Bear Market Hedging Strategies: Part 2

Editor’s Note: This is Part 2 of our Bear Market Hedging Strategies series. If you missed Part 1 yesterday, you can view the article here.

Yesterday, I covered tail risk hedging for black swan events.

Today, I’ll talk about three other methods I use in my portfolio to hedge in different situations.

Leveraged ETFs

These are great for trend moves. If the market is moving lower every day, I can hop on a leveraged ETF like the ProShares UltraShort QQQ (NYSE: QID), the ProShares UltraShort Dow30 (NYSE: DXD) or the ProShares UltraShort S&P500 (NYSE: SDS) to accentuate my returns. Just know that these reset daily and will not make you money unless you get a really big move right after you buy. A choppy market will not bring you gains through these assets.

LEAPS

Using LEAPS (long-term equity anticipation securities) is one of my favorite longer-term strategies in my options portfolio – especially on stocks that DO NOT PAY dividends. A LEAPS option is a proxy for owning shares and usually costs 10%-15% of what it would cost to buy the underlying stock. This is a great strategy to reduce your outlay while still giving yourself exposure to the potential gains of a stock. Plus, the one-to-two-year timeline gives you plenty of time to plan an exit strategy.

Spreads

I also look for ways to reduce my cost by using multiple options, or spreads, within the same trade. This is a good strategy for pure speculation plays, such as cheap options on potential flyers like Overstock.com (Nasdaq: OSTK) or Plug Power (Nasdaq: PLUG). The strategy is also good for reducing the cost of plays on stocks like Meta Platforms (Nasdaq: META) or casino stocks, since those sectors are so volatile and the premiums are so high. On down days, my spreads work like a charm because as one side loses, the other side gains.

In ALL cases, regardless of the strategy I’m using, POSITION SIZING is just as important as the strategy itself. Check out my article on the subject.

Why We Hedge…

Hedges are an insurance policy, much like leveraged inverse ETFs, and usually will not pay out.

On down days for the broader market, my hedges allow me to LOSE LESS (not lose zero). And on up days, I will make a lot more than I will lose on my hedges.

In this market, you should always have some hedges in place. BUT hedges work only if you have something to hedge against. That is the balance.

In an ideal situation…

- When the market goes up, your gains should outweigh the losses you incur from your hedges (“insurance payments”) by a country mile.

- When the market goes down, your hedge will protect you from major losses, similar to an insurance policy.

Action Plan: We use both short- and long-term hedging strategies like these all the time in The War Room. One of the great things about The War Room is that you can see us implement these strategies in REAL TIME – on both short-term and long-term plays. In fact, my partner Bryan has been killing it with his short-term hedges, to the tune of a 90% win rate in 2022.

Click here to unlock those short-term trades.

Fun Fact Friday

As we reach the halfway point of 2022, comparing where we are now with the drastically different economy we were in six months ago may give us some insight.

