Sometimes the Canary Doesn’t Die!

Back in the day, coal miners used canaries to detect dangerous gases in mines.

Canaries, and birds in general, are more sensitive than humans to poisons in the air. If the bird began to get sick or even die, the miners knew they shouldn’t go any farther.

That practice stopped in 1986.

Today, in the financial industry, the term “canary in the coal mine” refers to news that can be extrapolated across the board.

For example, if a bank reports bad earnings and blames it on the recession, it makes sense to predict that most other banks will report the same type of earnings. So investors sell the other banks they hold before their earnings are released in anticipation of bad news.

The canary isn’t always right, however.

Sometimes, a company that reports ahead of its industry is a lone wolf and not representative of the whole pack.

Sometimes, a company’s issues are related to that company and not the industry.

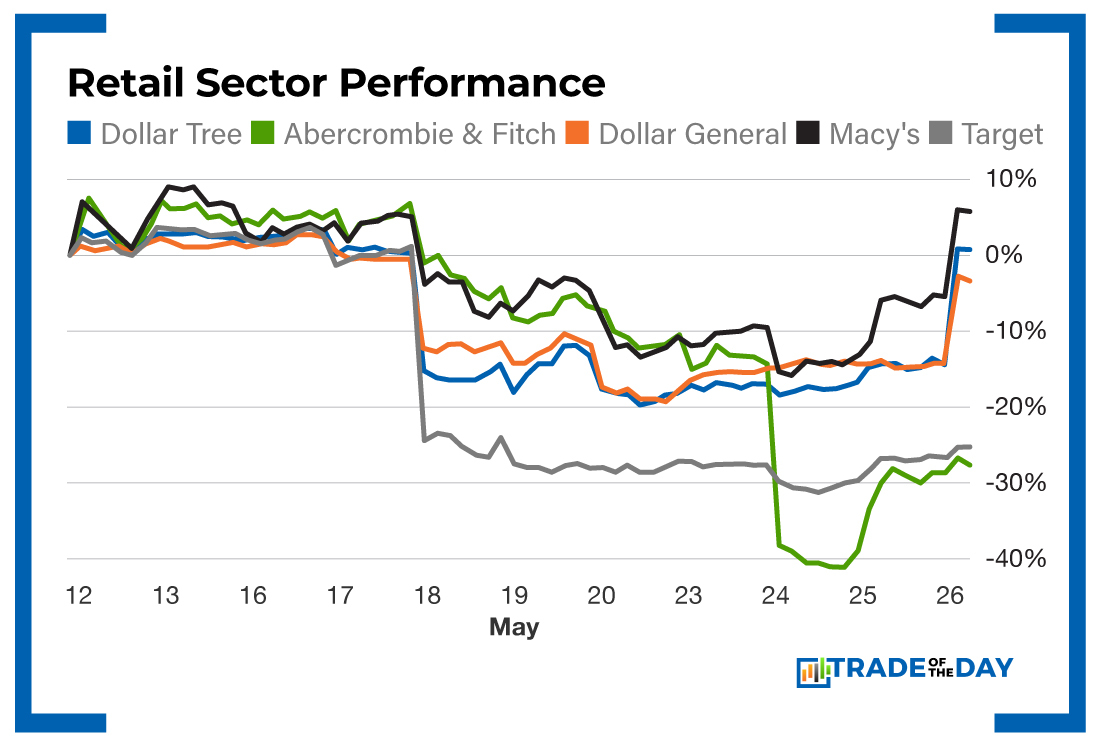

This week showed us that in the retail sector, not all is equal.

Investors assumed that after Target, Walmart and a couple of specialty retailers reported poorer-than-expected numbers, the entire sector was doomed.

As it turns out, that wasn’t the case. In fact, the opposite was true.

This week, retailers like Dollar General (NYSE: DG), Dollar Tree (Nasdaq: DLTR) and even Macy’s (NYSE: M) beat their expectations. How?

Well, Target (NYSE: TGT) and Walmart (NYSE: WMT) suffered from stocking, labor and inventory issues – they had too much of the wrong things and not enough of the right things.

Meanwhile, inflation-fatigued consumers spent more at Dollar General and Dollar Tree. And those who are making money and want to spend it shopped at places like Macy’s.

Predicting a trend from an entire industry is not easy, but it works a lot of the time when the industry is homogeneous, like steel or autos or oil and gas. Some products have more similarities than others and hence they are easier to correlate.

But when it comes to an industry like retail, which has multiple sources of products and is subject to shifting consumer demand and forecasts of what the consumer might like to wear next month, the equation becomes more complicated.

Action Plan: The best way to play this type of potential surprise is through the use of earnings strangles – or what we call Overnight Trades. With Overnight Trades, you play both outcomes, good and bad. If a stock moves up or down – as long as the move is big – you win! Overnight Trades are a strategy we’re famous for in The War Room. We’ve helped members pocket overnight gains of 396%, 141% and 508% thanks to crazy earnings events. And right now, we’re guaranteeing new members will receive 252 winning picks in their first 12 months.

More from Trade of the Day

How One Conversation Led to $100,000

Apr 23, 2024

How I Picked the Market Bottom

Apr 23, 2024

Warning: Trade This Notable Sentiment Shift

Apr 22, 2024

Why Next Week Could Be Big (Special Offer Inside)

Apr 19, 2024