This $120 Billion Opportunity Is the Next Frontier for Cannabis

Editor’s Note: A special invitation to Trade of the Day members!

On April 27, you’re invited to join Oxford Club CEO & Executive Publisher Julia Guth and Chief Trends Strategist Matthew Carr for America’s Legalization Summit.

This is a FREE event on the state of the cannabis industry, which will show you how to profit from the biggest asset boom of the decade…

Matthew will tell you all about his No. 1 cannabis value stock to buy, so I suggest you listen to him.

He called Canada’s legalization a full year in advance, which led him to gains of 226% in six months… 316% in one year… and 586% in five months!

Tune in for the free summit on Tuesday, April 27, at 8 p.m. ET.

Click here to reserve your spot.

As a sneak peek into what Matthew is tracking in the cannabis space, check out this piece from his free e-letter, Profit Trends, below!

– Bryan Bottarelli, Head Trade Tactician

Sometimes, a market expands much faster than anticipated. And that’s precisely what’s happening with cannabis.

Last year, global sales surged 48% to $21 billion.

Now, the majority of those came from the U.S.

In fact, Colorado alone – the most mature legal cannabis market in the country – accounted for $1 of every $10 spent globally on cannabis. And California, the single largest legal cannabis market in the world, saw sales boom 57%. It hauled in more than $4.4 billion in 2020.

But despite this growth, we’re still in the early stages here.

The U.S. cannabis market is now projected to skyrocket and top $41 billion by 2025. That’s more than double its current revenue. And Ben Klover, CEO of American multistate operator (MSO) Green Thumb Industries (OTC: GTBIF), believes the U.S. market could be worth $100 billion by 2030.

But this is only part of the story. Recently, we’ve seen the industry’s focus shift beyond North America.

The First $1 Billion Company Is Here

When I first started covering cannabis, my focus was on Canadian licensed producers.

Canada was preparing to legalize cannabis at the national level. And that was setting up handsome domestic and international opportunities for companies like Aphria (Nasdaq: APHA), Aurora Cannabis (NYSE: ACB), Canopy Growth Corp. (NYSE: CGC), Cronos Group (Nasdaq: CRON), Hexo Corp. (NYSE: HEXO) and OrganiGram Holdings (Nasdaq: OGI).

At the time, those companies still traded over the counter. They weren’t eligible to uplist to major U.S. exchanges such as the Nasdaq or New York Stock Exchange.

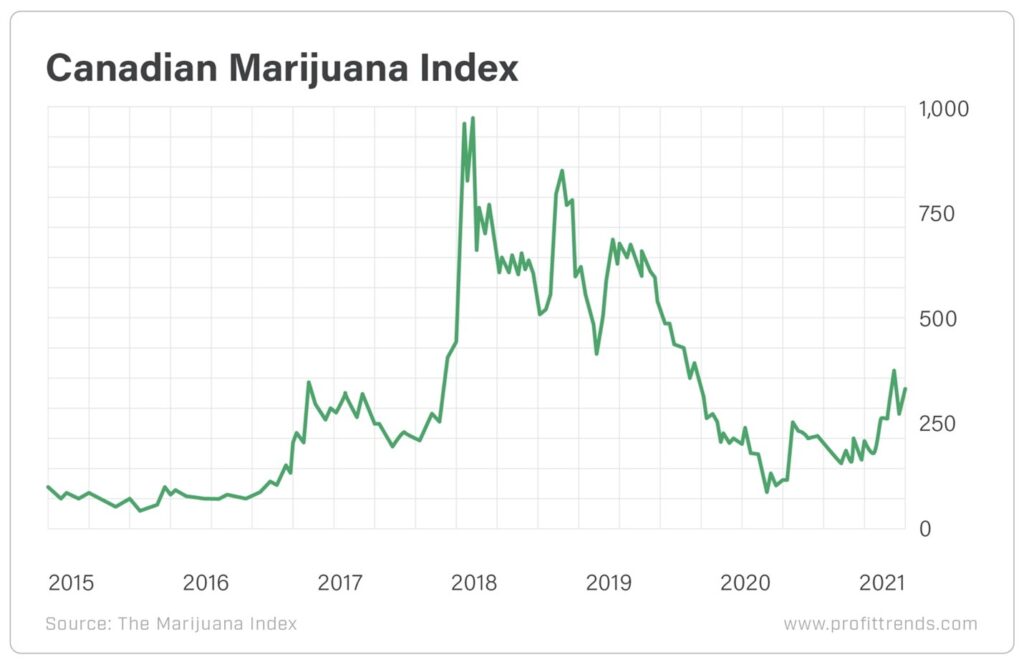

But these were the glory years for Canadian producers, when the Canadian Marijuana Index skyrocketed in value.

On top of that, with backing from the federal government, Canadian licensed producers rapidly emerged as the main international cannabis players. They snatched up assets all over the world and started signing deals to export products across the globe.

This is the major advantage Canadian cannabis producers still have over those in the U.S… at least for now.

But after Canada’s federal legalization in 2018, I set my sights on the next big market: the U.S.

There was a sea change underway, and American MSOs looked exceptionally well-priced. Especially in light of the projected size of the U.S. cannabis market.

Starting in mid-2019, the Canadian Marijuana Index faltered and has since failed to recover. It’s trading for less than half of what it was in 2018 and less than a third of its peak in late 2017 and early 2018.

