The Perfect Bear Market Trade?

I want to introduce you to a strategy that I love.

It’s called “in-the-money covered call writing.”

This strategy is powerful because it gives us three chances to make money.

That’s right, three!

First, we can make money if the stock goes up…

Second, we can make money if the stock stays where it is…

And third, we can make money if the stock does not go down more than a certain percentage – usually 20% to 40%.

That’s a lot of profit possibilities.

Here’s how it works…

Instead of selling calls above a stock’s share price, we sell them BELOW the share price and let time do the work for us.

How to execute a covered call trade…

- Pick out your net debit price – the net amount you want to pay for the stock.

- Buy to open (opening trade) the stock. Or sell to open (opening trade) the option.

- Enter your net debit price.

- Sit back and enjoy if it is deep in the money (strike price well below the current share price) or sit back and feel a little nervous if the strike price is above the current share price.

- At expiration, if the share price is above your cost, you win. If it’s below your cost, you lose.

- If the share price is above the strike price, your shares get called away automatically. If not, you can either sell the shares or sell more calls to reduce your cost further.

This strategy for call trades sounds confusing at first since most people focus only on making money from a stock going higher.

But, as this bear market has shown us, stocks go down as well. So it’s good to have this strategy in your back pocket.

Action Plan: Today, we executed a covered call trade in The War Room, targeting 22% upside with a 40% downside cushion. So we are planning to make 22% on this trade with a 40% cushion to the downside. I will take those odds any day!

Safe, disciplined trades like these are the reason War Room members are having an amazing trading week. In the last five days alone, we’ve closed 15 winners out of 16 trades for a 94% win rate – despite a brutal market. Click here to unlock those trades.

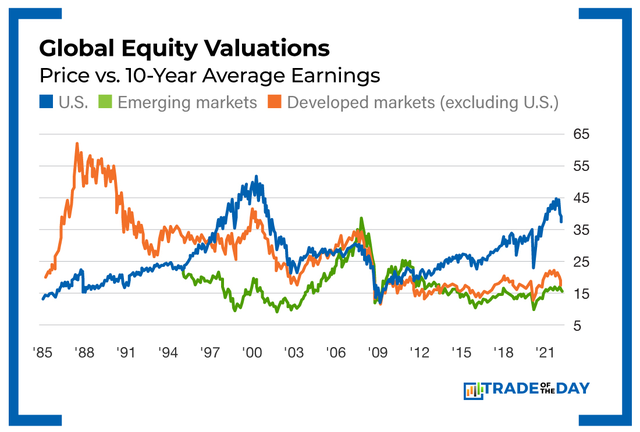

Fun Fact Friday

Friday Fun Fact: The recent sell-off has been brutal for all markets. However, sell-offs always bring bargain-bin opportunities. As you can see, U.S. stocks remain overpriced compared with those in other markets. That is why we’ve found a non-U.S. stock (which you can buy on U.S. markets) that we’ve dubbed The Last Great Value Stock. It currently trades for under $2, and it’s your best shot at finding value in the discounted foreign markets. Click here to unlock this trade!

More from Trade of the Day

When it Comes to Positioning – Size Matters

Apr 18, 2024

The One Strategy I’m Leaning on in a Choppy Market

Apr 18, 2024

One Crucial Wartime Trade to Make Now

Apr 17, 2024

Apr 17, 2024