Little Risk, Big Reward?

Whether you’re trading in a bull or bear market, it’s almost impossible to avoid risk. But our friend Alexander Green, the Chief Investment Strategist at The Oxford Club, has ways to reduce risk in your portfolio that you won’t want to miss.

It starts by owning a diversified selection of high-quality companies with excellent prospects.

And recently, Alex discovered the biggest development in medical technology in about 50 years. Bill O’Reilly – a longtime member of The Oxford Club – is even calling it, “humanity’s next great leap.”

Together, Alex and Bill discuss how you can get in early on this little-known company that only recently went public and is already taking in tens of millions of dollars…

Trading for well under $5, this stock could be your ticket to major gains in 2022.

Click here to learn more before it’s too late.

– Ryan Fitzwater

Where are stocks headed tomorrow? The answer is no one knows.

It’s impossible to predict the future of the market.

That may sound disappointing – or just plain odd – coming from someone who gives investment advice for a living.

After all, people in my line of work are supposed to have strong, well-reasoned opinions about the outlook for economic growth, inflation, interest rates, currency values, commodity prices and the market.

Yet those opinions are worth exactly what you pay to hear them: nothing.

Stocks are the best-performing asset class of all time – and that isn’t likely to change.

But whether stocks go up or down in the short-to-medium term will depend on events we can’t foresee.

Consider just a few of the biggest market-moving events of the last 35 years…

On Black Monday in October 1987, world stock markets crashed.

No government official was shot that day. No currency collapsed. In fact, there was no major news whatsoever.

Yet markets around the world plunged up to 40%… in a single session.

Who predicted this?

No one. (Excepting, of course, the broken clocks who predict a stock market crash every year.)

After a three-year recovery in stocks, we hit another bear market as the world geared up for the first Gulf War.

Who predicted that Iraqi President Saddam Hussein would suddenly invade Kuwait and grab its oil fields?

No one.

A few years later, the hedge fund Long-Term Capital Management lost $4.6 billion in four months.

Then-Federal Reserve Chairman Alan Greenspan had to recruit 14 major financial institutions to help supervise its orderly liquidation and avoid a financial panic.

Who predicted the collapse of a major hedge fund run by Nobel laureates?

No one.

In 2020, a novel virus escaped China and created a global pandemic, leading to a health crisis, millions of business shutdowns and the biggest spike in unemployment since the Great Depression.

Who predicted this?

No one.

Knowing all this, do you really care what some talking head on CNBC forecasts for the year ahead?

While the timing is always uncertain, we will have many bull markets and bear markets in the future.

Smart investors prepare for them in advance.

How?

You capitalize on bull markets by owning a diversified selection of high-quality companies, with excellent prospects, that sell at reasonable valuations.

You prepare for bear markets by asset allocating outside of U.S. equities, position sizing your stock portfolio and running trailing stops behind your individual positions.

You may feel you have a good grasp of what’s happening with the economy, interest rates, inflation and even geopolitics.

That’s still not enough.

Risk isn’t limited to what you can imagine. It also includes what you can’t imagine.

Don’t get me wrong. I’m an optimist. I see human ingenuity, technology and capital markets creating a far better future. I remain a long-term believer in equities.

The biggest risks are the ones you can’t see coming.

And the time to prepare for them is now.

Action Plan: I don’t try to jump in and out of the markets constantly, based on the media-driven news cycle. I don’t try to predict what crazy moves the Fed will make. Rather, I find the exact stocks that match my strict investment criteria…

I look for companies that are truly changing our world by inventing new products, gaining worldwide market share and increasing revenues quarter after quarter.

I recently discovered one stock that does all of this and more… and investors can hop in now while it’s still relatively unknown and trading at a major discount.

The Latest Smart-Investment Stock

This company is set to revolutionize the healthcare industry as we know it.

It consistently beats expectations and is poised for breakout success in the year ahead. Not only is this company offering revolutionary technology, but its stock crushed earnings by 91% and is trading for well under $10.

The company also has a rapidly growing pipeline, with more than 25 projects underway… And the world is beating a path to its door.

At the start of 2022, the company secured a new partnership with a French pharmaceutical giant.

This blockbuster deal is worth up to $5.2 BILLION – and it has billions more in partnerships with Bristol Myers, Bayer, Sumitomo Dainippon Pharma, Apeiron, and Rallybio.

I expect more will be knocking on the door soon…

The brilliant founder of this company has delivered big to the medical community… and to shareholders in the past.

Investors who got in early on his genomics company years ago could have turned $10,000 into $340,000 within one year (a 3,300% increase).

And now I’m happy to share this next opportunity…

Bottom line: It has as much upside potential as anything I have ever recommended.

Here are all the crucial details.

ALL

Good investing,

Alex

Fun Fact Friday:

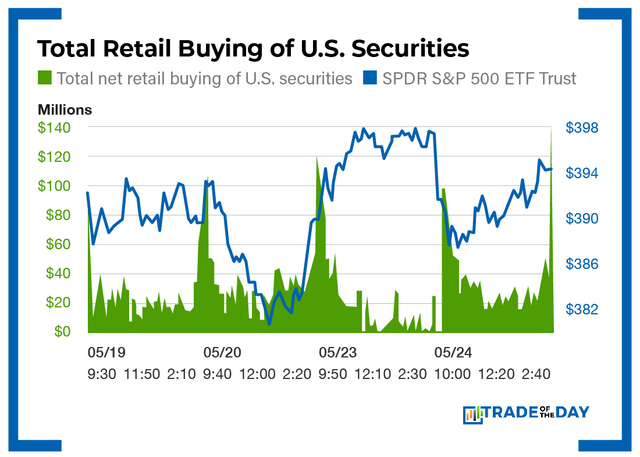

A recent surge of end-of-day retail investor buying activity has helped to fuel the latest market rally. The S&P 500 rose again Friday morning, putting it on track to extend a recent stretch of gains and snap a seven-week losing streak. What’s causing this end-of-day buying? Can it continue? Check back with us next week for our follow-up.

More from Trade of the Day

A Silver Lining From Last Week’s Underperformance

Apr 24, 2024

How One Conversation Led to $100,000

Apr 23, 2024

How I Picked the Market Bottom

Apr 23, 2024

Warning: Trade This Notable Sentiment Shift

Apr 22, 2024