The Right Time to Buy Protection

Markets are uncertain all the time, but sometimes they might be even more uncertain.

The concept of “even more” is interesting when it comes to uncertainty. It implies there are degrees of uncertainty!

Well, there are…

And the market has a measure for those degrees in the form of the volatility index. But that’s not what I am going to teach you today.

Today is all about when you should make a trade on an event that may hurt your position and put pressure on the long positions in your portfolio. You see, the clear majority of people bet only one way – on the market going up. That’s how we’ve been trained by Wall Street.

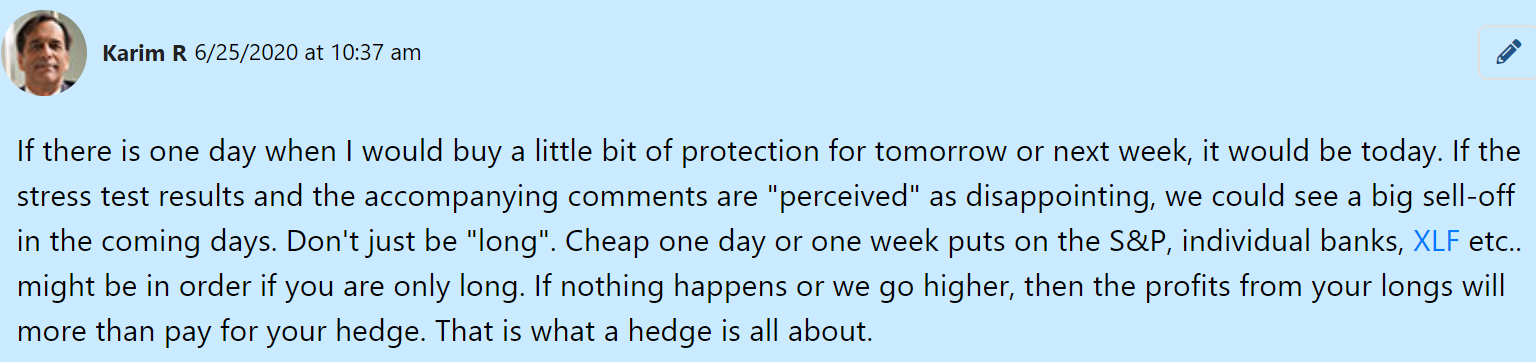

Well, yesterday I posted this to War Room members…

This morning, the market opened lower and traded as low as 770 points.

Members who took the advice made a lot of money today…

“WFC overnight 2 Jul 26.5 Put in @ $0.79 out @ $1.15 nice little 45% gain. Thanks Karim!” – A.C. 6/26/2020 at 9:50 a.m.

“I did a 1 day put on WFC for 24% gain today. Thanks Karim!” – Kathy P. 6/26/2020 at 10:55 a.m.

“Puts are runnin’ just as Karim forecast today and the past two weeks. Hedge, baby, hedge.” – Jerry K. 6/26/2020 at 10:59 a.m.

Of course, a lot of money was lost too with long positions in bank stocks, options or the market in general. The key takeaway here is that when there’s a big announcement that could hurt your position, you MUST have some protection.

Action Plan: These are the perfect times to use options on leveraged exchange-traded funds (ETFs). These leveraged ETFs are created precisely for big one-day moves, as they reset daily.

So for example, if you bought an option on a 3X leveraged ETF yesterday, you would have cleaned up today. You would have not only won the bet… but the option would have magnified the gain substantially.

The market giveth and the market taketh away. In The War Room, we want to play both sides of the table. You can do the same by joining me in The War Room today!

More from Trade of the Day

Why Next Week Could Be Big (Special Offer Inside)

Apr 19, 2024

When it Comes to Positioning – Size Matters

Apr 18, 2024

The One Strategy I’m Leaning on in a Choppy Market

Apr 18, 2024

One Crucial Wartime Trade to Make Now

Apr 17, 2024