Jump on This Red-Hot Holiday Trend Right Now

Do you want to get ahead of the strongest retail shopping trend this holiday season?

Then listen up…

According to Bloomberg, now that governmental relief programs have expired, Americans are hunting for deals.

Sure, wages have risen this year, but the increase in prices for everything (from energy and rent to food and vehicles) has eaten into those gains.

As a result, U.S. consumers are now increasingly shopping at discount stores.

According to Facteus (a firm that tracks credit and debit card transactions), spending at discount stores was up 65% last week (compared with the same period in 2020) – and up 21% from the prior week.

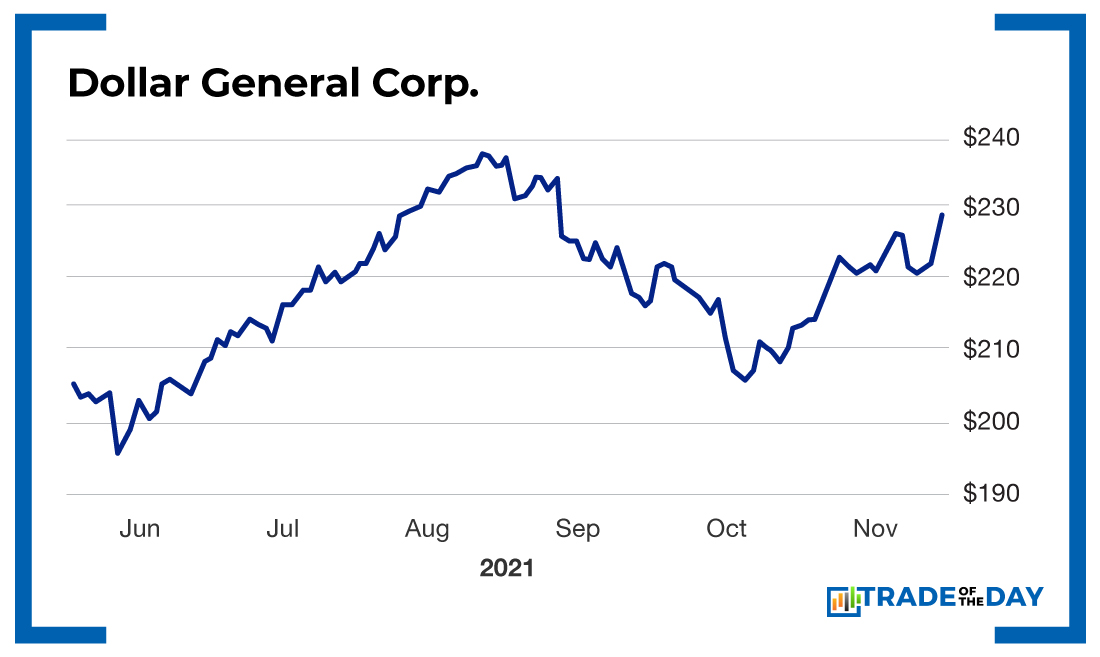

That’s why it’s now time to move into Dollar General (NYSE: DG).

After setting an early October low around $205, it’s back on the move.

Going into the holiday shopping season, a retest of $240 is within range – especially now that Wall Street firms are catching on.

Case in point…

Just this morning, fellow discount retailer Dollar Tree (Nasdaq: DLTR) rallied after The Wall Street Journal reported that activist investor Mantle Ridge wants Dollar Tree to take action to boost its stock price – which prompted Deutsche Bank to upgrade the stock from a “hold” to a “buy.”

So the move into discount retailers is on.

Action Plan: What’s good for Dollar Tree is also good for Dollar General – so the time to move in is now. In fact, inside The War Room, we’ve already used this discount-retailer trend to hit two intraday winners on Five Below (Nasdaq: FIVE) and Dollar General (NYSE: DG). If you’re ready to start profiting alongside us – and start turning these winning ideas into winning trades – you’re invited to enter The War Room right now.

Monday Market Minute

-

- We still love dip-buying American Water Works (NYSE: AWK). The new infrastructure bill allocates $55 billion for rebuilding water infrastructure, which should certainly offer a trigger.

- Another insider buy was reported for MoneyGram (Nasdaq: MGI) – 10,000 shares purchased by a director at $5.75 per share. Veterans Day last week delayed the report, as the SEC was closed on Thursday. We are playing alongside the smart money with a covered call play.

- What’ll be the hottest holiday toy this year? In our view, it’ll be the Funko Pop! toys that kids are going crazy over. From Star Wars to Marvel to sports players – and anything in between – Funko makes them, and the stock has dipped. It might be time to sneak into December calls going into the holiday buying season.

More from Trade of the Day

The Story Behind My 10 Bagger on RILY

Apr 25, 2024

A Silver Lining From Last Week’s Underperformance

Apr 24, 2024

How One Conversation Led to $100,000

Apr 23, 2024

How I Picked the Market Bottom

Apr 23, 2024