Spirited Striking…

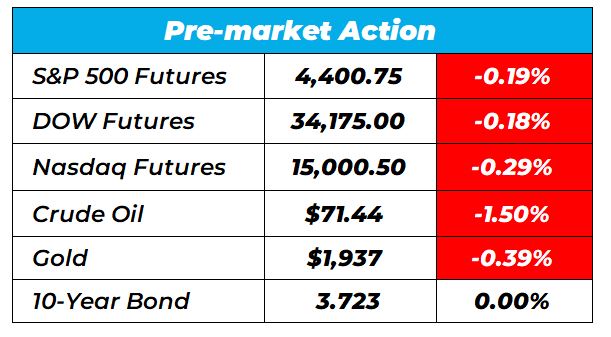

Good morning Wake-up Watchlisters! While you’re sipping coffee you’ll see stock futures traded lower on Thursday after three days of declines. Federal Reserve Chairman Jerome Powell hinted at more rate hikes yesterday, and a tech dip signaled concern about the recent bull trend. Also, Norway and Switzerland implemented rate hikes to levels not observed in over a decade.

Attention readers: Time is running out. Our FREE War Room Open House starts next Monday. Bryan and Karim will be sharing their best trading strategies without any payment required from you. Last month alone, they opened and closed 32 winning trades, including gains of 214%… 190%… even 293%! All in less than 24 hours.

Now, they want to prove they get RESULTS by letting you into The War Room. The Open House starts on Monday, June 26 and runs through June 30th, giving you five days worth of trades – all for free.

Click here to sign up to our War Open House today.

Here’s a look at the top-moving stocks this morning.

Spirit Aerosystems (NYSE: SPR)

Spirit Aerosystems is down 9.40% premarket after the company announced it will suspend factor production. The decision comes in light of Spirit Aerosystems employees going on strike, with all IAM-represented employees deciding not to work but will receive pay for their regularly scheduled work hours.

Tesla, Inc. (Nasdaq: TSLA)

Tesla is down 3.65% premarket after sinking 5.5% on Wednesday, its biggest loss in two months. The drop came after a Wall Street analyst advised it was time to take some money off the table. Barclays analyst Dan Levy downgraded Tesla shares to Equal Weight from Overweight, claiming the stock’s recent rally came from an overhyped AI boom. Also, Levy mentioned Tesla’s recent supercharger deal with Ford and GM network is more likely to pay off in the long term than in the short term.

$mid_ad_zone

NVIDIA (Nasdaq: NVDA)

NVIDIA is down 1.31% premarket after news that another company insider sold stock after its record highs last month. Mark Stevens, an insider board member since 2008, dumped $51 million worth of stock, according to the Securities and Exchange Commission filings on Wednesday. His colleagues Tench Coxe and Harvey Jones have also sold shares, unloading $59 million and $72 million respectively over the month of June.

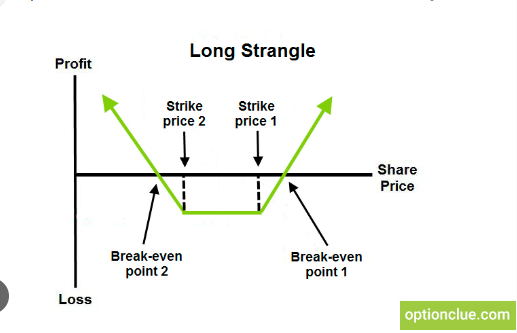

Our Head Fundamental Tactician Karim Rahemtulla specializes in tracking insider plays like the ones we’re seeing in NVDA. In fact, he believes in following the money so much he’s called it “the most accurate indicator he’s ever seen,” and he’ll be showing War Room Open House attendees how they could use this information to their advantage when trading.

Click here to sign up for War Open House.

KB Home (NYSE: KBH)

KB Home is down 1.17% premarket after the homebuilder announced improved buyer demand voer the coming months following better-than-expected second quarter earnings. KB Home said revenues would likely rise to between $5.8 billion and $6.2 billion, topping Refinitiv forecasts, as mortgage rates ease and house prices decline as a glut of new properties are now on the market.

Those are the biggest stock movers for today.

Happy trading!

The Wake-Up Watchlist Research Team

More from Wake-up Watchlist

May 17, 2024

Warren Buffett Reveals $6B Stake

May 16, 2024

Hydrogen Company Could Get $1.6B

May 15, 2024

May 14, 2024