Mondo Profits for Tech Stock

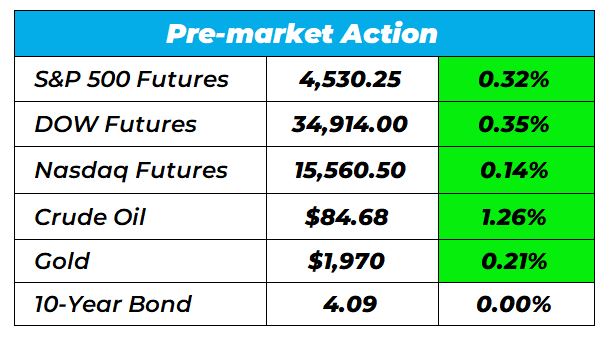

Good morning Wake-up Watchlisters! While you’re sipping coffee you’ll see stock futures rose on Friday following the August jobs report. Investors will be crunching the latest employment data for clues on what it could mean for the path of interest rate hikes. Any signs of job cooling could see the Federal Reserve ease off and get the “soft landing” its been looking for.

When the market dips and rises again, it’s important to consider value stocks that have a chance to rise along with it. Our Head Fundamental Tactician Karim Rahemtulla has been pounding the table on what he’s calling “The Last Great Value Stock.” It’s already up 60% this year, and Karim believes it still has a lot of room to grow.

Click here to learn how this under $3 stock could soar as high as $50 in just a few years.

Here’s a look at the top-moving stocks this morning.

MongoDB, Inc. (Nasdaq: MDB)

MongoDB is up 6.24% premarket after crushing its profit. During the second quarter, MongoDB earned an adjusted 93 cents per share, walloping forecasts for 46 cents, according to FactSet. Earnings reversed from a year-earlier loss of 23 cents. MDB stock has nearly doubled this year, rising almost 94% after Thursday’s close.

Lululemon Athletica (Nasdaq: LULU)

Lululemon Athletica is up 2.29% premarket after another solid earnings report. Oppenheimer & Co. Senior Analyst Brian Nagel said the clothing retailer is benefiting from the fact that people are still dressing casually post-pandemic. Lulelemon also raised its sales forecast for a second time due to more demand.

Broadcom Inc. (Nasdaq: AVGO)

Broadcom is down 4.16% premarket. The semiconductor company fell after a muted near-term sales outlook, linked to weaker enterprise spending. Still, it sees AL sales driving a larger portion of its overall revenues in the future, with AI sales expected to drive 25% of revenue by the end of 2025.

Our Lead Technical Tactician Nate Bear recently got positioned on an AI stock in Daily Profits Live.

Nutanix, Inc. (Nasdaq: NTNX)

Nutanix is up 20.13% in premarket after the company’s board authorized the repurchase of up to $350 million in stock. The cloud company reported quarterly revenue that topped analysts’ estimates and issued strong sales guidance. Earnings came in at $0.24 per share, beating the Zacks Consensus Estimate of $0.15 per share. The report represents an earnings surprise of 60%.

Tech stocks have been major winners in 2023, more specifically AI stocks. And our Lead Technical Tactician Nate Bear recently launched his service, Profit Surge Trader. The service involves Nate trading just ONE TICKER over and over for maximum potential profits.

Click here to see how Nate charts “post-earnings surges” for his One Ticker Payouts.

Gold investment numbers are soaring

As inflation continues to eat away at the dollar, over 100,000 investors are buying up gold at a price not seen in years. Gold has outpaced some of the world’s best assets like stocks, bonds and real estate.

Click here to start investing in metals today.

Those are the biggest stock movers for today.

Happy trading!

The Wake-Up Watchlist Research Team