Profit Like Crazy in This Quarantined World (Part 2 of 3)

Do you remember the Trade of the Day from February 24?

It was titled “My Top Coronavirus Picks.”

My recommendation that day was simple. I recommended War Room members buy Clorox (NYSE: CLX).

Those who followed that advice wrote me this afternoon – telling me how much money they made.

As you’ll see, the profits are mind-blowing…

One member made out like a bandit with a 592% gain, while another member made a whopping 161%!

“My CLX $185 ca11 yesterday for $2.63 is up to $18.20 – continue cleaning, America!” – M.P.

“CLX April 17 $185 in yesterday at $8.40, out today $21.95.” – R.M.

My point of sharing these testimonials is not to brag – or beat my chest…

I want to show you just how valuable the free trading information you’re receiving here in Trade of the Day can be. The gains members are generating from this free service could be your own personal daily wealth generation tool.

So with that I’d like to lead directly into Part 2 of this week’s three-part Trade of the Day series.

Now, I continue to believe that this market is in a dangerous spot.

Just take a look at the list of high-profile CEOs who have stepped down this year leading up the recent market turmoil…

- Microsoft co-founder and CEO Bill Gates

- The Walk Disney Company CEO Bob Iger

- Mastercard CEO Ajay Banga

- Salesforce CEO Keith Block

- Uber Eats Vice President Jason Droege

- MGM CEO Jim Murren

- Aurora Cannabis CEO Terry Booth

- IBM CEO Ginni Rometty

- Match Group CEO Mandy Ginsberg.

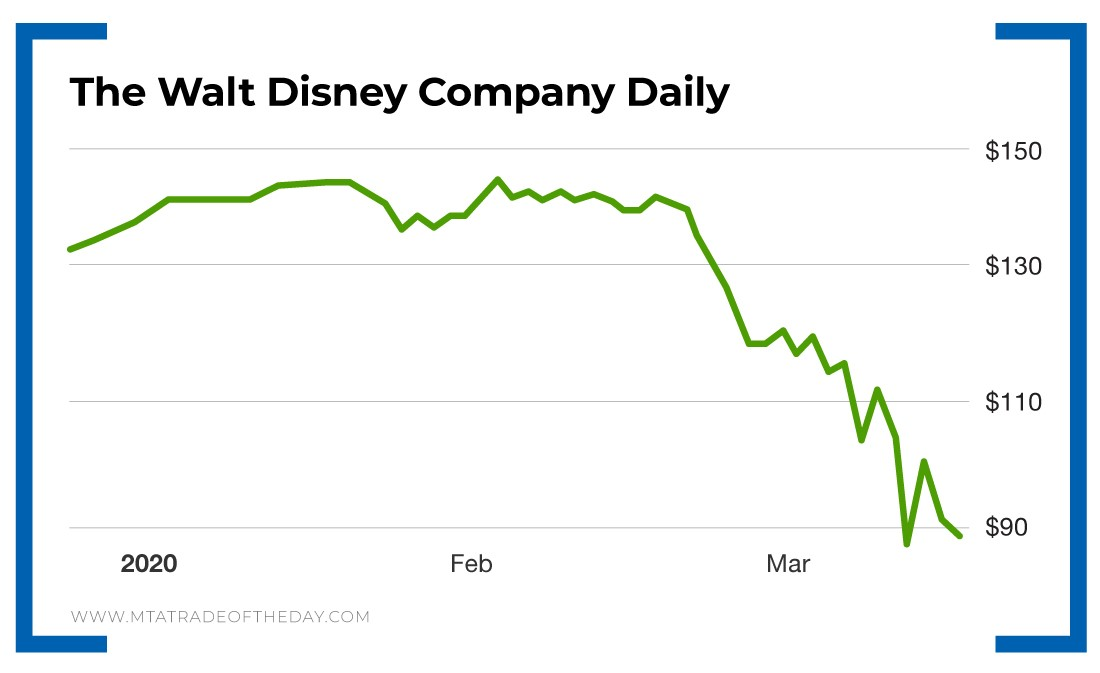

To me, one name sticks out on that list, Bob Iger, former CEO of The Walt Disney Company (NYSE: DIS).

Why?

Let’s consider what’s happening with Disney right now…

First off, Disney owns a part of Hulu. Hulu has live sports for $55 a month. Disney also owns ESPN. And right now, there are no more live sports. That’s trouble.

Second, weekend box office movie receipts are headed to a 22-year low. Experts are predicting that Hollywood could take a $20 billion hit from the coronavirus impact. That’s also trouble.

And the company has issued a statement saying they will close its theme parks for the foreseeable future. That’s strike three.

Clearly, that’s three critically important aspects of the Disney business model – rendered useless by the devastating impact of the coronavirus.

Sure, it still offers Disney Plus streaming service, which people can watch at home while quarantined…

But all those customers are already booked – already accounted for. Those revenues are already baked in.

In other words, having people sitting at home watching Disney Plus doesn’t move the needle at all.

That’s why I believe Disney is in trouble.

Action Plan: So far this week in The War Room, members have traded a number of winning put positions – which make money when a particular stock moves lower.

As I noted yesterday, Planet Fitness was one of our recent big put winners. And now Disney is another put play that I added to the list. I think new lows are coming – and I’m here to help you profit off the weakness.

If you’d like to start profiting alongside members with my daily trades, then you’re invited to join me in The War Room!

P.S. The more volatile the markets, the better! Since the market crisis got started in February, I’ve hit winners on 40 out of 42 trades. I think it’s about time you started ringing the register alongside us!

P.P.S. Tomorrow, in Part 3 of this series, I’ll outline the full list of stocks I like and don’t like in this new world of social distancing. Don’t miss it. Until then, stay safe, everyone.

More to come tomorrow!

More from Trade of the Day

When it Comes to Positioning – Size Matters

Apr 18, 2024

The One Strategy I’m Leaning on in a Choppy Market

Apr 18, 2024

One Crucial Wartime Trade to Make Now

Apr 17, 2024

Apr 17, 2024