My Top 3 Housing Plays (Don’t Miss No. 3!)

Mark Twain once said, “Don’t wrestle with pigs.”

Why? That’s simple… “You both get dirty and the pig likes it.”

That’s exactly how I feel about today’s political news flow.

So instead of covering that mud bath, let’s shift our focus onto making money.

This leads directly into one of the hottest sectors around: homebuilders.

Now, I admit, when the COVID-19 pandemic first began in March, I would’ve never guessed that it would trigger a new housing boom.

But, as amazing as it sounds, that’s exactly what happened.

The combination of ultra-low interest rates and the new trend to move to more open spaces to ride out the virus has triggered an unexpected boom in the housing market.

The National Association of Realtors just reported that sales of new and existing homes in the U.S. hit their highest levels since the housing bubble in 2006 and 2007.

Specifically, existing home sales were up 10.5% year over year in August, while new home sales were up a whopping 43.2% in the same period.

At this rate, unsold housing inventory stands at three months of supply, which is right around a 20-year low. Throw in the California wildfires – and it’s clear that homebuilding stocks are set up to be winners.

So how do you play it?

Here are my top three homebuilder picks (listed in order of safest to most speculative)…

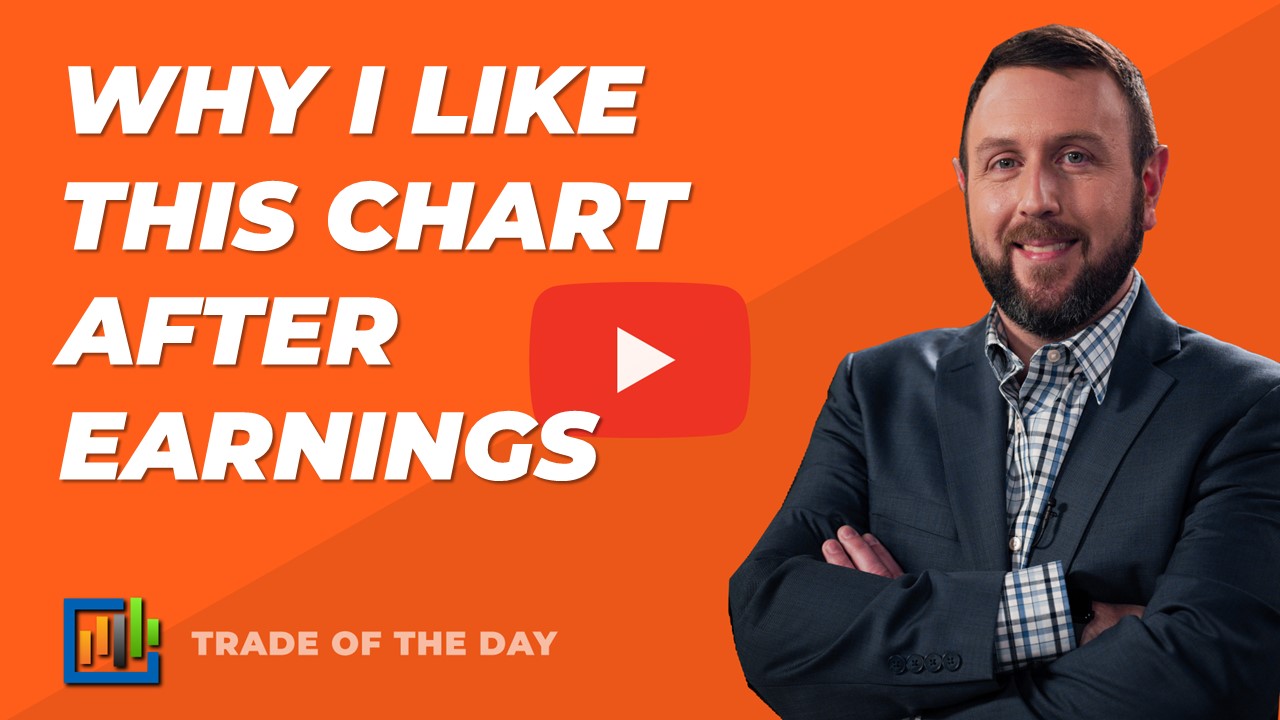

No. 1: SPDR S&P Homebuilders ETF (NYSE: XHB)

This is the most comprehensive homebuilder play, which gives you a diversified basket of everything homebuilder-related.

