Take Your Profits on Two Perfectly Timed Stock Buys!

Three orders of business today…

First, some profit taking.

Back in the beginning of February, when the market began to turn lower, I mentioned two stocks you should own throughout this crisis…

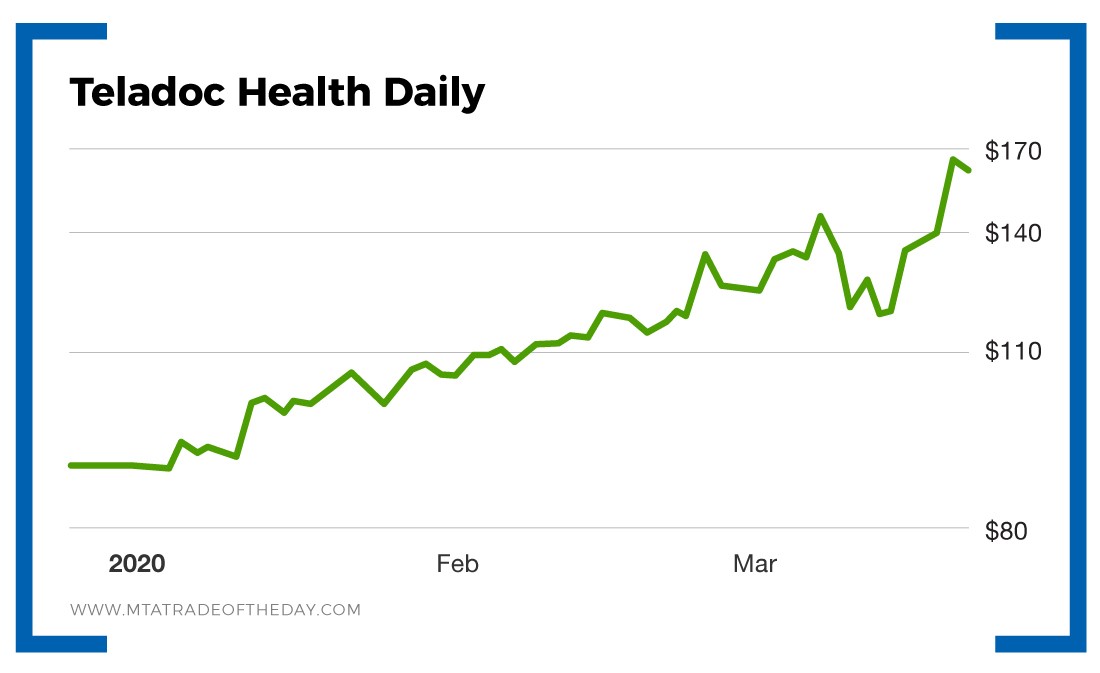

Stock No. 1: Teladoc Health.

Stock No. 2: Zoom.

If you followed along and bought either stock, you’re up huge – all in the midst of the biggest market panic since the Great Depression.

Teladoc Health is up around 60% since February. Zoom is up around 70% since February.

If you played either of these names, take your profits now!

Yes, I will continue to love each stock going forward. But right now, cash is king. If you bought these stocks from the free market advice here in Trade of the Day, you’re certainly showing a huge profit.

So now take your money and run. And as always, if you rang the register – drop me a note and let me know how you did!

Second order of business, let’s talk about jobs in the U.S.

Consider this jobs count…

- Restaurants and bars: 12.3 million total jobs

- Hotels: 2.1 million total jobs

- Retail: 15.7 million total jobs.

Let’s assume the worst – and speculate that half of those workers have recently lost their jobs.

If so, that’s a surge of 15 million job losses – just from these three industries alone.

As a point of reference, during the global financial crisis, unemployment peaked at 9 million job losses. So, very realistically, we could come close to doubling that with the very first jobs report here in 2020.

So yeah, forgive me if I think the market rally we saw today is temporary.

And finally, let’s talk about why I like the gold sector…

In The War Room, I recently introduced two gold assets – both of them amplify the daily movements of gold at three times the rate. Today I’d like to tell you a little about each one.

Play No. 1: Direxion Daily Gold Miners Index Bull 3X Shares (NYSE: NUGT).