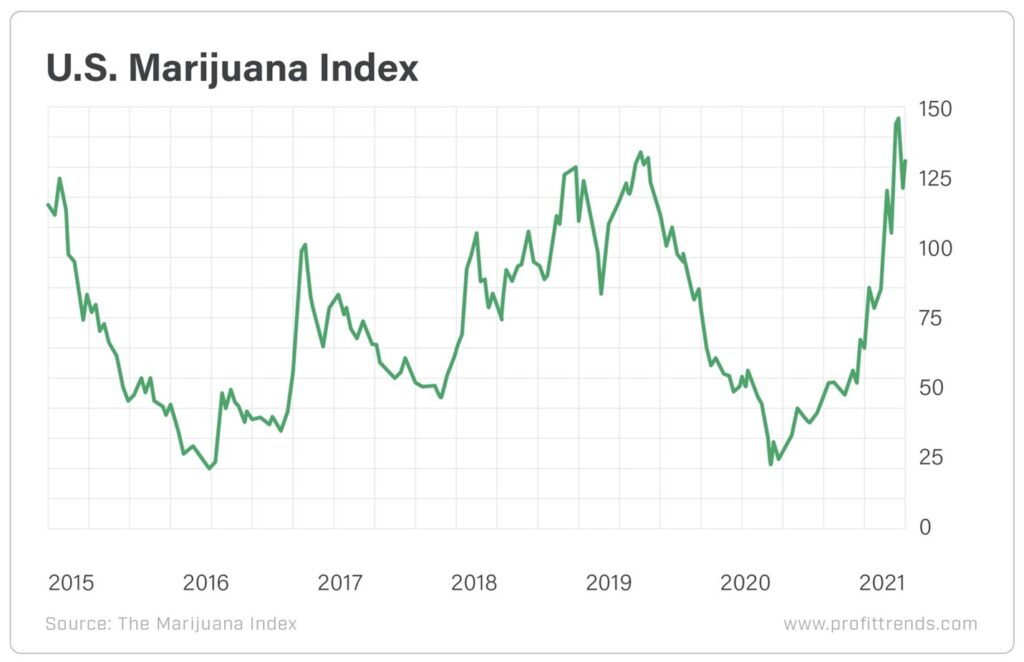

On the other hand, American MSOs are setting new all-time highs.

After bottoming out in March 2020, the U.S. Marijuana Index has catapulted higher.

And there’s a good reason for this.

These cannabis companies are reporting revenue far beyond anyone else in the industry. In the first quarter of 2020, Green Thumb Industries became the first cannabis company to report more than $100 million in revenue.

Competitor Curaleaf Holdings (OTC: CURLF) has since become the first cannabis company to report more than $200 million in quarterly revenue, and it will be the first cannabis company to report more than $1 billion in annual revenue in 2021.

Not to mention, Trulieve Cannabis (OTC: TCNNF) and Cresco Labs (OTC: CRLBF) will each report more than $800 million in revenue in 2021, as will Curaleaf and Green Thumb.

But last month, Curaleaf made a major announcement about the future of its business.

The Next Frontier in Cannabis

Curaleaf is the largest cannabis company in the U.S. It operates more than 100 dispensaries across 23 states. And its $11 billion market cap is almost equal to those of the next two largest competitors combined.

But the MSO is preparing for the next stage.

It announced it was acquiring Emmac Life Sciences for $286 million. Now, this deal is much smaller than its $830 million acquisition of Grassroots Cannabis (which closed in 2020). But it’s almost equally as profound.

You see, Emmac is the largest cannabis operator in Europe. The company has a presence in booming markets such as Germany, the United Kingdom, Italy, Portugal and Spain. And it plans to be able to produce 10 tons of cannabis per year by 2022.

These are key opportunities for Emmac and Curaleaf. Germany is the largest cannabis market in Europe – and will likely be the first to legalize adult-use, as early as this year. And the U.K. is the largest cannabis producer and exporter in Europe.

Now, at the moment, Europe allows for medical cannabis use only. But 2021 could be the year we see a change. As it now stands, the European cannabis market is projected to be worth $37 billion by 2027. That’s a 957% increase from the $3.5 billion it collected in 2019.

But the total European cannabis market is expected to be worth $120 billion. And the region is home to more than 784 million people, more than twice the population of the U.S.

The Emmac acquisition gives Curaleaf a foothold in Europe. And it signals that Curaleaf isn’t content with just being the largest cannabis company in the U.S.

Rather, it is a force to be reckoned with on a global scale.

It also marks the first significant overseas acquisition by a major American MSO, signaling that U.S. companies are throwing their hat in the ring with Canadian licensed producers.

The U.S. market is booming and is the largest opportunity… for now. But the rest of the world, especially Europe, is poised to close the gap very quickly. And this is a market I think all cannabis investors need to start building stakes in now.

Here’s to high returns,

Matthew

P.S. I’ll be talking about the U.S. cannabis industry even more in depth on Tuesday, April 27. It’s a free virtual event, so be sure to reserve your spot. Click here now!

More from Trade of the Day

My Favorite Way to Hedge Choppy Markets

Apr 25, 2024

The Story Behind My 10 Bagger on RILY

Apr 25, 2024

A Silver Lining From Last Week’s Underperformance

Apr 24, 2024

How One Conversation Led to $100,000

Apr 23, 2024