The one-year total return is 23.59%, and these are its top 10 holdings.

- Whirlpool 4.61%

- Carrier 4.39%

- Fortune Brands 4.22%

- Trex 4.20%

- D.R. Horton 4.19%

- PulteGroup 4.17%

- NVR 4.15%

- Trane 4.15%

- Lowe’s 4.14%

- Lennox 4.06%

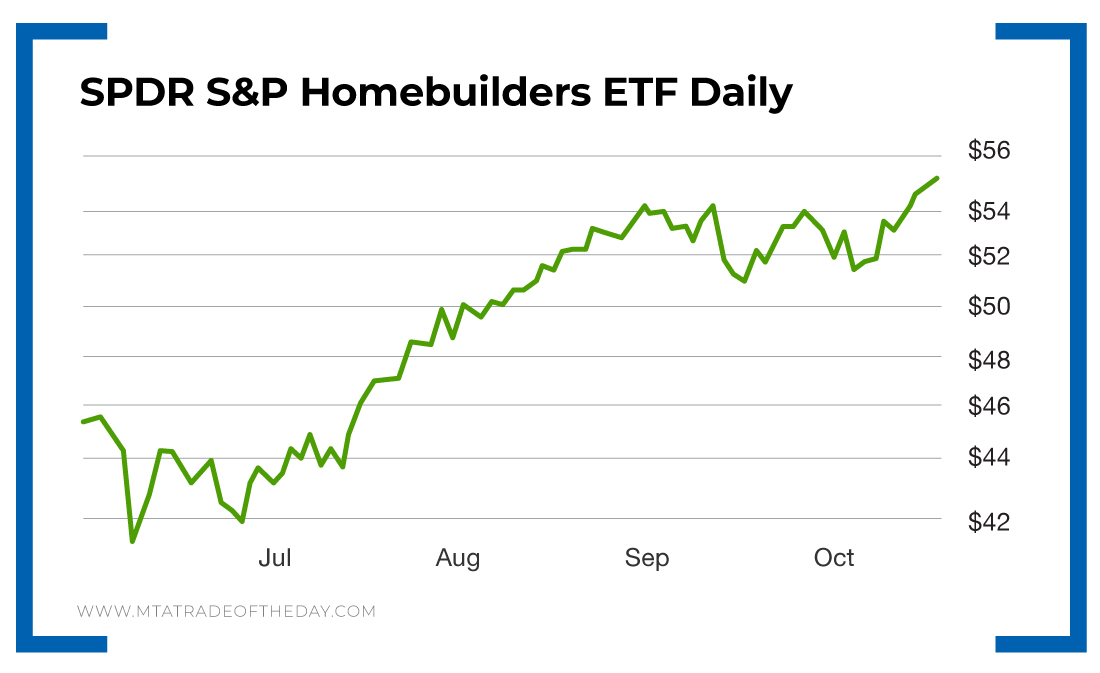

No. 2: Redfin (Nasdaq: RDFN)

Absent in the basket of SPDR S&P Homebuilders ETF holdings are any real estate brokers – and Redfin represents the best way to have exposure to this sector. It’s the most comprehensive online real estate broker, which provides title and settlement services to buy and sell your home.

