The Cheapest Stock on Wall Street: Revealed

As the markets look to recover after a 10-week decline, it’s smart to look for some of the best bargains on Wall Street.

Karim did this during the COVID Crash – which led to his enormous winner on Cleveland-Cliffs (NYSE: CLF).

Taking his methodology a step further…

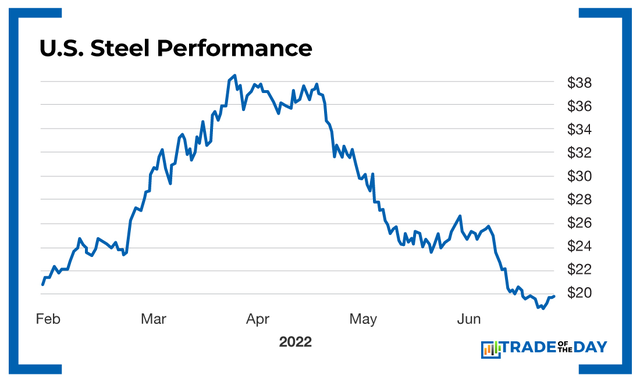

I scanned for stocks on the S&P 500 with the lowest price-to-earnings (P/E) ratios based on projected 2022 earnings. And right now the cheapest stock in that scan is U.S. Steel (NYSE: X), which has a P/E ratio of 1.9.

========================

*NOTE: For reference, Warren Buffett considers a stock with a P/E ratio of 10 a good value. So at 1.9, you can see how attractive U.S. Steel is.

*NOTE II: As a quick refresher, P/E is a measure of a company’s current share price relative to its earnings per share (EPS). P/E ratios are used to determine the relative value of a company’s shares in an apples-to-apples comparison. Right now, U.S. Steel has the lowest ratio of earnings per share to stock valuation on all of Wall Street.

=========================

As a general description, U.S. Steel produces and sells flat-rolled and tubular steel products, primarily in North America and Europe.

The company was founded in 1901 and is headquartered in Pittsburgh, Pennsylvania.

It’s logical to wonder…

“Why is U.S. Steel so low?”

Well, the auto industry accounts for 25% of steel demand in the United States, and as I’m sure you know, it’s been operating below capacity due to the chip shortage. As we look toward 2023 – and the chip shortage gets corrected – production could see a major boost.

Action Plan: If you’re looking at the current market pullback and wondering what the cheapest stock to buy at these bargain-basement levels is, U.S. Steel (NYSE: X) – in my opinion – is your best bet. To see exactly how we’re playing this stock in The War Room, accept our invitation and join us now.

P.S. How has The War Room performed during the recent market pullback? Well, how’s this for a track record!?

War Room 2022 Hedge Stats

- Win rate: 90.476%

- Average return (unweighted): 12.31%

- Average hold period: 3.52

- Total return on 2022 War Room hedges: 157.16%

If you want to see how we know exactly when to ENTER and when to EXIT every trade, check out my newest training video, on what I call the “Perfect Timing Pattern” – click HERE.

Monday Market Minutes

- Russian Gold Mine? The Group of Seven has announced a ban on imports of Russian gold to keep pressure on Vladimir Putin. Will the boycott of Russian gold push prices higher – like we saw with oil and energy? If so, we’re positioned to take advantage. Tracking.

- Awesome Axsome! Axsome Therapeutics (Nasdaq: AXSM) is up 44% after saying it received proposed labeling from the FDA for its AXS-05 product candidate for the treatment of major depressive disorder.

- Bottom Out or Bear Market Rally? With the mixed open today, it’s wise to consider that inflation is still high and there’s a war on Europe’s borders. It’s possible we’re in another bear market rally and haven’t seen the bottom yet.

- Is This Coin a Wooden Nickel? The crypto market has lost $2 trillion in market cap since its November high. And the cryptocurrency exchange operator Coinbase Global (Nasdaq: COIN) has gone down almost 10% since Goldman Sachs downgraded it from “Neutral” to a “Sell” this morning.

More from Trade of the Day

When it Comes to Positioning – Size Matters

Apr 18, 2024

The One Strategy I’m Leaning on in a Choppy Market

Apr 18, 2024

One Crucial Wartime Trade to Make Now

Apr 17, 2024

Apr 17, 2024