down there, it’s worth buying for its growth potential, its profitability and its AI tech.

That’s what I mean when I say you need a road map to navigate all the AI hype. There’s no doubt that every investor needs exposure to the AI space and its explosive growth potential… but if you’re not careful and just go after every ticker that has an AI angle right now, you’re going to lose your shirt.

![]()

YOUR ACTION PLAN

Fortunately, I’ve hand-picked what I think are the absolute best ways to profit from the AI boom right now. You’ll want to get in on these trades before Wall Street catches on to where the real profit potential is in this space.

Click here to get all the details on AI’s $100 trillion “Big Bang” moment.

Cheers,

Shah

FUN FACT FRIDAY

The Snowiest 24 Hours Ever! The biggest one-day snowfall in the United States was 5 feet, 3 inches – in Georgetown, Colorado, on December 12, 1913.

More from Trade of the Day

This Secret Helped me Retire Many Times Over

May 3, 2024

Play Short Squeezes “To The Moon”

May 2, 2024

Place Your Bets, Apple Earnings Tonight

May 2, 2024

How to Trade the Market’s #1 Fear

May 1, 2024