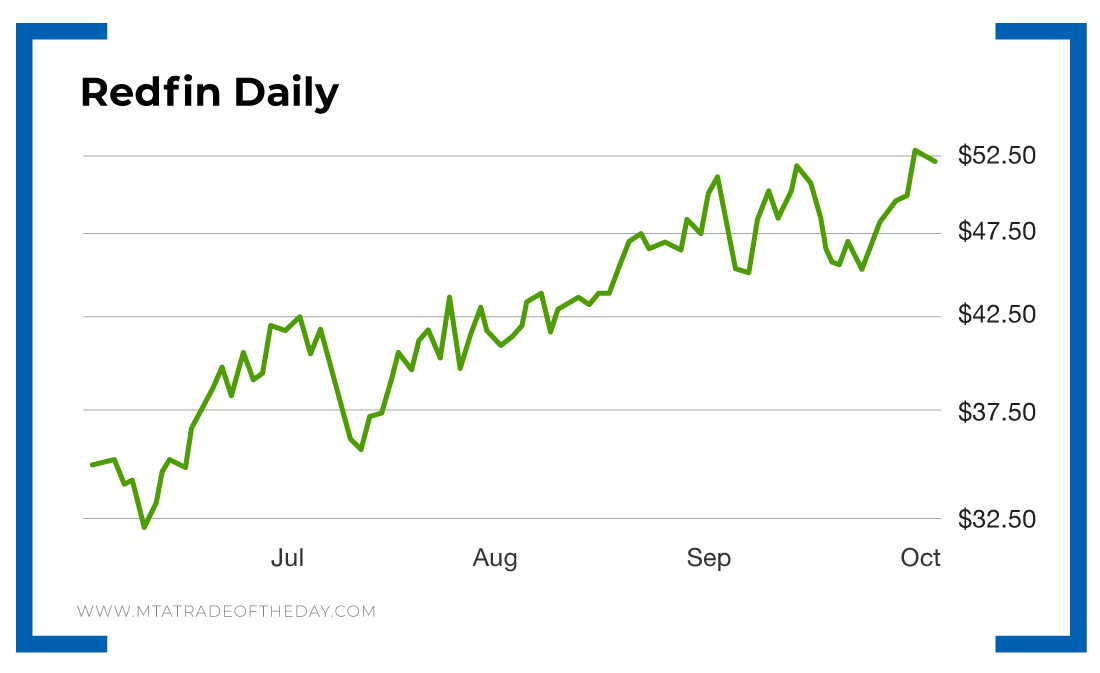

No. 3: Social Capital Hedosophia Holdings (NYSE: IPOB)

Social Capital Hedosophia Holdings is the newest project from Social Capital founder Chamath Palihapitiya, who took Virgin Galactic public by way of a special purpose acquisition company (SPAC).

Now it’s doing the same with Opendoor, which has reinvented how people buy and sell a home with a digital, on-demand experience. This is the most speculative – yet most powerful – of the three plays. If you’re willing to speculate, then add some on dips!

Action Plan: The most conservative of the homebuilder plays is the SPDR S&P Homebuilders ETF, which gives you the broadest exposure to the entire sector group. After that, Redfin is my top brokerage play – followed by the most speculative play in the group, Social Capital Hedosophia Holdings. Looking specifically at this company, I like the idea of buying and reloading on a dip down to $17. As for all other entry prices, I invite you to join The War Room for real-time buy and sell advice. Why join us? Well, we just hit 21 winners in a row. How’s that for FOMO (fear of missing out)!? Jump on board this winning freight train now!

P.S. Our strategies make The War Room something unique and profitable. We’ve handed members an insane 76.95% win rate since we launched! Over that time frame, we’ve had a 10.04% average gain with an average holding period of just over seven days. And this year alone, on average, we’re hitting almost two winning trades every day the markets are open. So what are you waiting for? Join me now and get in on the hottest action in the market!

P.P.S. You’re invited to follow us on Instagram! Your Trade of the Day membership just got a whole lot better. You see, we just launched a new Trade of the Day Instagram page. (If you don’t already have an Instagram account, you’ll need to create one.) And today – you’re invited to join us. It’s totally free! Just go here – and click “Follow.” And that’s it – you’re in!

On this page, Karim and I will post charts, videos, and even some funny and entertaining memes – most of which you won’t get from your typical Trade of the Day email alerts. You’ll get fresh, new content – available wherever you go. You’ll love it. So take a quick second – and follow us now!

More from Trade of the Day

When it Comes to Positioning – Size Matters

Apr 18, 2024

The One Strategy I’m Leaning on in a Choppy Market

Apr 18, 2024

One Crucial Wartime Trade to Make Now

Apr 17, 2024

Apr 17, 2024