Time to Short Dollar Tree?

In today’s video, I’m going to do a couple of things.

First, I’m going to go over last week’s charts.

You’ll want to check this part out because there’s a good chance one of our current plays is going to go higher, and I’m going to tell you exactly why.

Next, I want to show you a fresh trade setup, one that I’m watching right now.

Click the image below to watch the video.

Action Plan: I’m really excited for this year’s War Room Open House. I went it alone when I first started trading. And while I did learn a lot, I didn’t learn the strategies I needed to become a CONSISTENT trader until I surrounded myself with like-minded people. That’s exactly what you get in The War Room. And right now, Bryan and Karim are offering you the chance to see their service live for one week – absolutely FREE.

Click here to sign up for The War Room’s Open House.

Short Setup: Dollar Tree (DLTR)

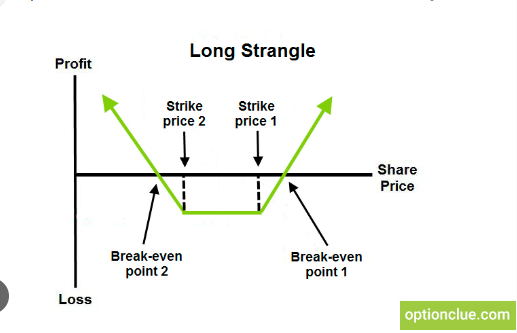

I’m looking for a short in DLTR. I like the topping pattern on the daily chart, plus the trend, the pattern and the squeeze – all of these are coming together for a short. Now, the share price isn’t quite into my short area yet, so let’s break down the trade. Below is the chart of DLTR with my entry, stop and target zones. Please watch the video for a more detailed explanation.

If shares can rally into my short zone – around $142 to $144 – I’d like to buy the November 18 $140 puts. I’ll use a stop on a daily close over the 55-period exponential moving average, around $146. And my targets to the downside will be $135 and then $130. Check out the chart below for reference.

Update on RH (RH)

If you got in the RH trade, now’s a good time to take profits. I mentioned that you wouldn’t have to trade much to make solid gains. A $1,000-plus winner on a one-lot trade? That’s the power of the “TPS Method.”

Fun Fact Friday

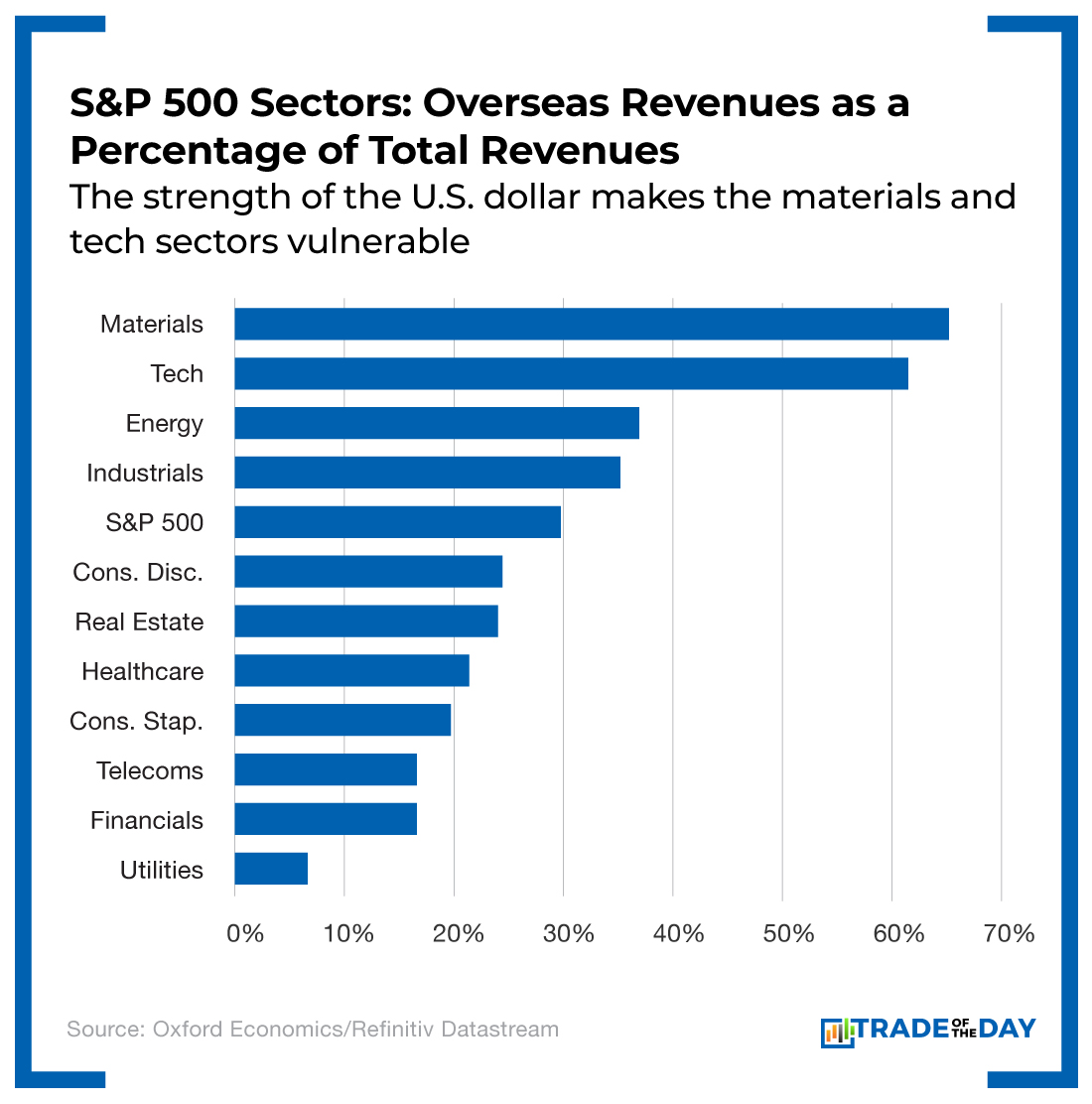

We recently covered three stocks that will be hurt by the U.S. dollar’s strength. A strong dollar erodes overseas revenues for U.S. companies with major international divisions. Below, we zoom out to look at the bigger picture. You can see which sectors are most vulnerable to the dollar’s strength. It’s a smart time to check your exposure to these industries. If the dollar remains strong, it will be a headwind for these stocks.

More from Trade of the Day

How to Trade Overnight Earnings: +200% Winner

May 9, 2024

Have I Changed my Mind About Bitcoin?

May 9, 2024

Key Takeaways From our Winning JOLTS trade

May 8, 2024

Why I’m Buying Dips & A New Trade Setup

May 7, 2024