Yikes Docusign…

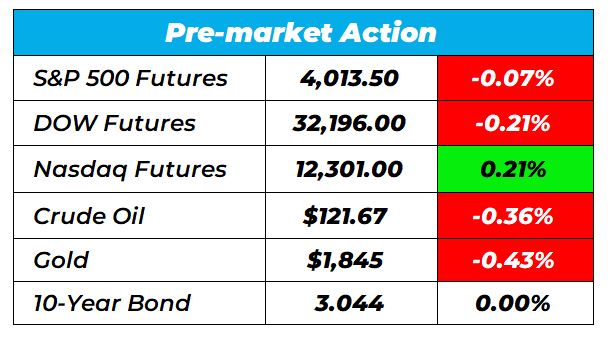

Good morning Wake-Up Watchlisters! While you’re sipping that green tea lassi you’ll see stock futures were mixed as investors await updates on inflation, which is expected to reach a 40-year high amid elevated gas and food prices. The release of the consumer price index later this morning should also paint a clearer picture.

The good news is – no matter if a stock goes up or down – we have strategies in The War Room to help members make gains in the market. Right now we’re guaranteeing 322 winning trades for members in their first 12 months. Click here to unlock these trades.

Here’s a look at the top-moving stocks this morning.

Docusign (Nasdaq: DOCU)

Docusign is down 25.76% after the online signature group posted weaker-than-expected second quarter earnings and forecast less revenue growth for the remainder of the year. With more workers returning to the office, Docusign is struggling to hold investor interest. The company earned 38 cents per share over the three months ending in April, missing Wall Street forecasts by around 8 cents. Docusign is looking volatile.

Cheniere Energy (NYSE: LNG)

Cheniere Energy is up 4.84% premarket. The company agreed to sell liquified gas to Equinor ASA, a Norwegian energy company that plans to gain access to additional LNG supplies amid a tight commodity market and surging demand for the super-cooled fuel. U.S. LNG companies have been exporting record volumes to the European Union following sanctions on Russia over Moscow’s invasion of Ukraine that reduced supplies in an already tight market. Cheniere Energy is a stock to keep an eye on.

AutoNation, Inc. (Nasdaq: AN)

AutoNation is up 3.10% premarket as 2 estimates have been raised, pushing the company’s Zacks Consensus Estimate for 2022 to $23.20 from $22.13. That’s earnings growth of 28% as AutoNation was at $18.14 last year. AutoNation is looking strong.

Netflix (Nasdaq: NFLX)

Netflix is down 3.96% after Goldman Sachs analyst Eric Sheridan lowered his rating on the stock to ‘sell,’ while slashing his price target by $79 to $265 per share. Sheridan cited consumer pressures and increased rivals in the streaming market. Netflix lost 200,000 subscribers over the first three months of the year and expects to lose 2 million by the end of the second quarter.

Do Your Stocks Meet These 5 Success Factors?

As the fed stops printing unlimited money and interest rates rise, there will be a new set of criteria for successful stocks going forward. Our Head Trading Fundamental Karim Rahemtulla breaks down the 5 most important factors for success in the new markets. Click here to read more.

Those are the top market movers today.

Happy trading!

The Wake-Up Watchlist Research Team

More from Wake-up Watchlist

Apr 23, 2024

Electric Vehicle Company Drops…

Apr 22, 2024

Sony in Talks to Takeover Media Company

Apr 19, 2024

Apr 18, 2024