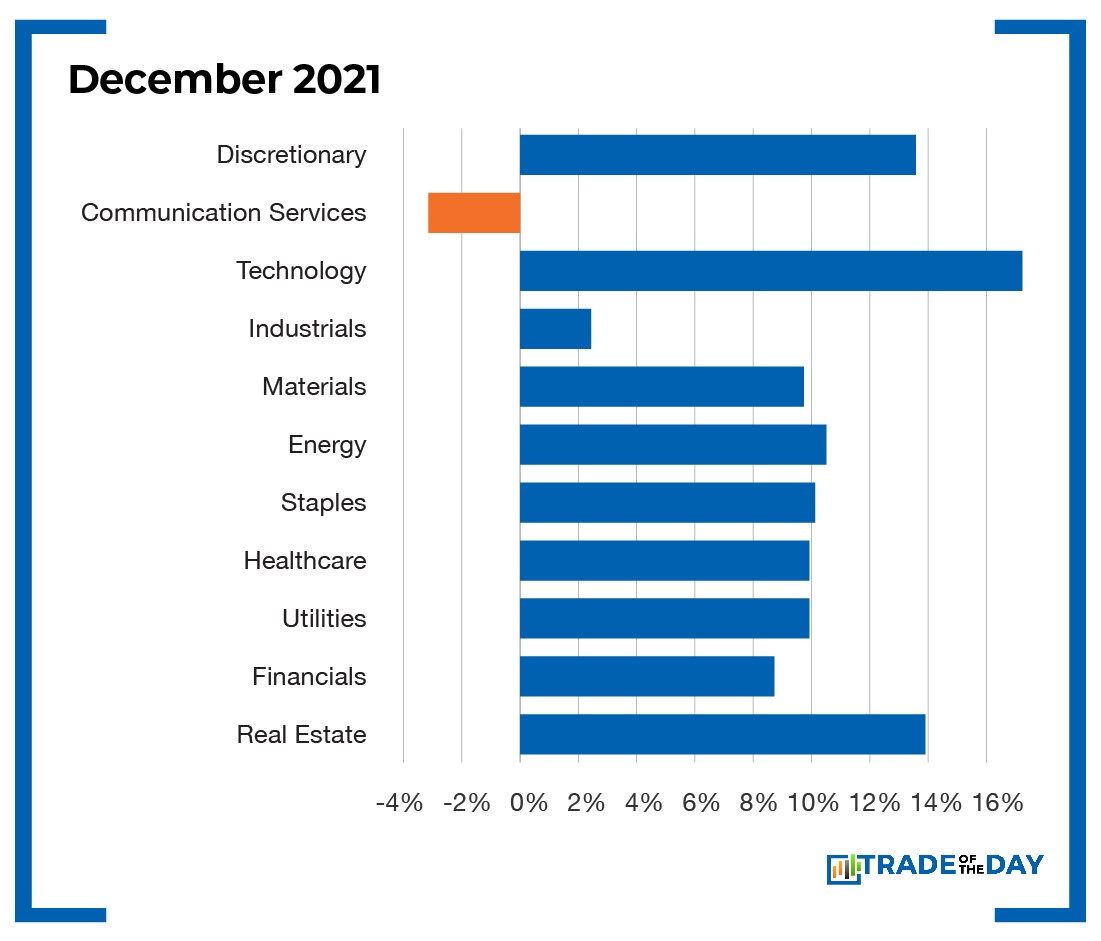

December 2021

The market changed significantly in December 2021. Tech stocks like Apple (Nasdaq: APPL) and Alphabet (Nasdaq: GOOG) were riding high – though the sector started sliding in late December. Little did we know, the Nasdaq’s November high was behind us. Oil began a steady climb in a bull market that had been kicked off by vaccine announcements 14 months earlier.

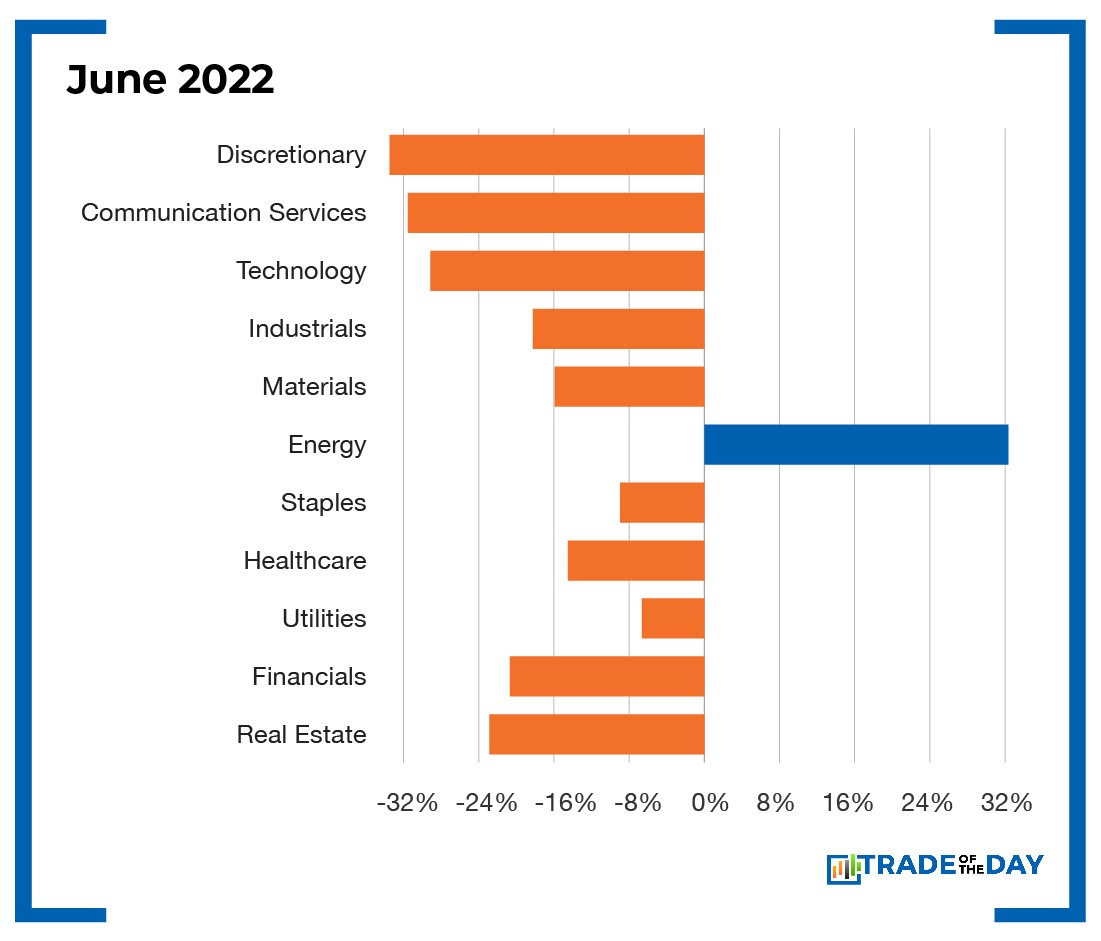

As we turned the corner into 2022, almost all of the upward momentum was focused on energy. Tech stocks have since taken a massive hit, with big companies like Alphabet (Nasdaq: GOOG), Meta (Nasdaq: META) and Amazon (Nasdaq: AMZN) the early leaders of the downside. Almost all upward momentum has been focused on energy. This all comes despite investors touting the start of a new bull market in energy back in March. Turns out it was a new bull market in fossil fuel energy.

More from Trade of the Day

When it Comes to Positioning – Size Matters

Apr 18, 2024

The One Strategy I’m Leaning on in a Choppy Market

Apr 18, 2024

One Crucial Wartime Trade to Make Now

Apr 17, 2024

Apr 17, 2024