My Top 3 Stock Picks for 2022 (Part 2 of 3)

Let’s continue with Day No. 2 of my three-part series profiling my top three stock picks for 2022.

In case you missed yesterday’s issue of Trade of the Day, I’m kicking off the investing year by posting my top three stock picks for 2022.

All three picks are intended to be bought immediately – and I believe each will significantly outperform the S&P 500 over the course of the 2022 calendar year.

Will my top three picks perform?

Or will they fall flat?

That’ll be something you and I can track this year.

Yesterday, I revealed that pick No. 1 is Carrier Global Corp. (NYSE: CARR).

Now let’s move directly into my 2022 top pick No. 2…

Hertz Global Holdings (Nasdaq: HTZ).

As I’m sure you know, Hertz Global Holdings is a global vehicle rental company that operates under the brand names Hertz, Dollar and Thrifty.

Like Carrier, I believe that Hertz has three powerful tailwinds moving in its direction in 2022.

The first tailwind is pricing power.

Hertz Global, Avis Budget and the privately held Enterprise control a combined 95% of the U.S. rental car market – which gives them a powerful advantage. If you’ve rented a car at any point since this past spring, you know now expensive it has gotten – and that there’s nothing you can do about it. There is no alternative. Jeffries analyst Hamzah Mazari said, “What once was a dysfunctional oligopoly with no pricing power is [now] a functional oligopoly with pricing power.”

The second tailwind is the company’s financial position – which can be attributed only to a stroke of incredible luck.

Hertz declared bankruptcy just before the pandemic began – which allowed it to reorganize right as its core business was devastated by the world’s travel shutdown. But Hertz emerged from bankruptcy this past June with a clean balance sheet and minimal net debt, which has allowed it to redefine its business. It plans to purchase 100,000 Teslas by the end of 2022, and it has struck a deal with Carvana to sell used cars (which are actually appreciating in value!).

The third and final tailwind (which I find the most eye-popping) is Hertz’s comp-sale valuation.

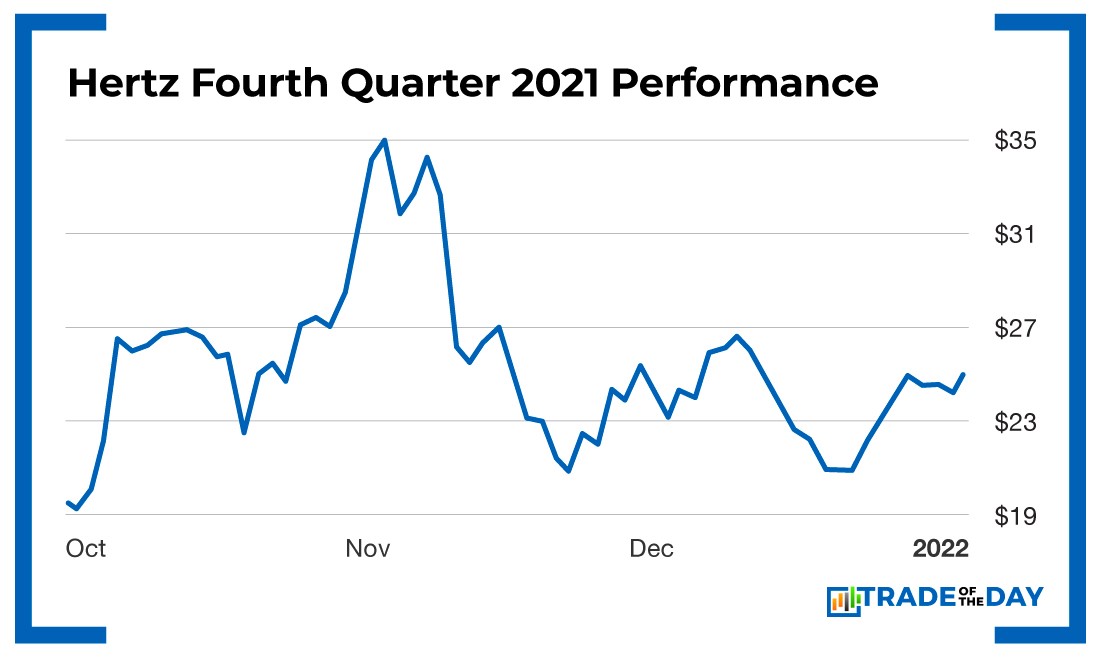

Over the last 52 weeks, shares of Hertz are down 7.4%, grossly underperforming the S&P 500’s gain of 28.79%. However, take just one look at the performance of the company’s top competitor, and you’ll see what a bargain Hertz represents right now. Are you ready for this?

Over the last 52 weeks, shares of Avis Budget Group (Nasdaq: CAR) are up a whopping 485%. Yes, you read that correctly. With a 52-week high of $545.11, Avis Budget Group was one of the best-performing stocks of 2021 – which shows you exactly how much catch-up potential Hertz has going into 2022.

Action Plan: Add it all up, and these three powerful tailwinds are why I think shares of Hertz are an immediate buy at current levels – and why they’re my second top pick for 2022.

Tomorrow, I’ll reveal my third and final top pick for 2022 – which is my favorite of the three. In order to get access to pick No. 3, you must be a paid member of Trade of the Day Plus. If you’re ready to join our premium service, then you’re invited to “level up” your membership and receive my top pick for 2022 tomorrow after the close. Sign up now to ensure that you don’t miss my favorite pick for 2022!

More from Trade of the Day

Key Takeaways From our Winning JOLTS trade

May 8, 2024

Why I’m Buying Dips & A New Trade Setup

May 7, 2024

May 7, 2024

Six Reasons to Add This to your Portfolio Now

May 6, 2024