We Bought This 5G Stock at the Market Bottom – Did You?

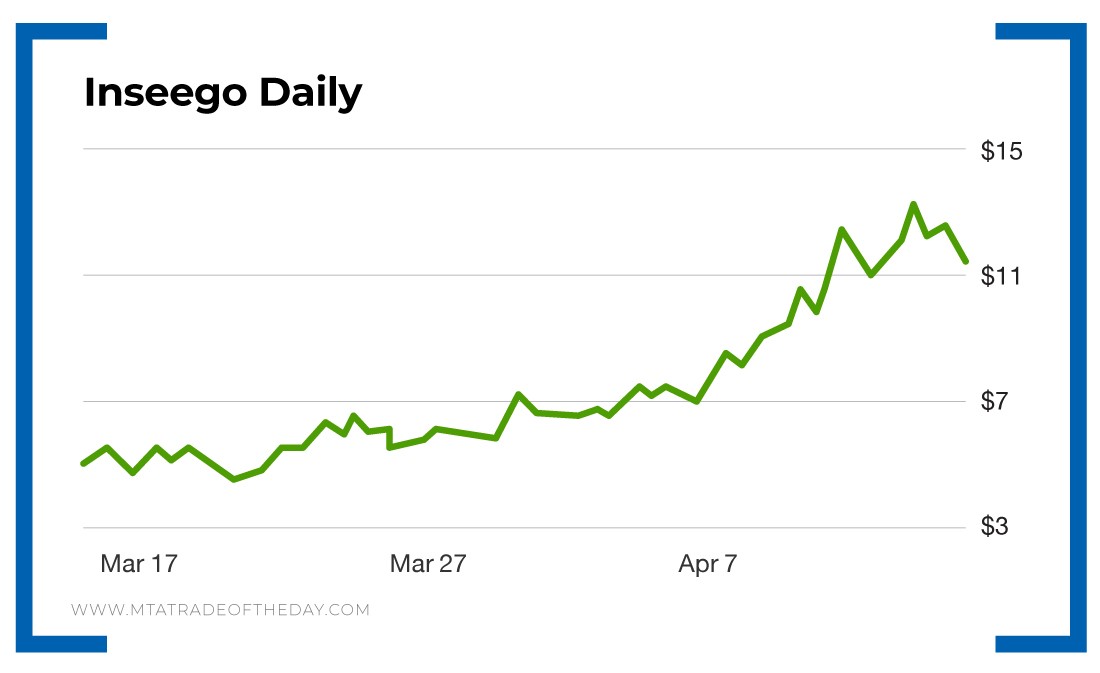

On March 23, when the market hit what appeared to be the bottom, I made the call to buy Inseego (Nasdaq: INSG), the maker of 5G equipment for the home. It was trading in the $4 range. It’s arguably been the best performer in the market since, hitting $13 this week – just three weeks later.

Look how War Room members made out on the trade…

“If it wasnt for KR, I wouldn’t have have gotten in when it was briefly below $4/share! The covered call play on INSG was additional whip cream on top!” – Song on April 17 at 10:20 a.m.

“Bought it outright when you rec. @$4… sold @ $11.7. Thank you so much! Reloaded with a strangle.” – Kurt Hauquitz on April 17 at 10:26 a.m.

“I have INSG. You are saying I should get out? I’m at 98%.” – Jennie Kim on April 16 at 1:04 p.m.

“Sold at 164% gain on options.” – Keith Schumacher on April 16 at 10:22 a.m.

It was not the first time we made money from this trade, and it won’t be the last.

However, while some War Room Members have cashed in huge on this play – as you can see from the testimonials above – most members took a more measured approach and entered Inseego using a covered call trade.

Why?

Because we bought at the market bottom!

Can you imagine anyone buying anything when the market looks like it’s going to zero? Well, I knew it wasn’t going to zero, and I also knew that we wanted to be in a great company at a great price. And what better time to do it than when others are panicking?

The covered call was the perfect trade, as it allowed us to get into the shares for cheap. The big reason for this was volatility. The VIX was in the 70s (in a panic stage, options premiums are HUGE). And when options premiums are high, you should be a seller of those options because the panic will subside and those premiums will come back down. It’s a great situation for put sells and covered calls.

When you enter a covered call, you buy shares of the stock and you sell call options at a higher price against them. If the stock closes at or above your strike price at expiration, your shares are called away at the strike price. Your profit is the difference between your cost and the strike price.

And if the shares stay below your strike price, you keep both your shares and the premium you received when you sold the option. It’s a win-win on a company you want to own.

Inseego is a different type of animal, and it was a play that literally went to the moon. Everyone who was in the trade – from put sellers to covered call players – made a ton of money… Mount P., one of our War Room members, who profited 471%, put it best:

“Inseego en fuego bought INSG 4/17 $7.5 calls paid 70 cents, up to $4 now.” – Mount P. on April 14 at 10:46 a.m.

If you want to get into plays like Inseego, there is no better place than in The War Room, especially if you want to be a buyer when everyone else is panicking. You’re in good company here!

More from Trade of the Day

Why Next Week Could Be Big (Special Offer Inside)

Apr 19, 2024

When it Comes to Positioning – Size Matters

Apr 18, 2024

The One Strategy I’m Leaning on in a Choppy Market

Apr 18, 2024

One Crucial Wartime Trade to Make Now

Apr 17, 2024