The Direxion Daily Gold Miners Index Bull 3X Shares trades at a rate that’s three times the daily performance of the NYSE Arca Gold Miners Index (via futures contracts). Volume is heavy – with around 10.5 million shares traded per day.

Its largest holding is the VanEck Vectors Gold Miners ETF, which is made up of some of the largest gold mining companies in the world, such as Newmont Corp. and Barrick Gold Corp.

At only $8.40 per share for a three times leveraged gold play, the Direxion Daily Gold Miners Index Bull 3X Shares is now on my radar as a great way to play the major metals companies.

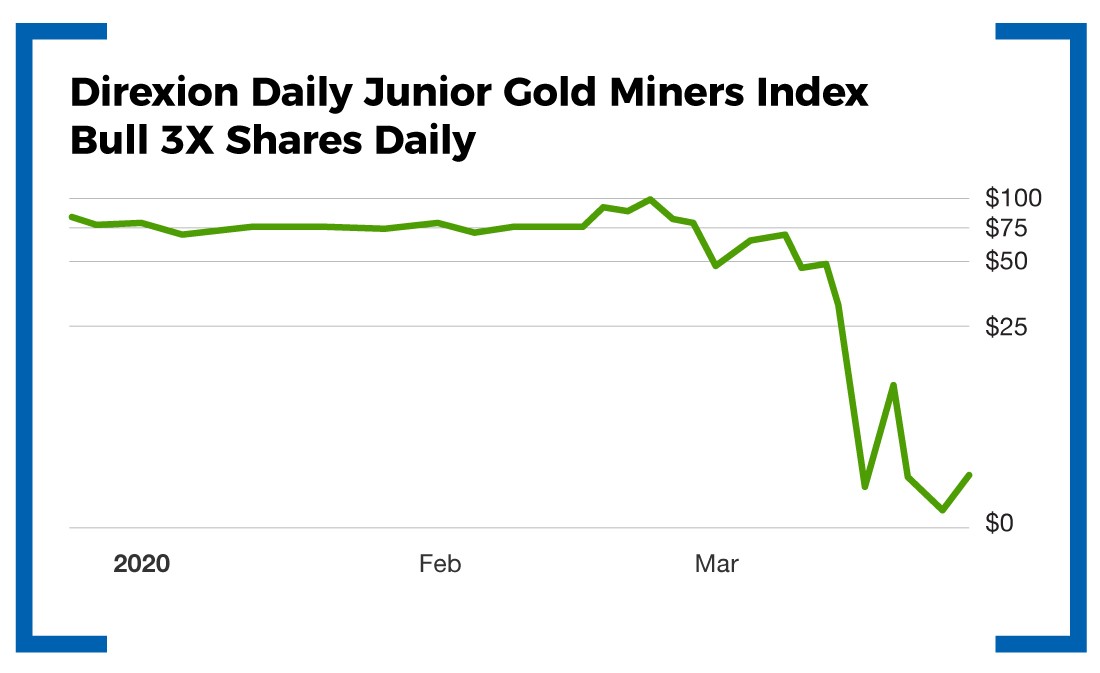

Play No. 2: Direxion Daily Junior Gold Miners Index Bull 3X Shares (NYSE: JNUG).

The Direxion Daily Junior Gold Miners Index Bull 3X Shares is another three times gold asset, which is linked to the movements of and futures on the VanEck Vectors Junior Gold Miners ETF.

Action Plan: Now get this. In mid-February, the Direxion Daily Junior Gold Miners Index Bull 3X Shares traded for more than $100. And right now it’s down to $5.

The options spreads on it are tight, so this is certainly a playable asset on a day-to-day basis. Yesterday in The War Room, members took a nice winner playing it. And now members are ready for more.

A word of caution: These three times leveraged assets reset each day – so the movements are quite substantial.

If you want to trade them with precision, I invite you to join me in The War Room today!

More from Trade of the Day

My Favorite Way to Hedge Choppy Markets

Apr 25, 2024

The Story Behind My 10 Bagger on RILY

Apr 25, 2024

A Silver Lining From Last Week’s Underperformance

Apr 24, 2024

How One Conversation Led to $100,000

Apr 23, 2024