This Signal Means BUY!

There are a lot of “signals” investors look at to determine whether to buy a stock. However, I believe one stands out above all else…

Insider buying – the legal kind.

In The War Room, members have made as much as 2,058% on insider trades that I have covered.

But what makes an insider trade successful?

Here are five things I look for:

- Do insiders buy in clusters? Meaning, do more than two or three insiders buy at the same time?

- Are the insiders who buy on the front lines? In other words, I look for C-level officers who are involved in day-to-day operations.

- Are they spending more than their base compensation? You have to have conviction to put that much money on the line.

- Do they buy after a bad announcement that sends the shares lower? They know what’s coming down the pike in future quarters, and if they think the stock is being unfairly punished (meaning the stock price is cheap), they step in.

- Are the fundamentals of the company intact? There’s no point following insiders into a bad trade. Even they aren’t perfect and sometimes are just blinded by loyalty rather than focused on the facts.

If you follow these rules, you’ll be in the green more often than not.

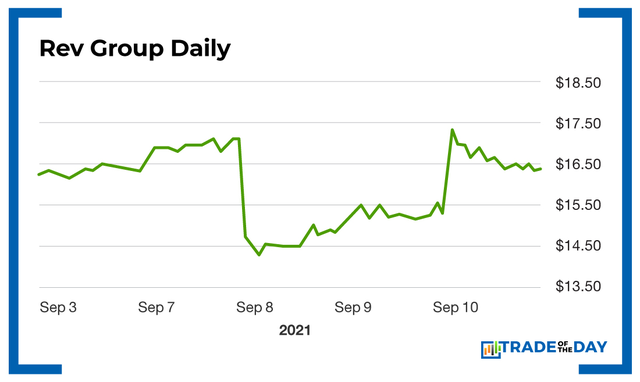

Just this week, one of our insider plays, Rev Group (NYSE: REVG), reported worse-than-expected earnings due to supply chain issues. That’s a common theme from many companies this year.

The stock sold off, and guess what? An insider stepped up and bought 50,000 shares for $750,000 in the open market, on top of what insiders bought a couple of months ago. That’s conviction, and the shares moved more than 30% from the lows set earlier in the week. And War Room members were in the trade.

Action Plan: Don’t miss the next insider trade in real time! The place to get it is in The War Room, where I monitor this type of trade in real time, every day. Click here to join me today – and get 300 wins guaranteed in your first year!

More from Trade of the Day

When it Comes to Positioning – Size Matters

Apr 18, 2024

The One Strategy I’m Leaning on in a Choppy Market

Apr 18, 2024

One Crucial Wartime Trade to Make Now

Apr 17, 2024

Apr 17, 2024